Is it time to short cable?

Whenever you say ‘short cable’ some joker will say “actually, Vince Cable is quite tall”. It may be time to follow the electorate, though, who shorted Cable in his Twickenham constituency in the General Election this year and short cable (£:$).

Arbitrage is a big deal in trading and any sort of speculative endeavour. As traders we’re always looking for disparity since that’s where opportunity lies. Disparity is created by all sorts of stimuli, sometimes entirely unconnected and unintended, but at other times manufactured by governments to encourage certain kinds of behaviour.

For example, different rates of corporation tax encourage companies to relocate their operations overseas (even if only virtually, to Luxembourg). Ireland has the lowest rate of corporation tax in the EU (with the UK not far behind), and as a result many companies have set up shop there. But they can equally walk away if the deal doesn’t stay sweet enough, and they have the clout to sway policy because they are a major employer. Big business is big business, and governments will bend over backwards to keep them and the jobs they bring. Chinese businesses will be looking at just this sort of consideration when they want to set up shop in Europe. Rules for Chinese banks setting up in London have been eased to encourage them to come here, for instance. It’s a competitive world out there.

Interest rates are a similar phenomenon. Disparity creates opportunities for FX traders, if not for you and me with our holiday money. Of course these days the margins are tight but when you’re dealing with trillions it all adds up. In FX there is a thing called the carry trade. Basically, you take money from a country with very low or negative interest rates and then put it in countries with higher interest rates, perhaps the US now, to make a profit from the difference.

The consequence of this is that the currency with the higher rate becomes stronger as demand increases and vice versa. A stronger currency is good for imports and a weak currency good for exports.

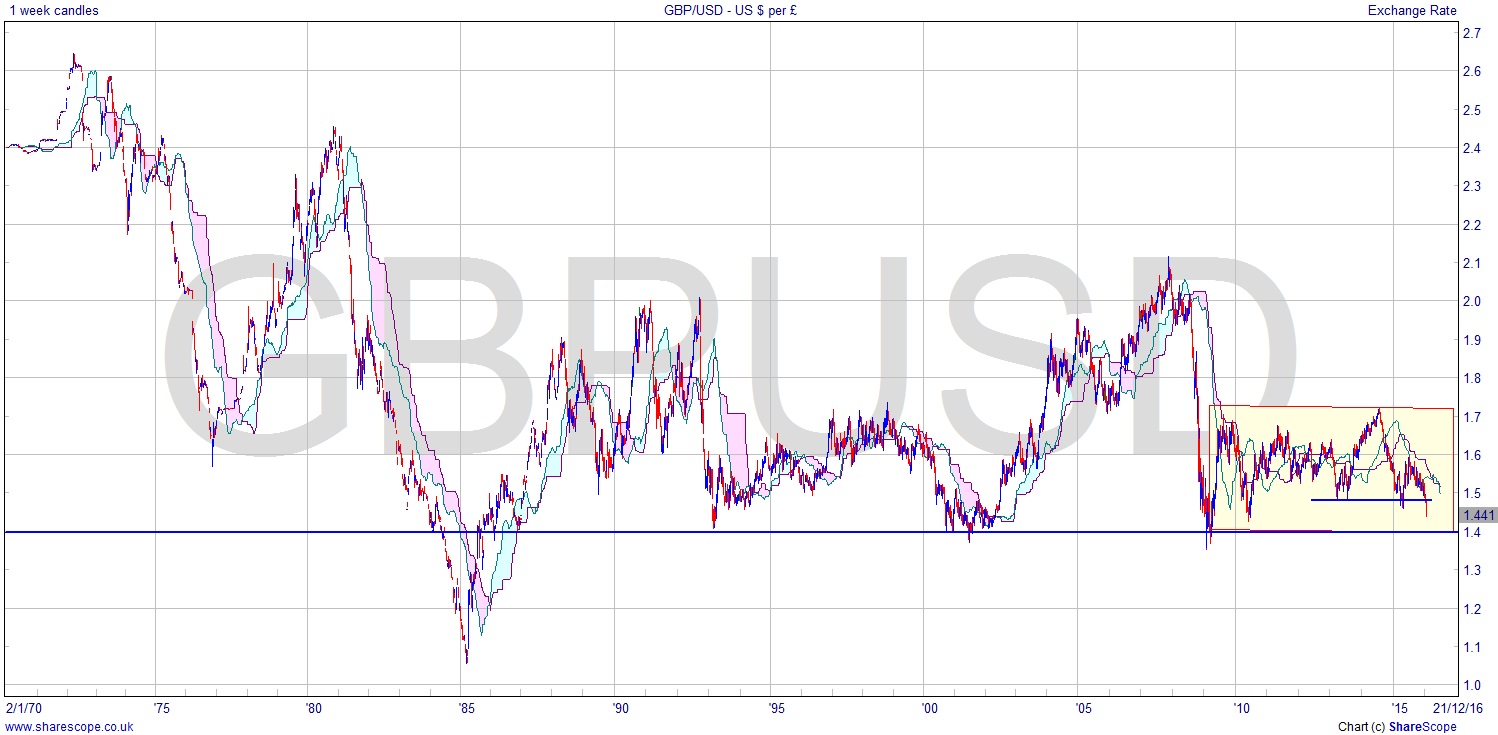

So the Federal Reserve increasing the base rate in the US is a big deal. And the effect we would expect is that the dollar should become stronger. And that is exactly what we’ve seen, which puts us in a very interesting position technically. I’m using the weekly chart back to 1970 for cable (£/US$) because we could be on the verge of one of the most significant currency trades in 50 years.

We have a very clear level of support at $1.40 which has been touched on various occasions: in 1993, 2000-2001, and most recently in 2009. So a very strong support level. If it breaks we’d expect a big move down, and possibly quite quickly. It hasn’t been below that level since the 1980s.

We’ve also been in something of a congestion area for the last five or six years. OK, it’s a bit of a messy range, but it’s a range nonetheless. If we apply the measured move logic to the chart, then we’d expect to see good downside – possibly as big as the move into the range – should the price properly break the $1.40 level. Let’s say the top of the move was $2.00 around 2007-2008, and the range from $1.40-$1.70 – then we’d expect a move below of 30c. That’s around $1.10. The low of 1985 was a little below that at around $1.08. That’s a nice neat target, supported well by the chart. I’ve deliberately been conservative with the figures I’ve used so as to ignore over-shoots, like the $2.10 I’m calling $2.00.

That is definitely one for the watchlist, or a speculative starter position if you like. We have after all broken down below the more recent lows quite convincingly. I’ve marked the range-bound area in yellow shade, and shown the recent break of support.

Of course we may well follow suit and raise interest rates here, which would make this a longer play, but as long as we’re lagging the US that should be good enough. It seems unlikely that the Bank of England will adopt an aggressive course of raising rates in retaliation, since that would just make it harder to export, which is a much bigger deal to us than the US. Besides, many other countries in the US sphere of influence principally use dollars in the first place. So trade with countries using dollars is a zero sum game for the Americans, not so for the UK.

Comments (0)