Safety First: The Ruffer Investment Company (RICA)

The recent market volatility has vividly highlighted the risks associated with mainstream equity funds. In the first few weeks of the year the FTSE 100 index lost more than 9% of its value and although it has since recovered not everyone is comfortable with these sorts of fluctuations in their wealth.

Risk averse investors who want more stability in their portfolio might want to consider allocating part of their money to a fund that focuses on capital preservation. A good example is the Ruffer Investment Company (RICA), which seeks to generate consistent, sustainable and absolute returns in all market conditions.

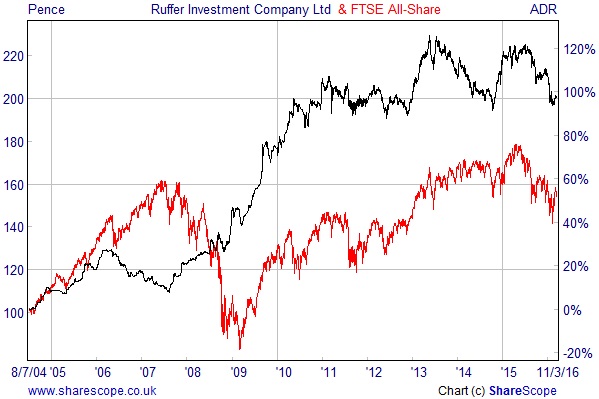

RICA aims to achieve a positive total annual return, after all expenses, of at least twice the Bank of England Bank Rate by investing predominantly in a portfolio of UK and international shares and bonds. Since it was launched in 2004 the shares are up by almost 100%, whereas the FTSE All-Share has gained less than 60% and has been considerably more volatile.

Ruffer makes an excellent diversifying holding because it has a low – and sometimes negative − correlation to the equity markets. This means that it tends to do well in difficult conditions. During the worst of the financial crash from 1 July 2007 until 30 June 2009 the total return to the fund’s shareholders was 36% compared to a loss of 31% for the FTSE All Share Total Return index.

The managers, Hamish Baillie and Steve Russell, are extremely cautious at the moment and have put together a defensive portfolio with the largest allocation being a 43% exposure to UK and international index-linked bonds. They have a further 2% in cash, with gold and gold equities making up an additional 6% and protective put options 1%.

Another 9% has been invested in illiquid strategies with the equity allocation being just 39%. The latter is mainly concentrated in Japan and North America with each of the stocks chosen on the basis of their favourable fundamentals. The five largest equity positions are: Boeing, T&D Holdings, Sumitomo Mitsui Financial Group, Mitsubishi UFJ Finance and Lloyds Bank.

Last year Baillie and Russell significantly reduced their equity exposure and it is now the lowest it has been since the 2007/08 financial crisis. This helped to keep the fall in NAV down to 1.7% in January, which was better than the 3.1% drop in the FTSE All-Share Total Return index, with the inflation-linked bonds and gold both providing positive contributions.

The managers think that the markets will continue to be volatile as the authorities resort to additional forms of monetary and fiscal stimulus in an effort to overcome the deflationary forces affecting many of the world’s major economies. They think that government debt levels are too high to be sustainable and will have to be eroded by inflation and negative real interest rates.

The Ruffer Investment Company has a market value of £311m and ongoing charges of 1.13%. Over the last 12 months it has traded on an average premium to NAV of 0.37% but has recently slipped to a discount of 2.2%. This could offer a decent buying opportunity for risk averse investors who want to diversify their portfolios.

Comments (0)