Preparing For Volatility Headwinds

The stock market is doing well this year, as investors are betting on a quick unwind of the current tightening cycle. But, there are many risks hovering around, particularly that of a recession and of interest rates remaining at high levels for longer than anticipated. Being that the case, volatility may rise during the year, as investors digest the changing reality. While staying away from the market may appear conservative at this point, it may pay to, at least, eliminate part of the risks. To that extent, there are a few ETFs offering a core investment strategy but with a tilt towards less volatile assets that can be interesting.

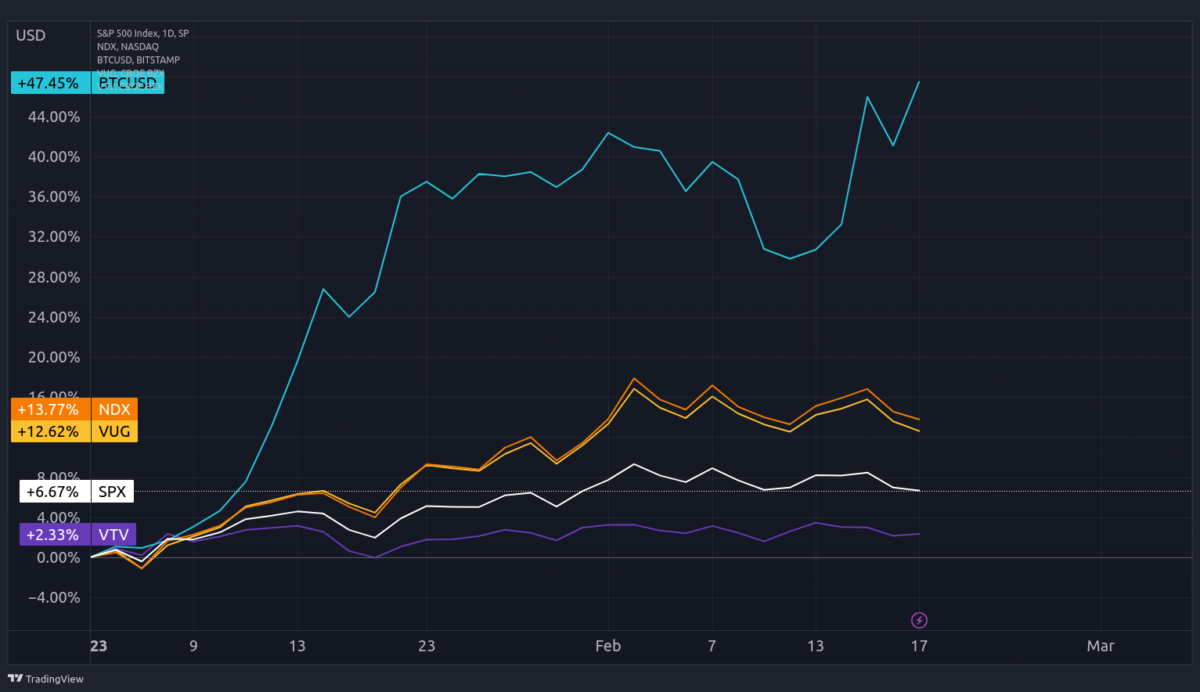

The yield curve is hiding something huge. The steepness of the current inversion is at a 42-year record. If we look at the spread between a 10-year and a 2-year US government bond, which is depicted in the chart below, we can easily spot that the current spread of -0.78% was last seen in 1981. Not even during the 2000 crash or the GFC of 2007-2009 we saw such levels of inversion. In my view, this reflects the high odds investors are placing on a quick reversion of the current rate cycle. While further rate hikes won’t come as a surprise, investors expect the Federal Reserve to cut rates again sooner rather than later. Such expectation is behind some heightened optimism pushing stock prices higher, particularly for growth and technology stocks, and for nascent markets like crypto. Year-to-date, the S&P 500 is up 6.7% while growth and tech stocks are doubling on that performance. The case for bitcoin is even more extreme, as the digital asset is rising almost 50%. This performance is eventually too good for the current macro conditions, and it relies on a subset of events that may end diverging from reality. There is ample margin for negative surprises and investors should prepare for an increase in uncertainty and volatility over the year.

Two factors may contribute to amplify volatility: a worsening growth outlook (or greater uncertainty concerning growth prospects) and a sudden change in market expectations about the timing of monetary policy. With inflation still rising at a much higher pace than central banks are willing to accept, even if economic growth stalls, I wouldn’t expect rates to normalise on the downside as fast as the market is expecting. I think risk and uncertainty will continue to increase over the year as investors readjust their expectations, and this could trigger increased volatility. For that reason, I propose a few ETFs with a tilt towards less volatile stocks. This way, investors can keep investing in a market that is rising, but get some protection against volatility at the same time.

iShares MSCI USA Min Vol Factor ETF (BATS:USMV)

The idea here is to get a broad exposure to US equities in a way minimising risk. The fund invests in a portfolio of assets that are expected to be less volatile than the broader market, but still capturing market returns. USMV is a very large ETF currently managing $29.4 billion in assets, spread over 165 holdings. The expense ratio comes in at 0.15% and top holdings include Cisco Systems, Merck & Co, Verizon Communications, Duke Energy and Gilead Sciences.

iShares MSCI Global Min Vol Factor ETF (BATS:ACWV)

Investors looking for a global exposure to stocks should look to this ETF instead of USMV. The top geographical exposures are: US (55%), Japan (11%), China (8%), Taiwan (5%) and India (5%). Two points must be highlighted. First, investors shouldn’t add this ETF to a portfolio with USMV because it would result in some kind of duplication. Second, while the ETF has “global” in its name, it still misses many regions of the globe like Europe, for example. ACWV is much smaller than its US sibling but still has $4 billion in assets under management and invests in 385 stocks. Its top holdings include Merck & Co, Waste Management, Johnson & Johnson, Pepsico and Gilead Sciences. Annual expenses come at 0.20%.

iShares MSCI EAFE Min Vol Factor ETF (BATS:EFAV)

EFAV helps complement the global exposure to minimum volatility offered by ACWV by adding stocks from Europe, Australia, Asia and the Far East. However, there will be some duplication when adding both to a portfolio because both have a significant exposure to Japan. EFAV don’t invest either in the US or Canada. Its total holdings include 225 stocks and assets under management account for $7 billion. Top holdings include Novo Nordisk, Swisscom, Sanofi, Koninklijke Ahold and Novartis. The expense ratio is 0.20%.

iShares MSCI Emerging Markets Min Vol Factor ETF (BATS:EEMV)

My last proposal is EEMV, which is a low volatility fund with exposure to Emerging Markets, including China (26%), Taiwan (19%), India (13%), Saudi Arabia (9%) and South Korea (7%). This ETF has $4 billion in assets spread over 316 holdings. Top exposures include Bank of China, First Financial Holding, Chunghwa Telecom, Taiwan Mobile and President Chain Store. The expense ratio amounts to 0.20%.

Other options

The above ETFs are just some of the options available in the market. For a US exposure to less volatile stocks, there is a good alternative from Vanguard, the Vanguard US Minimum Volatility ETF (BATS:VFMV). It invests in 181 US stocks and presents itself with an expense ratio of 0.13%. It’s a good alternative to USMV. For a specific exposure to small caps, there is the iShares MSCI USA Small-cap Min Vol Factor ETF (BATS:SMMV). With small caps currently beating the rest of the market, this may be a good alternative because of its focus on smaller companies while keeping the minimum volatility goal.

Final comments

In a year so far marked by optimism, it may be wise to question such great prospects, particularly given the macro conditions we live in. Inflation is still high, interest rates are rising, and we are due for a downturn. Investors are relying too much on a favourable rate cycle, which has the potential for negative surprises. Investing in stocks proved a good bet so far, as broad stock indexes are rising, particularly those related to growth and new technologies. However, pessimism spreads fast, and it doesn’t hurt to be careful and invest with some downside protection. The ETFs presented above offer some protection for volatility headwinds. However, in case there is a crash don’t expect any of these funds to hold tight, as they are just tilted towards less volatility and they’re not recession-proof funds.

Are interest rates actually now high? They are based on the last 15 years but perhaps they are now back to where they should have been…………save for BoE/Government meddling!

Completely agree