Something for the Weekend – Le Crunch for Apple

I know what you must be wondering. What sort of things do I ponder when I’m not thinking about the markets? Well, I’m glad you asked. Three things are playing on my mind. Why do magpies sound like someone shaking a box of matches? Why do pigeons’ wings sound like they need oiling, and how can swans, so graceful as they swim about, be so much like Judy Murray on Strictly when they try to take to the air?

However, there are questions to which I do know the answer, although I wonder whether the same can be said for the people involved. For example, Labour seems to be struggling with the very concept of democracy within the party. This may explain why they think they can win an election any time soon – or ever! Then there’s the way Mark Carney seems to think that cutting interest rates will do anything other than hold the Recessionary Sword of Damocles a little longer, postponing the inevitable, whilst creating a Summer Sale environment for property buyers from overseas.

Well for those that did indeed Sell in May and go away, following my piece on the subject, it’s back to work. St Leger Day is next week (10th September). Last autumn was an absolute bonanza and this one must be looking pretty good, what with uncertainty all over the place. This is the week to get your ducks in a row. Perhaps Apple (NASDAQ:APPL) is worth a look now the EU has decided to go round the back door to scupper Ireland’s 12.5% corporation tax haven. This makes the UK look pretty attractive with our 15% rate on the horizon. The EU wanted to coerce Ireland into normalising CT rates some years ago. But the Irish economy is built on it, and whilst it may appear to Merkel – of course soon to be replaced with a right wing leader like most countries in the EU – to be protectionist, it may just push Ireland over the edge to leave the EU and join forces with Corner Shop UK, open all hours for business.

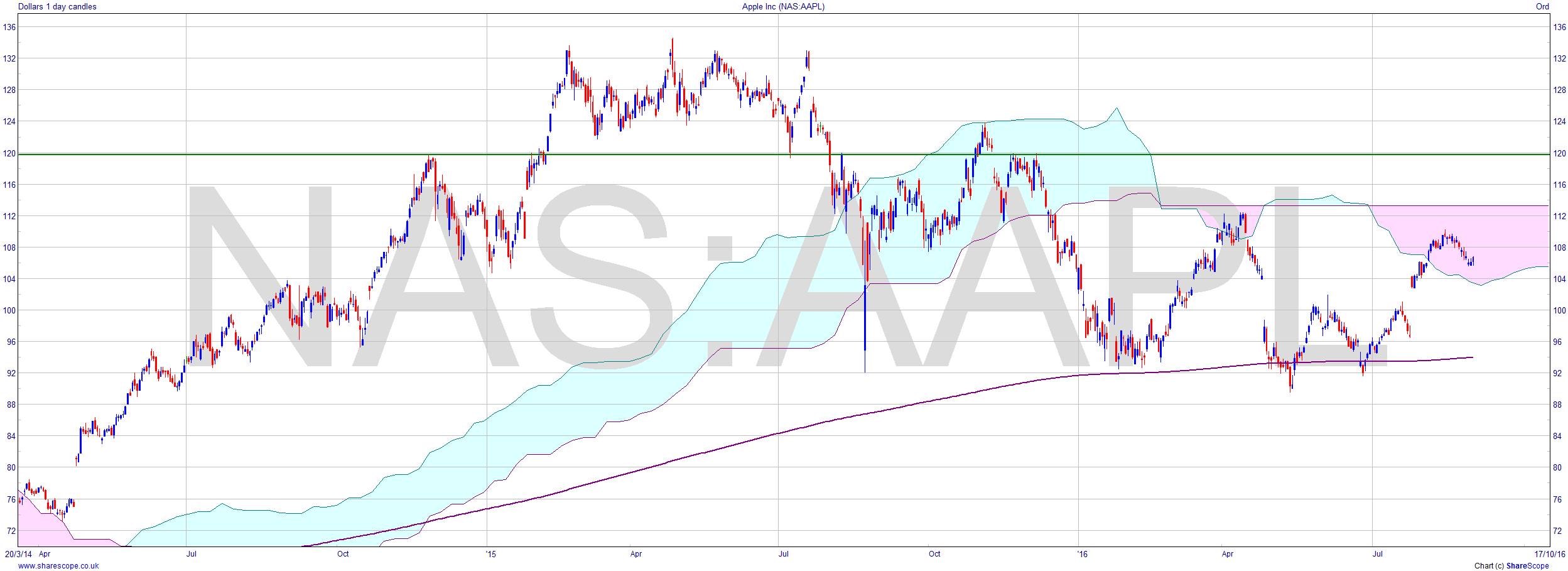

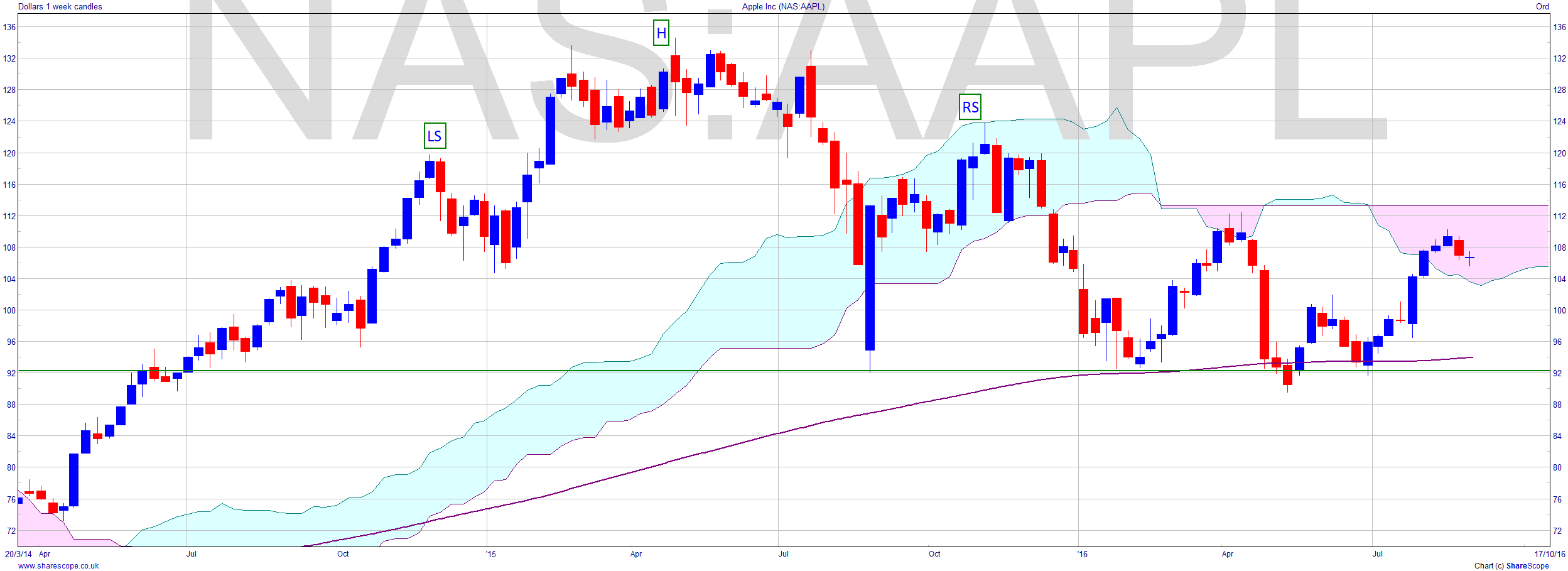

I looked at Apple last August. “The fall below $120 is significant, especially from a gap down”, I wrote. The stock promptly fell to $92 by the first week of September. It’s been bumbling along against the backdrop of a US market reaching new ATHs. Not impressive to say the least. I pointed out the H+S in January, and whilst Apple is certainly making a meal out of failing, using my early entry – i.e. anticipating the neckline – there have already been some nice gains to bank using simple Dow Theory – the lower high in April for example. It’s still looking pretty weak and I suggest sticking to the book and using tried and tested market entries.

Finally, I mentioned them in April and wrote “Apple (AAPL), for example, is looking not only weak, with the H+S having formed back in the last part of 2015, but also it’s only found support at the level it sold off to in the late summer panic. It’s off 25% since a year ago. MACD supports a small rally”. In the cloud now it seems lacklustre. That is presently a lower high but we also know that we’d expect a stock to touch the other side of the cloud yet, so I wouldn’t be rushing in on a short. That would match the last high in April. This offers an uncertain signal and possibly the confirmation of a trading range. Maybe the US economy is dragging Apple up. They should invent something new if they want to get back to ATHs. Perhaps an iSick that calls in convincingly pretending you’re ill when you can’t be arsed going to work, or iConoclast for Labour supporters, iRate for Carney to know what interest rate will annoy the most. I fear €13bn is not a huge amount for Apple so that may not be enough to see the stock plummet, if indeed the Ministry of Schadenfreude is capable of enforcing payment.

Comments (0)