My Pick of the Year is Actually the Pick of the Year

Writing for Master Investor for over a year now has been an interesting experience for me, as it has forced me to lay out my analysis and hang my hat on predictions very publicly. And in many cases on stocks or markets that I wouldn’t trade in myself, as they wouldn’t suit my portfolio risk profile, for example. It’s been hard work as although one can’t be right all of the time obviously being wrong is highly unattractive in such an arena. I’m reminded of a saying from the world of sales though: it’s funny but the harder I work the luckier I get.

Obviously luck is a line of sight effect which humans either over-estimate or under-estimate. There is really no such thing as a ‘lucky person’. Someone may be lucky at one moment but overall what we consider luck is randomly distributed. That said, I like the advice to always borrow money from pessimists, as they won’t expect it back.

So I’ve been meaning to look back and see how successful my work here has been, but then they’ve started coming up in the news thick and fast, almost saving me the bother. But I will draw attention to them because obviously no one else will.

Regular readers will not have been surprised by the mild winter that was counter to the meteorologists forecast, as I wrote this in an article last October, by simply applying financial stock techniques to weather data: “Now, I’m not saying it won’t be a cold winter, but I am saying the probability from my analysis is that here in the South East it’ll be a fairly mild one, so I wouldn’t want to bet against that.”

Similarly, on June 17th, a week before the result of the EU Referendum was known, my readers won’t have been surprised by the Leave win as I set out my reasons and wrote: “I’m predicting Leave based on that.”

The fall of Cable again will not have been a surprise to regular readers as I first mentioned it in January, a month before the EU Referendum was announced incidentally, along with a target: “The low of 1985 was a little below that at around $1.08. That’s a nice neat target, supported well by the chart.”

There have been many others, and I will make a point of pointing them out over the coming weeks. But back to the trade of the year. Well there’s nothing quite as satisfying as reading yesterday on Bloomberg and the FT about something I wrote about a year ago initially: Ireland. I first drew attention to the huge opportunity in the Irish market and suggested an ETF to take advantage of it, there being surprisingly little choice, as in this one or a selection of individual stocks.

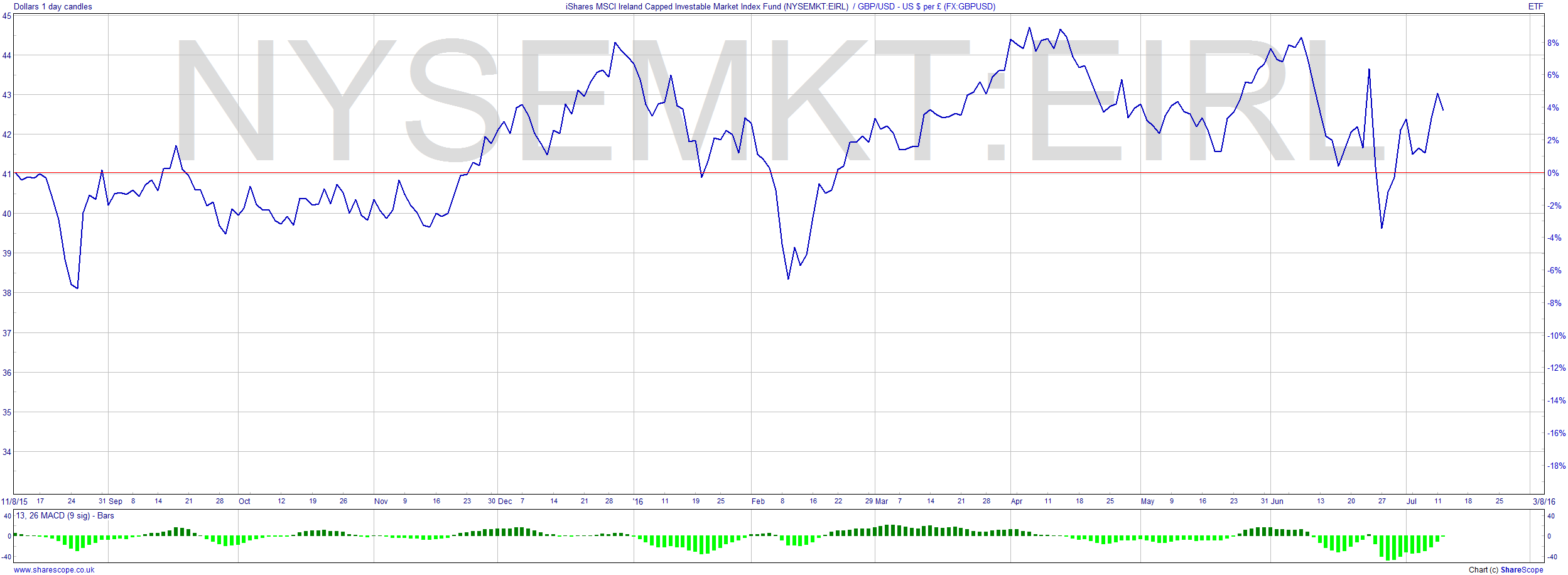

When pressed to come up with a pick for 2016 I went for the Irish market (ETF) again. Since then the figures for the growth in Irish GDP for 2015 have been announced. Yesterday in fact. Bear in mind that China was the golden boy of markets with its regular 8% growth during the infrastructure period, now much lower, but still above the 1%-2% we typically see in developed countries. Ireland hit 26% growth. Here’s the NYSEMKT:EIRL chart relative to Cable (£:US$). Obviously cross-currency trades need managing accordingly. GDP normally translates onto the markets over a 6-9 month period.

Don’t be surprised. Be informed. Please tell your friends about me. I’ve earned it!

Comments (0)