Another Round of Delayed Hikes

Things are getting nasty for central banks. They’re wasting their remaining credibility with foolish predictions that just end up being revised at every policy meeting. As I expected, the FED kept rates unchanged for the sixth consecutive month after hiking its funds target in last December to 0.25 – 0.50pc. The FED’s prediction of four rate hikes for 2016 has been slashed to two hikes. The market expects even less, as a rate hike is trading at less than a 50% chance. Next stop: July 27. Prediction: No hike, once again.

As usual, markets retreated prior to the FED’s meeting, in a kind of demonstration of what investors are capable of if the FED were to hike rates. It’s like a kind of blackmail, pressing policymakers to keep the status quo. But, apart from this sentimental behaviour, many also blame the increasing Brexit odds for the extra pre-FED volatility. Maybe that is part of the story, but over the last few years, we have heard all kinds of excuses when the time to hike rates eventually came. China, emerging markets, oil prices, corporate profits, Greece, fiscal cliff, strong dollar, sluggish productivity, global turmoil, low inflation expectations, sluggish growth, lack of a press conference following the FOMC announcement, and many more. This time it’s because of the fear Britain will leave the EU, next time will be because of a sluggish August, and in September it could be because of the US election proximity.

In the press conference that followed yesterday’s FOMC meeting, Janet Yellen expressed concern over the effect Brexit may have on global markets and, indirectly, on the US economic outlook. While I understand that such an event will certainly produce some volatility in financial markets, it doesn’t justify the massive change in policymakers’ predictions that can be found in the economic projections material made available by the FED yesterday.

Besides slashing the number of expected rate cuts from four to just two, the FED revised down its rate forecasts for 2017 and 2018. The median forecast is now 1.625pc (down from 1.875pc in March) for 2017 and 2.375pc (down from 3pc in March) for 2018. At the same time the FED now believes the long-term nominal rate is 3% and not 4%, as it has been for the last few years. Yellen is following in Bernanke’s footsteps, arguing the real long-term interest rate is now just 1% or less to justify the low nominal rates.

In her speech, Janet Yellen also expressed concern with the diminishing gains in jobs and with the decline in market-based inflation measures. While non-farm payrolls have been recording gains for years now, the truth is that we cannot ignore the fact that the last three reports have been showing declining figures, with the latest May numbers coming in at a worrying 38,000 jobs.

What does it all mean? In my view, it means that rate hikes will be much softer than anticipated. With economic growth and inflation being on the lower side, the FED will continue to delay rate hikes. After all, they don’t see a reason to hike rates and don’t want to be blamed for any potential economic retreat. It’s easier to tackle inflation than unemployment (at least that’s what they think), so let’s wait and see…

One thing must be acknowledged about the FED and its predictions: they’re always wrong. If you want real guidance just look at the market and forget the dots in the FED report because they will most likely be revised down once again. The lower their predictions for inflation and growth (and consequently interest rates, or vice versa), the more investors believe the economy is sluggish, and the more their actions contribute to making that a reality. I sometimes think they would be better off hiking rates to create an idea of well-being than to wait so long for better conditions. Sluggish predictions are becoming entrenched into people’s beliefs.

Regarding the near future, and keeping in mind the FED has just four meetings until the end of the year, I would suggest a near zero chance of two hikes occurring. If it took six months to recover from the first hike, I wonder how the FED will be able to hike two times in a much shorter interval. Interest rate hikes will continue to be data dependent and at this time I believe that the most important figures to keep on the radar are GDP estimates and non-farm payrolls reports.

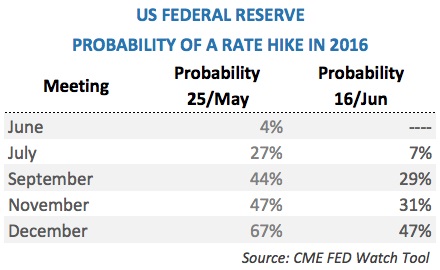

The next FED meeting, to be held on July 27, will most likely result in no action. The FED will by then have available the 3rd estimate for the first-quarter GDP figures and another non-farm payrolls report. But unless these are really strong, the FED will prefer to wait for confirmatory data, in particular because it is an error to hike rates before August when market volumes decline substantially. A rate hike at the end of July could create unnecessary volatility. At the September meeting the FED will have a few more data points, which include a total of three GDP estimates and three non-farm payrolls. By then, the FED may be tempted to hike its key rate by 25bps to give time to at least threaten the market with a second hike in December. The CME FED watch tool is currently attributing odds of 7.2% to a July hike and 29.4% to a September hike. In my view everything will depend on the aforementioned GDP and non-farm reports, with the odds for them to come in on the negative side increasing.

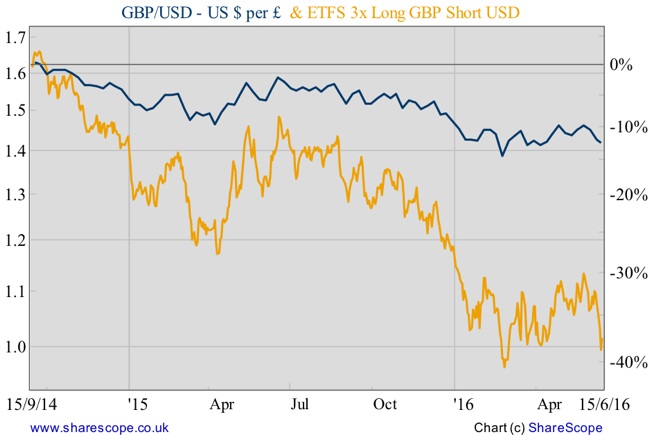

There’s no doubt the world is still unprepared for rate hikes as the global economy keeps growing at a sluggish pace. With the FED delaying rate hikes, the prospects for emerging markets and commodities are improving and the dollar may observe some softness. In fact, the FED may be looking for some dollar slippage to allow exports to improve and help corporate profits increase. Europe and Japan may have to react with additional easing and even push their rates further into negative territory. Because of this I still think that VanEck Vectors Gold Miners UCITS ETF is worth holding onto this year (see Macro Investor – How To Prepare For Helicopter Money p. 58-63). At the same time I expect sterling to recover against the dollar over the next few weeks. While the latest polls show the Leave option in front, Betfair odds still show an implied probability for the Remain option at 61%. The gap between telephone polls and betting markets, along with the FED delayed hikes, open a speculative opportunity in favour of the pound. I’m adding the ETFS 3x Long GBP Short USD to my portfolio just in case…

Comments (0)