From mighty oaks mighty Kiwis can grow

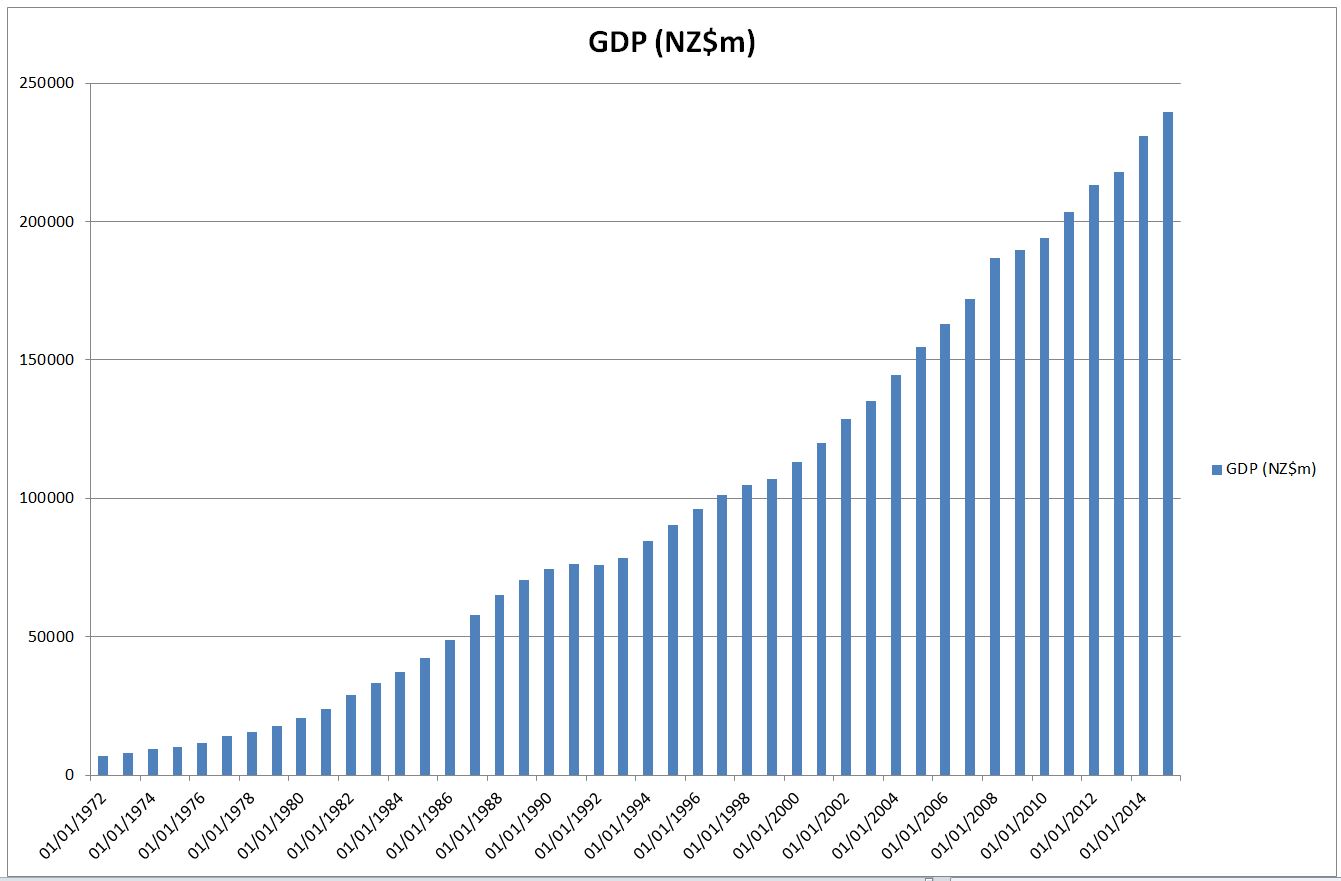

When places are far away and not that vocal it’s easy to forget they are there. New Zealand is one such example. Quietly beavering away, building a sound economy since the UK joined the Common Market back in 1973, New Zealand has set up a very sound business. Their GDP chart is excellent. Almost every year since 1973 they’ve seen an increase in GDP, the only blip being in 1992, and then only marginally.

They’ve built on markets in the Asia-Pacific region, which from a geographical and practical point of view always made much more sense than trading with one of the most remote countries in the world to them: the UK.

I was listening to a very bullish Lockwood Smith, High Commissioner of New Zealand to the UK, bigging up New Zealand last week at a lecture called “Britain, the EU and Global Trade”. The key to their success, he claimed, was to reverse the source of their failure. In the 1980s the wine industry had been protected from competition by import tariffs on foreign wines. As a result the NZ wines were like vinegar as there was no competition. The industry was on its knees and so New Zealand took a chance and removed the import tariffs. Its fortunes reversed and the wine industry is now a major part of the country’s export business, and one of which they are, quite reasonably, proud.

This led to NZ being at the cutting edge of international trade agreements, in which their basic approach has been free trade. This, according to Smith, has underpinned the success of the Kiwi economy. An interesting point he made as to what would happen if the UK were to leave the EU (since many questions were being asked about Brexit), was that if the UK does leave the EU, then “New Zealand will be beating a path to your door”. This was something of a surprise to some panellists.

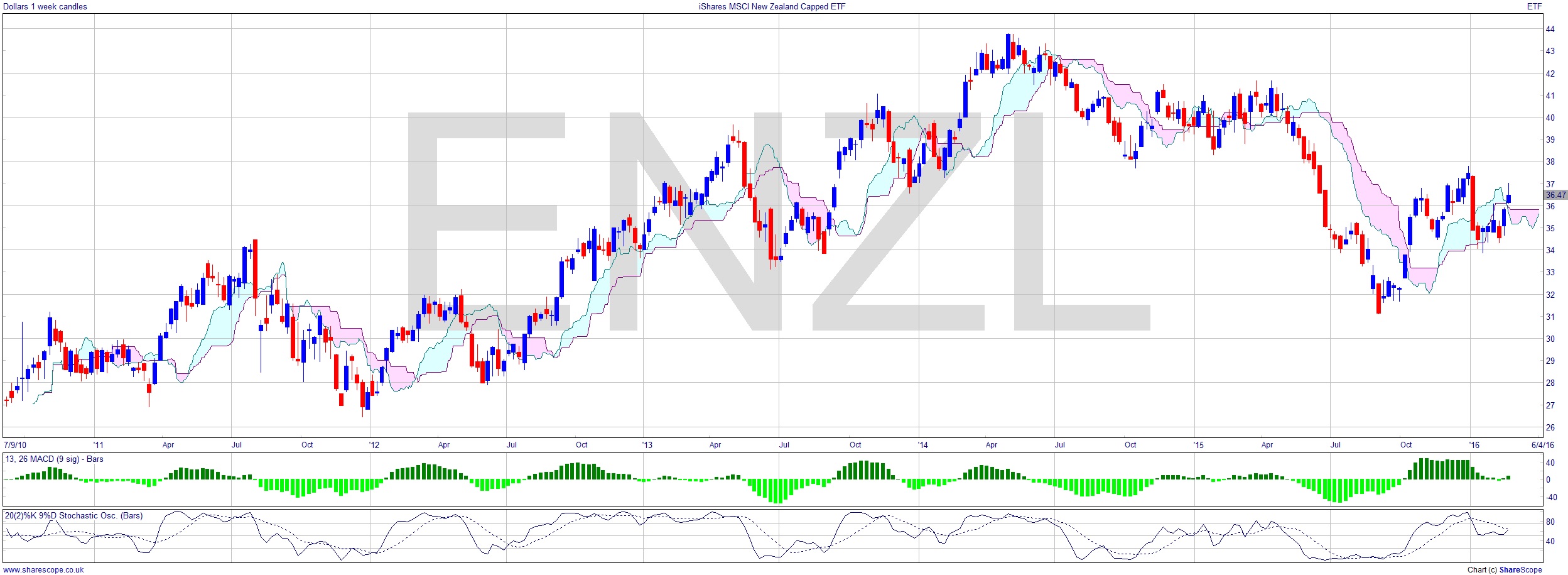

So I have looked at a New Zealand ETF, one that doesn’t include Australia. iShares MSCI New Zealand Capped ETF [ENZL] fits the bill nicely. A peak in 2014, which turned into a H+S which we’ve now seen play out, certainly underperforms the GDP chart, but we’re now seeing the price above the cloud again and, with Higher Lows in place, the possibility of a rally.

Another interesting thing about New Zealand (I’m sounding like E.L.Wisty now) is that it has free trade agreements with China. This is interesting because lots of other countries are taking advantage of that fact and sourcing Chinese goods and materials through New Zealand. It’s a very clever stance and somewhat unique. And there’s far less red tape when trading with New Zealand than with China.

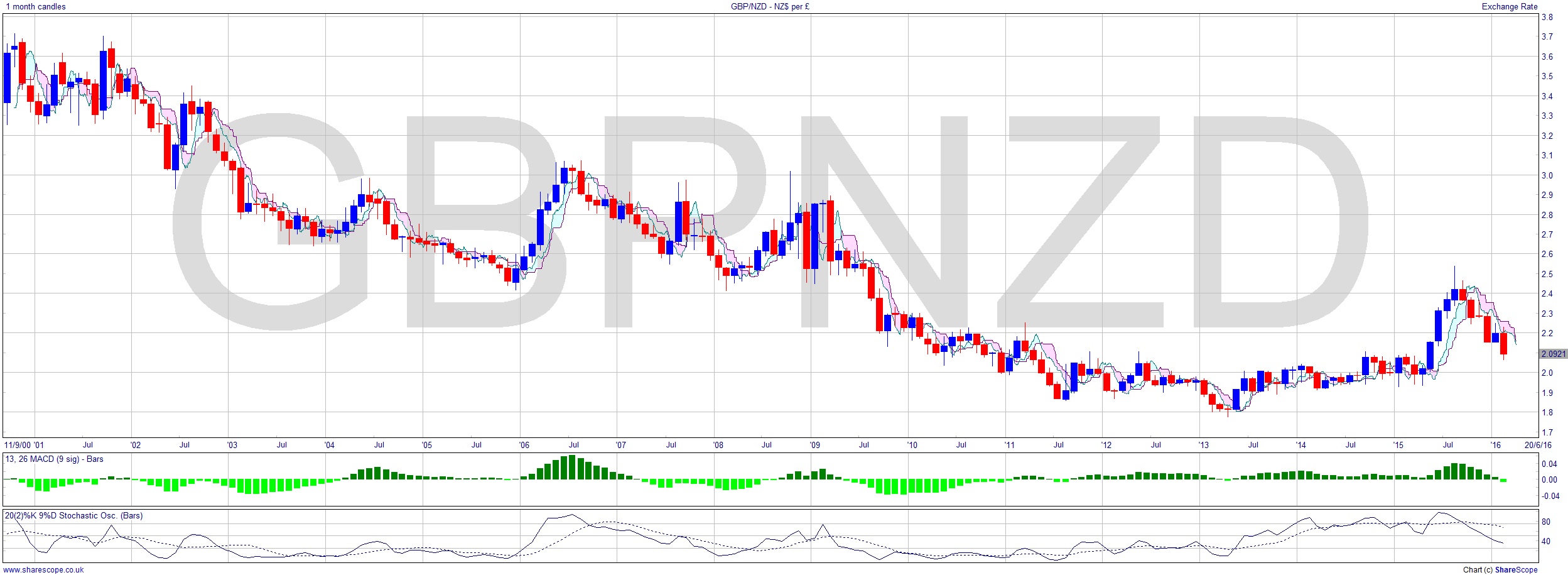

The Kiwi dollar is strengthening after a blip last year, so there’s even a case for not hedging; but either way New Zealand looks well positioned for the future. I got the impression they very much do hope we’ll leave the EU, which means Australia and plenty of other potential trading partners probably do too.

Comments (0)