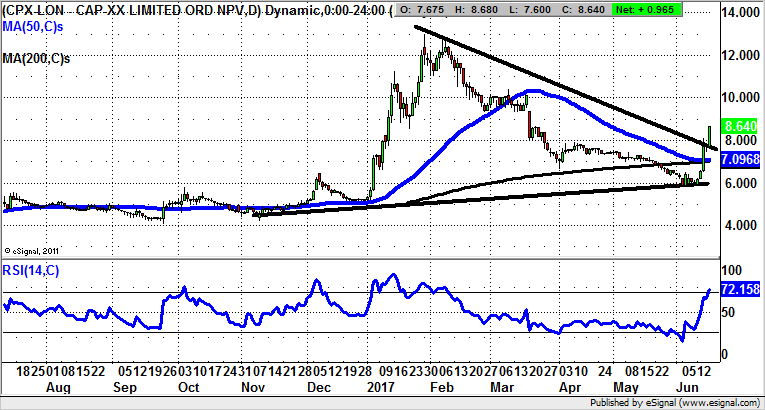

Cap-XX: Triangle breakout targets 12p plus

Cap-XX (LON:CPX) seems to be sending some mixed messages out on the fundamental front. But at least on the technicals we are looking at a situation where the longs are on the front foot.

The 7 June update from supercapacitor designer and maker Cap-XX was a good news/bad news affair in the sense that while the company gushed about how well it is doing in terms of advancing new licensing agreements and contracts, some of the business it has been looking forward to doing could be delayed until the next financial year.

What is interesting about the stock market response on all of this is that the glass has been deemed to be half full rather than half empty, almost as if the delay factor is not as bad as feared. Indeed, what can be seen on the daily chart is the way there has been a clear breakout through the top of a large post November triangle formation.

The resistance line of the formation currently runs at 7.5p with the message currently being that while there is no break back below this level, and especially the 50 day moving average at 7.09p, we should be treated to further significant upside. This should stretch to one year resistance at 12p. The time frame on the 12p target is the next 1-2 months. Any dips towards the broken trendline at 7.5p can be regarded as buying opportunities.

Comments (0)