Something for the Weekend – Looks Like a Win for Brexit

Fairly unsurprisingly I was in a pub the other day and I had a scrunched up piece of paper and there was a bin behind the bar in the semi-distance. I lined up the shot and launched the paper at the bin. It bounced on the side and landed on the floor next to the bin. The barman walked over to the paper, picked it up and gave it back to me so I could have another try. Right in the hole this time. Had the barman been a woman instead then I wouldn’t have been given that second chance. And there it is: gender politics explained.

Something we don’t need a referendum on is the notion that in the normal course of events people should be treated equally and be equal under the law. The problem with special interest groups is that they fragment activism, which should be aiming for everyone to be treated equally. But then certain groups perhaps want to be the ‘some’ who are ‘more equal than others’. Feminism is a good example. Either it stands for equality for all, in which case it has the wrong name, or it doesn’t, in which case it has the wrong century! New Feminists are often so militant they turn off men who support their cause. Ladies that Lynch I call them.

After my sporting success at the pub I got in a mini cab and got talking to the driver. He’s made a point of asking all his passengers, for months on end, which way they’ll vote in the EU Referendum. It amounts to well over 1,000 people he’s asked and he said only 15 of those 1,000-odd said they’re voting Remain. From an analytical stand point on demographics alone ‘Leave’ must have the edge: older people and homeowners and better off people are more inclined to vote and more inclined to vote Leave, especially if they’re over 60. Younger people who might generally vote ‘Remain’ are less likely to vote and engage with politics. I’m predicting Leave based on that.

How can we make money? It’s highly likely that money will be flowing out of Sterling and into the safe haven of dollars before the 23rd. There’s also the speculative element that the Fed will raise the base rate, which would strengthen the dollar too. A weak pound as we leave Europe would do wonders for exports. Most countries don’t have much of a choice in continuing to trade with the UK, as for many we represent such a large amount of trade that if they stopped it’s probably true we could go into recession (although technically we have been anyway since 2008), but so too would the trading partner in question. It’s a bluff. Things will of necessity carry on much the same for the short term.

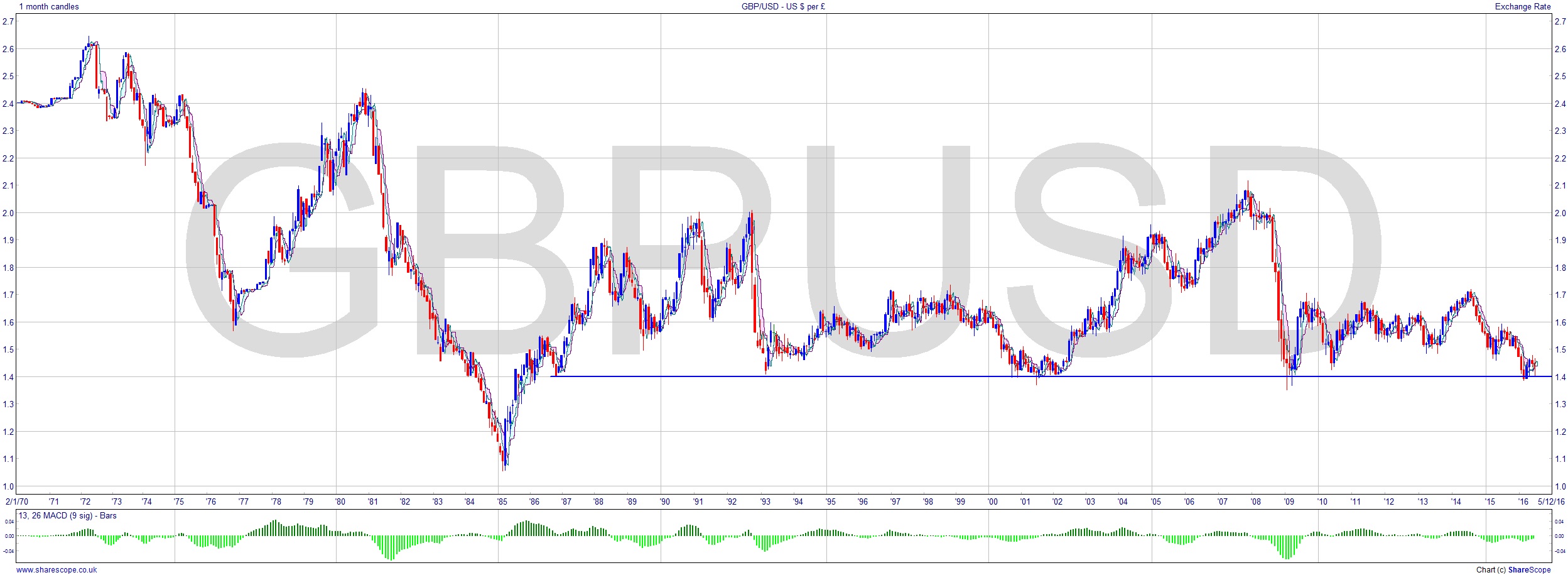

I wrote about Cable as a longer term shorting opportunity in January and April and now the circumstances may be presenting themselves to see that floor broken at around $1.40. As for the countries we won’t have a trade agreement with after Brexit, we could drop-ship through New Zealand, which has a free trade agreement with many countries. They are well placed to source Chinese goods for us, for example. And you may recall from an article in March the New Zealand High Commissioner to the UK said if the UK does leave the EU “New Zealand will be beating a path to your door”. This is not pie in the sky.

You can see on the monthly chart that we are again testing the support at $1.40 which dates back to the ‘90s. That broken, there’s no support until $1.05, the historical low back in 1985. There are many ways to play it depending on your risk profile and time horizon. There’s likely to be some serious volatility around the 23rd though, so expect margin requirements to be higher than normal and set stops accordingly. If you can get on the right side of a price spike though, it’s a great way to take advantage of the limit order. You can take profits that would have been almost impossible manually if you get it right.

Comments (0)