Morrisons: Failure and Hostile Take-Over Ahead?

What a week last week was. The Tories voted to cut disability benefits by £30/week, yet the back bench revolt prevents the liberalising of Sunday trading hours because apparently, in the House of Commons at least, it’s still 1950. To be fair it’s Labour that has the Keep Sunday Difficult campaign. Make Sunday a day worth being alive for I say. The only day many of us get off at complete leisure and it’s not even a real day cos everything’s shut or closing early.

Well it’s certainly not good news for supermarkets. Talk of Morrisons recovery is quite possibly premature. I rather think all the majors were hoping for the vote to succeed. Morrisons cut their recent dividend, which at least means they’re not borrowing to maintain it, from either Peter of Paul. They say recovery will take time. The big question is how long?

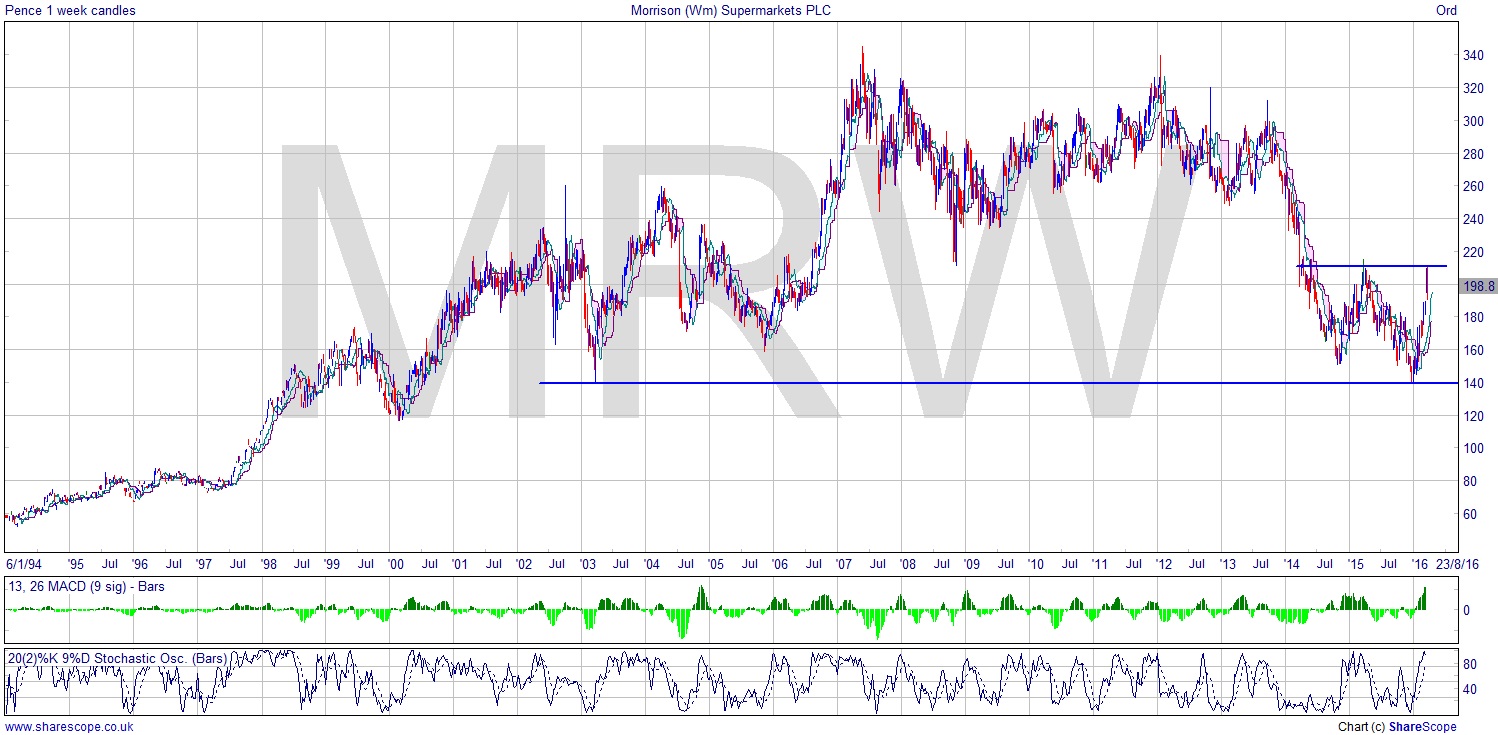

The Morrison [MRW] chart is at a crossroads. The weekly chart illustrates very well indeed how we could be at a reversal point, although I’m not a big fan of double bottoms, let alone in a poor economy, during a massive competitive war between rival supermarkets, and what looks very much like a congestion area rather than a reversal.

It’s failed at the 200p mark now, rather than shooting through it which would have been a cause for thinking long. Morrison rattled along in a congestion area for most of the first half of the noughties, so I wouldn’t hold your breath to see a resolution one way or the other. The recent highs and lows from ’14-’16 are progressively lower, a weak sign itself. The Stochastic is very toppy, although one must always remember with a stochastic that it is limited to 100, so it isn’t as ‘high’ as it can go just because it’s around 100, it can stay there too.

We have recently reached support at the 140p level from 2003. Ok, no one much is thinking “oh, I’d better sell, it’s getting down to the price I paid 13 years ago”, or if there is they’re in the wrong business. But if this is a measured move then we’d be looking to see 90p – 100p downside from 140p. Morrison at 40p. Well I expect I could raise the capital for a take-over bid at that price.

As I said though, don’t hold your breath. A well out of the money Covered Warrant on the short side could be a punt, but it would be just that. We need to distinguish between punts and trades/investments. Food retail has always been a tough game and now the supermarkets are caught between a rock and a hard place. Especially the ones at the more ‘blue-collar’ end of things. People want the absolute cheapest produce and also they want to at least pretend it’s ethically sourced. Even consumers want plausible deniability these days. Another impossible conundrum, like reducing emissions and producing cars with decent fuel economy, ethically sourced dirt cheap food. Our whole 21st century first world economy is a lie in that sense. How can you have any pudding if you don’t eat your Greenwash?

It’s an interesting move for Morrison to be selling food through Amazon. That’s probably the thing to watch. Maybe there’s fun to be had getting your cherry bombs delivered by drone in the suburbs.

Comments (0)