Zak’s Daily Round-up: ADN, AHT, CTAG and QFI

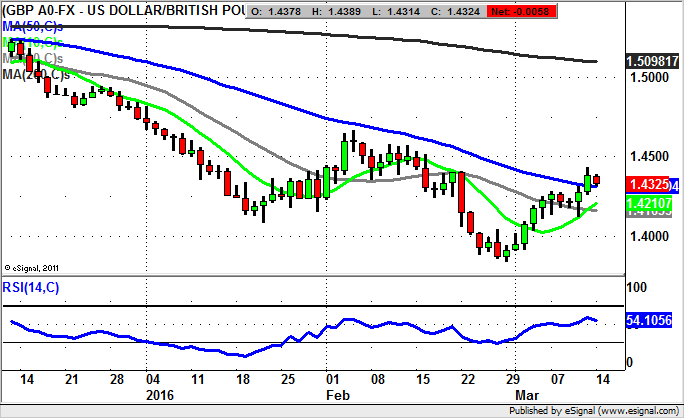

Market Direction: Sterling / Dollar Above $1.42 Targets $1.46

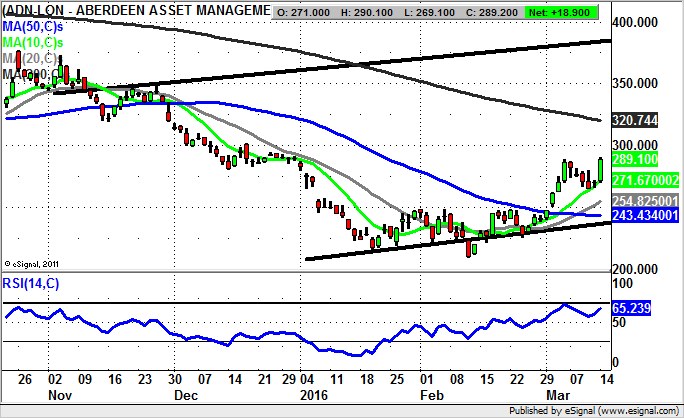

Aberdeen Asset Management (ADN): November Price Channel Target At 380p

While the FTSE 100 seems to be somewhat bogged down under 6,200 – presumably pausing given the event risk this week on the economic / central bank front, it seems to be the case that there is plenty to shoot for as far as technical stock opportunities, both in the FTSE 100 and further down the market. This is especially the case in terms of what I would call second line FTSE 100 stocks such as Aberdeen Asset Management, and Ashtead (AHT), which follows below. The present position here on the daily chart shows the way that Aberdeen has made a decent base following the initial sharp January double gap to the downside. Since then there has been a break above the 50 day moving average now at 243p for the start of March, followed by a rebound off the 10 day moving average at 271p. This is a very positive ricochet in that it represents a V shaped bull flag breakout, one which could deliver yet more significant recovery. The favoured destination at this point is seen as being the 200 day moving average now at 320p over the next couple of weeks. After that the one – two month target is the top of a wide rising trend channel from as long ago as November, with its implied 380p destination. At this stage only really a weekly close back below the 50 day line would really suggest that the build here was about to fade into a false dawn.

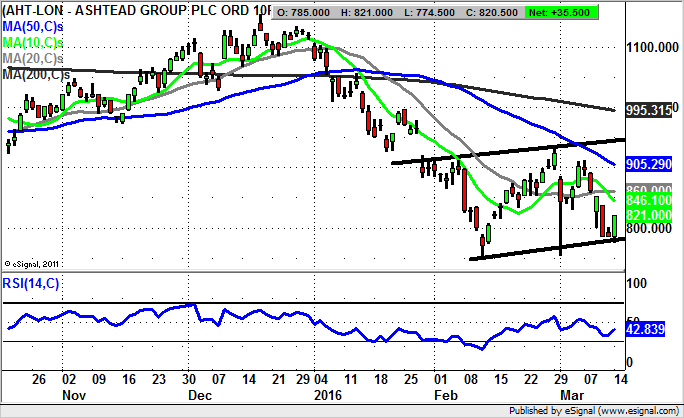

Ashtead (AHT): Higher Lows Lead Back To 950p

It can be seen from the daily chart of Ashtead how we have been treated to a rather wild ride over the past couple of months, as there would appear to have been something of a tug of war between the benefits that this dollar earner should have had given the recent weakness of the Pound, and worries over global economic growth. However, the latest message from the technicals here would appear to be that even if this is not the end of the bear run for the shares, we could be due at least an intermediate recovery. This is said in the wake of the two higher lows for March above 750p, and above the February 749p intraday low of the year to date. What also helps build confidence is the way that for the start of the week we have been treated to a key reversal to the upside, with the message being that at least while there is no end of day close back below the intraday low of Monday at 774p, a decent near term upside scenario beckons. Just how high this could fly is suggested by the top of a rising trend channel from the beginning of the year at 950p. The timeframe on such a move is expected to be as soon as the end of April, after which one would fear a fresh leg to the downside if this zone was not conquered.

Small Caps Focus:

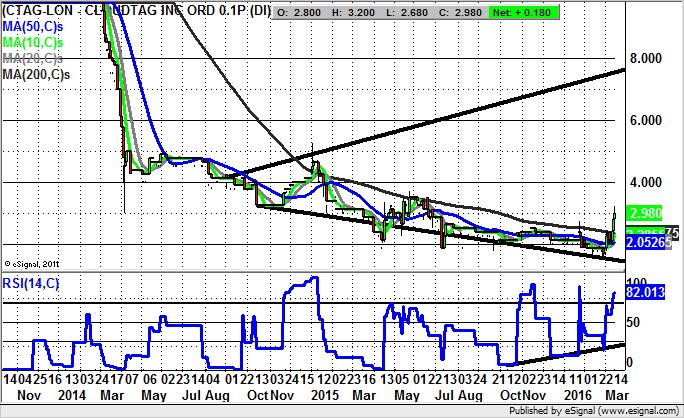

Cloudtag (CTAG): Broadening Triangle Targets 7p

Although it is evident that shares of Cloudtag are not the most liquid in town, it can be seen how the charting pattern of the past six months and more had been reasonably robust. Indeed, the price action has just made its big breakthrough with the clearance of the 200 day moving average at 2.25p. In fact, what is interesting is the way that this clearance has been made at the second attempt, with no need for a pullback – to date. The best way forward at this stage looks to be to keep an eye on the former January peak at 2.72p to come in as new support and / or be the area to buy down to. This is especially the case given the way that the RSI at 82 / 100 is now very overbought. While it does look as though the momentum here is strong enough to take the shares on from current levels quite sharply, it may be worth waiting a session or two to see whether there is a retracement. Otherwise, we do have a decent upside penciled in. This is calculated by looking to the top of a broadening triangle, one which has been in place from as long ago as September 2014. The resistance line projection of the triangle is pointing as high as 7p, and while this does feel as though it is a long way away, there is every chance it could be hit as soon as the next 2-3 months. At this stage only back below the 50 day moving average / early March support at 2.05p would really question the upside / breakout scenario.

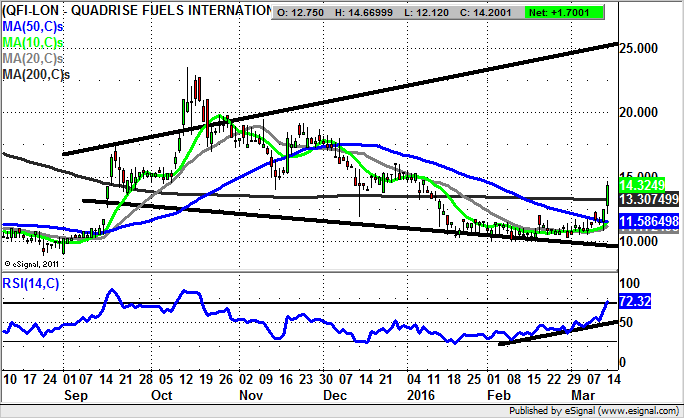

Quadrise Fuels (QFI): Broadening Triangle

Another minnow, and another former favourite charting situation, which at least in the recent past did let the bulls down. This is said particularly in the wake of the post October head & shoulders breakdown for the shares from 20p plus, clearly a disappointing and somewhat painful move. However, what can be seen since the start of the year is the way that the shares have managed to rehabilitate themselves with an extended base at and just above the 10p level. Even more helpful from the beginning of last month was the way that one could see a rising RSI trace and then was able to drawn an uptrend line in the RSI window. The position now is that we are being treated to an end of day close through the 200 day moving average now at 13.30p. The implication is that aggressive traders would now be buying into this situation and targeting as high as the top of a broadening triangle with its resistance line projection pointing to 25p. The timeframe on such a move is seen as being as soon as the next 1-2 months. Only a break back below the 50 day moving average at 11.58p would now question the idea of a decent recovery here.

Comments (0)