Zak’s Daily Round-Up: BARC, OCDO, AVO and UKOG

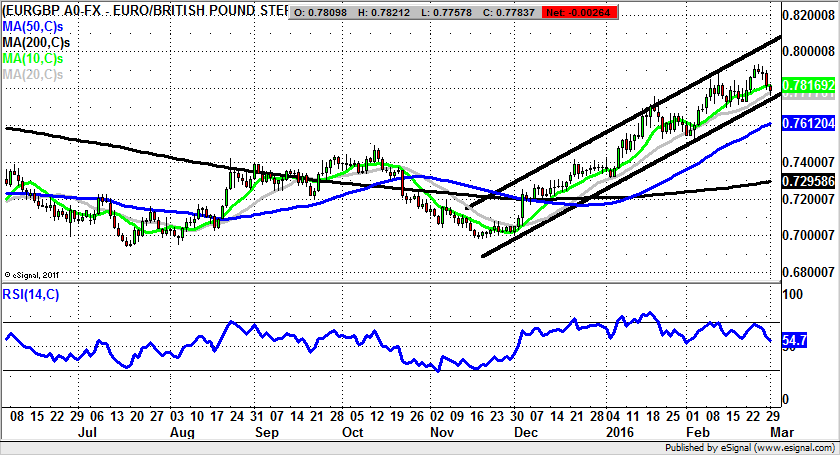

Market Position: Euro / Sterling – Above 77.50p Targets 80p

Barclays (BARC): 2015 Price Channel Target at 140p

Perhaps the first point to observe about the aftermath of the update from Barclays that while the dividend was cut on impairments and profits were squeezed, rival Lloyds Banking (LLOY) saw a £2bn special dividend payout. Given that both companies will be struggling due to the conditions in the sector, one would venture to suggest that either Barclays is in a particularly dire position, or that Lloyds is being too generous – or indeed, perhaps the truth is a combination of the two factors. But getting back to just Barclays, we have a tale of woe made worse by PPI, litigation and the meltdown in the oil & gas area and emerging markets. The problem is that rather than going for the “less risky” domestic market, it would appear that banks such as Barclays simply cannot avoid making a beeline for all the car crash lending situations. This is over and above the problem that the banking sector is clearly facing major long-term structural issues. On this basis alone, it is very difficult to put a positive spin on not only the latest results, but what the future drivers of income may be. This is even more of an issue given the way that many of the restructuring moves such as disposing of assets in Africa have yet to be completed. Looking at the daily chart we have a situation with a deeply entrenched breakdown. The main and perhaps only point of positive interest is the way that even in the aftermath of the latest update the shares have not broken the 147.75p low of the year to date. While this may only be a matter of time, at this stage we may have a level to trade around, if only on the basis that those who are short of the stock may have a support test target, while longs can wait for an approach to buy into. The minimum momentum buy trigger would be an end of day close back above the 10 day moving average at 163p, combined with a break of RSI 50. Unless we see this over the next few sessions one would assume at least a 147.75p retest, and probably down to the May price channel floor.

Ocado (OCDO): Below 50 Day Line Targets 200p

It has been quite a rise as far as online grocer Ocado is concerned over the recent past, with the company in the frame as a bid target, and now as the “loser” in a three way deal between itself, Morrisons (MRW), and Amazon (AMZN). This would lead us to believe that the big international player the group was referring to as a forthcoming deal partner could actually have been Amazon. The question now is how the market is going to react to Morrisons being the smart player, and Ocado something of an also ran. The problem is that without some kind of magic bullet on the fundamental front, we are reminded that this company is not too much more than a “meals on wheels” that struggles to make a profit. This is despite the way that it has to be conceded Ocado has a high-tech supply chain technology system. From a technical perspective we are seeing the shares trading in the aftermath of a February bull trap through the 50 day moving average now at 274p. The risk now is that provided there is no end of day close back above this feature, we could see shares of Ocado head as low as the November price channel floor currently pointing to the 200p zone. The timeframe for such a move could be the next 1-2 months.

Small Caps Focus

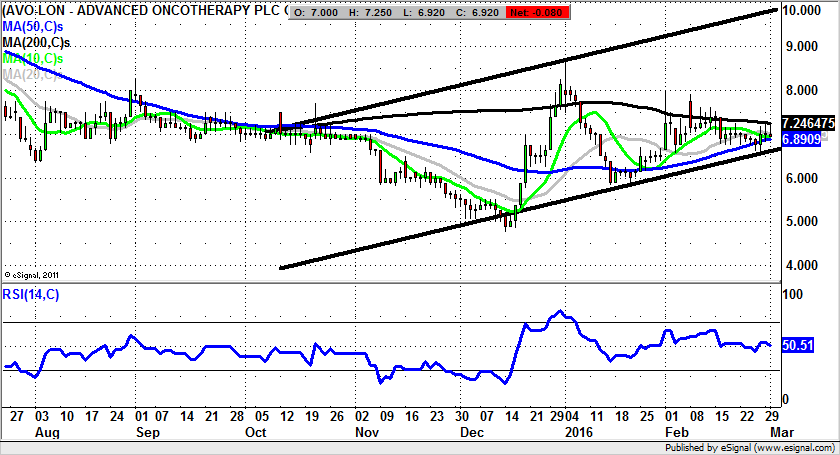

Advanced Oncotherapy (AVO): Above 2015 Support Line Targets 10p

It goes without saying that on a fundamental basis one would be keen for Advanced Oncotherapy, the cancer treatment group, to do as well as possible. This is with or without it being a great investment for its shareholders. Nevertheless, there is a decent chance of both shareholders and patients benefiting over the near term. This is said on the basis that there has been a rebound off the floor of a rising trend channel in place since October. The floor of the channel currently runs at 6.6p, with the implication being that provided there is no end of day close back below this notional support, the upside argument should prevail. Just how high the stock could stretch is suggested by the late 2015 resistance line projection at 10p, a 1-2 month price target. Only cautious traders should wait on a clearance of the 200 day moving average at 7.24p before taking the plunge on the upside.

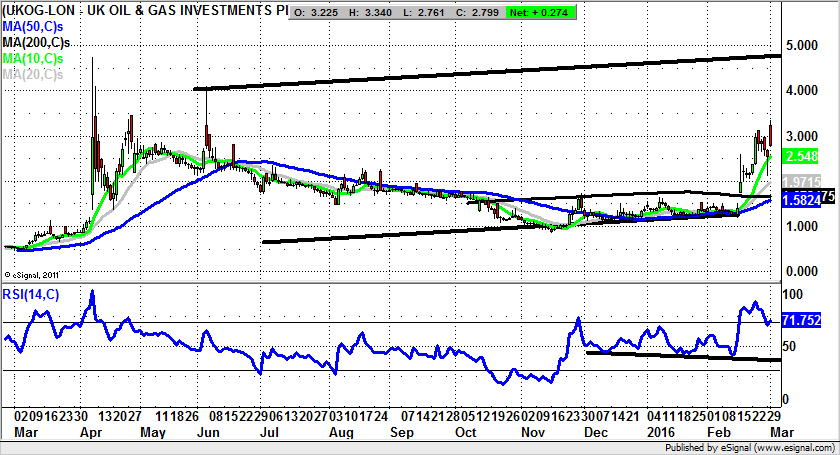

UK Oil & Gas (UKOG): Above 2.5p Leads to 5p

It is certainly worth revisiting the present position at UK Oil & Gas, partly to explain the technicals as they stand now, and partly as a counter to the cynics and doubters who have been all over this company and its projects. The charting position has been and remains that of an ongoing breakout, with the best description of what is happening now being a mid-move consolidation. This is currently based at the 10 day moving average level of 2.5p, which is a line in the sand as far as the bull argument is concerned. The implication is that one would be looking for any dips towards the 10 day line to buy into UK Oil & Gas, with the initial target a retest of today’s 3.34p peak. A weekly close above this number should be enough to take the stock as high as 5p which would involve a retest of the best levels of the past year. This is even though the RSI indicator is now at 70 plus, and just above the conventional overbought space.

Comments (0)