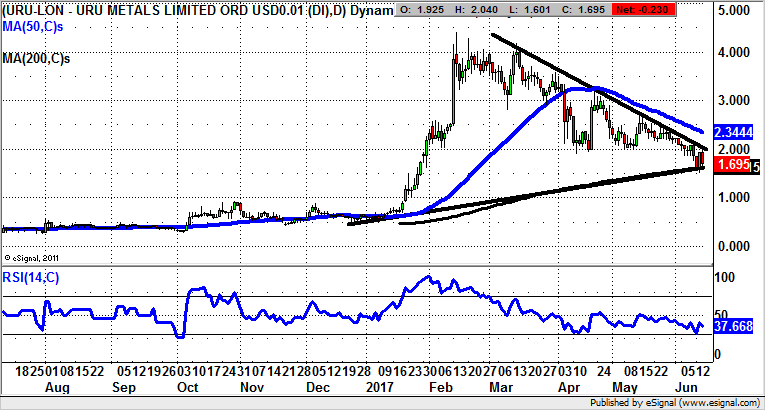

URU Metals: All about the 200 day line

I was keen enough to attend a presentation of URU Metals (LON:URU) earlier this year when the shares were trading above 4p. The question now with the stock below 2p is: What are the technicals saying?

For a company which was seemingly on everyone’s lips to start 2017, there appears to be something of a vacuum in terms of the newsflow of late. All I could really dig up was the latest from Northland Capital Partners on URU Metals, telling us about the board changes and an update from the key Zebediela Nickel Project.

However, the issue here at the moment is that there does not appear to be anything to suggest there is a compelling rush to get back into the fray. Instead, it would seem that we are obliged to play the waiting game, especially in terms of the acquisition of Lithium projects – a red hot area for many private investors currently.

Looking at the daily chart and it can be seen how we are trading in the aftermath of a February/March triple top at 4p plus. The present position is that one would want to see buyers coming in aggressively towards the 200 day moving average at 1.60p. Yesterday they did. But this seems to be fading. The other approach here would be to go for a momentum trade, and wait on a March resistance line at 2p. However, at the moment this feature feels like it is a long way away.

Comments (0)