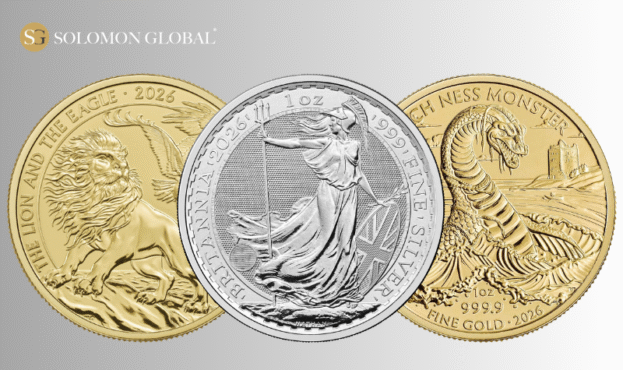

Solomon Global Introduces Most Exciting Royal Mint Gold and Silver Bullion Coins of 2026

Gold and silver investors have, no doubt, been excited by the remarkable rally that these precious metals have seen. However, collectable gold and silver coins have an additional worth above the intrinsic value of their metal content.