US Markets Round-Up

With the news today that Facebook will have to pay more UK tax, I thought it was about time to do a round up on the US markets.

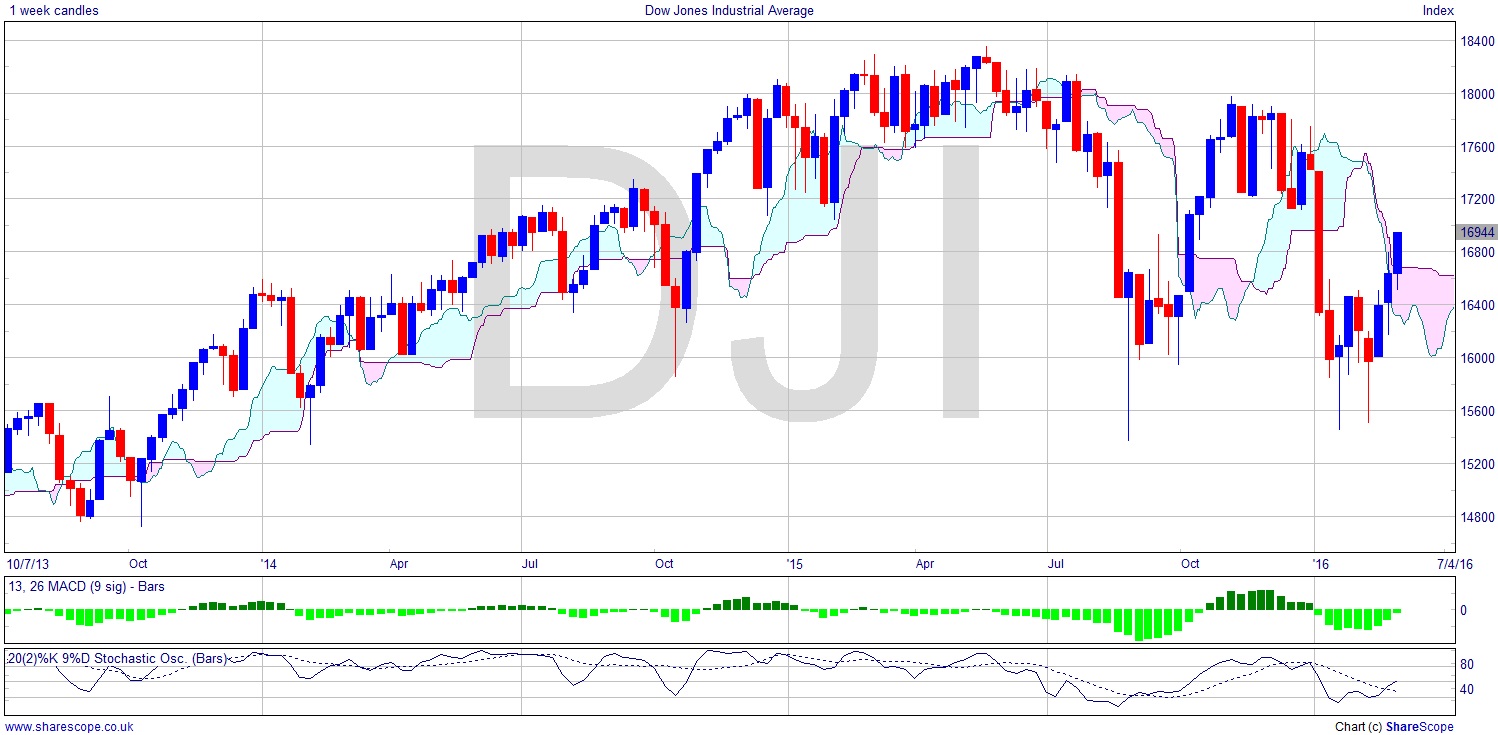

First off the Dow (DJI) looks nice and bullish for the moment. It’s above the cloud there and probably heading up to the region of 17,700, with the MACD just going positive and a fair bit of support from that. Note the higher low on the stochastic as well, just a few weeks ago. You can use Dow Theory on indicators too, and a higher low is as bullish on the stochastic as if it were the price itself. We do still have a H+S in the bigger picture, don’t forget, so 17,700 is a decision point: it’ll either fail and resume the downward trend or if it goes on up it would have to go quite a bit higher for it to nullify that H+S weakness.

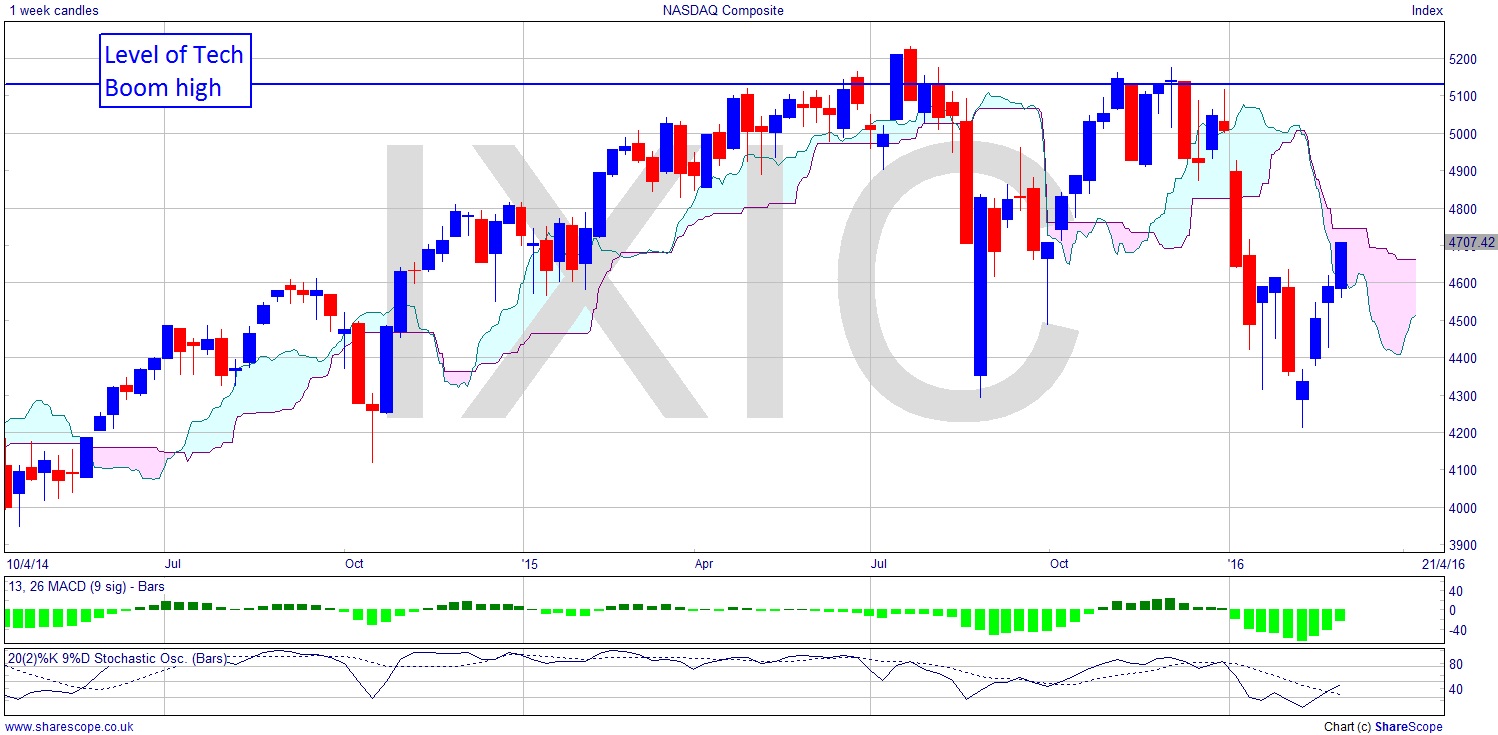

The NASDAQ (IXIC) is more of a leading index. This is because it’s based on a lot of hot air and expectation due to the companies in it being mainly Tech-based and not capital-asset intensive. This means the value of companies is much more open to suggestion rather than a balance sheet valuation of fixed assets, or even stock, in many cases. Note that the NASDAQ is inside the cloud, which is not the same thing as being above it by any means. We’re seeing a lot more weakness here than in the Dow. That tends to suggest that we will see the Dow’s H+S weakness resume after a brief rally. Note also that the NASDAQ still hasn’t managed to break the level of the Tech Boom high and stay above it. Again we’ll probably see a little rally here but I wouldn’t be expecting to retire off it or anything.

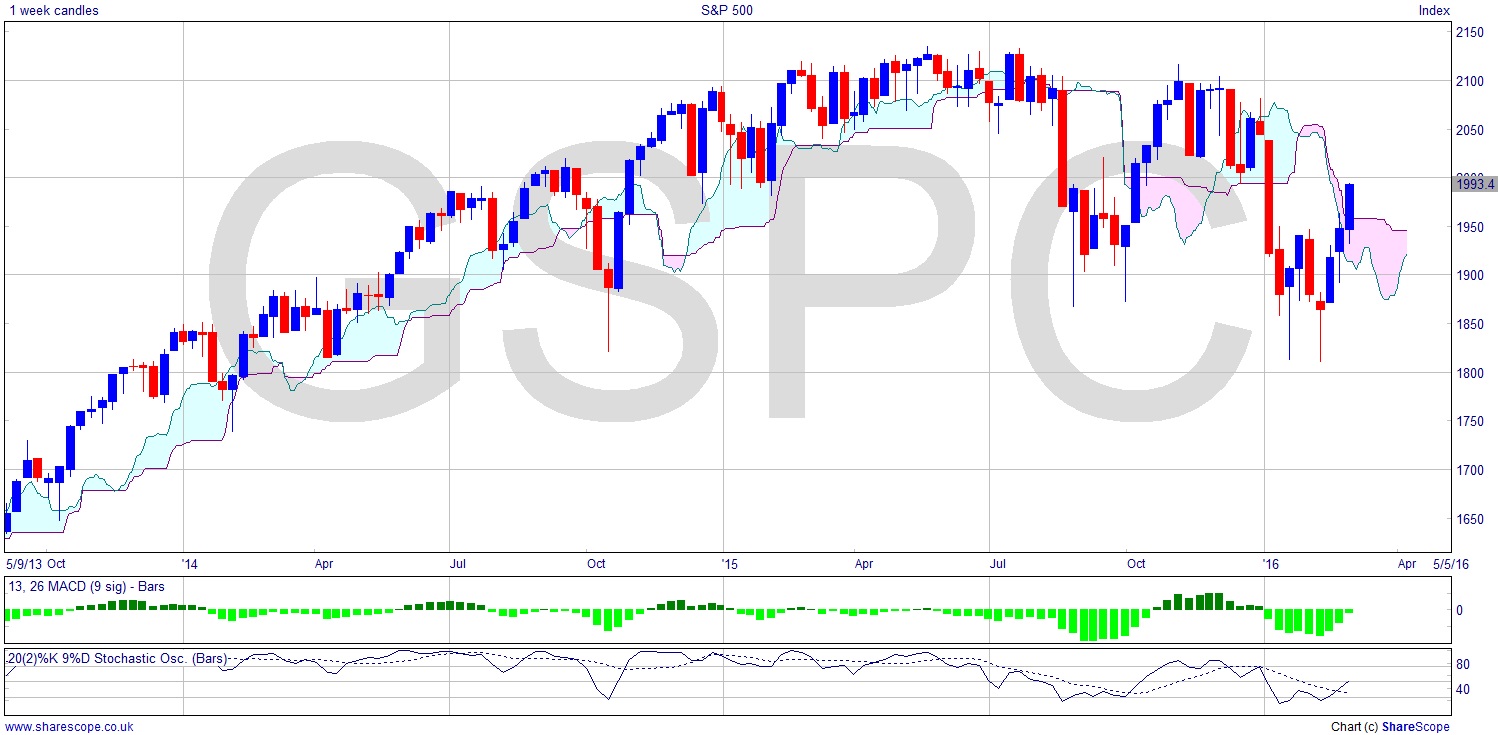

The S&P (GSPC) really just shadows the Dow at the moment. Above the cloud and a minor rally expected.

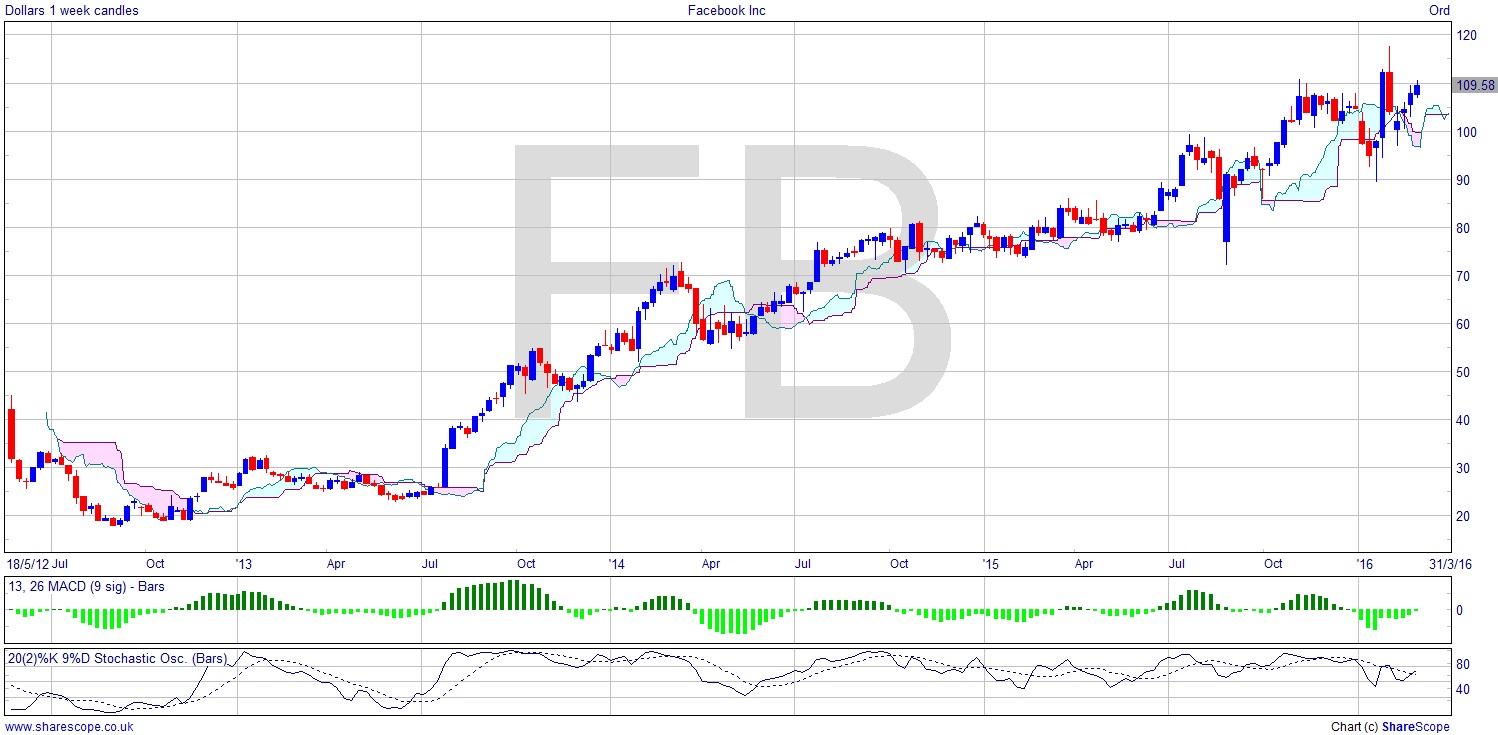

So what about Facebook (FB) then? Well it’s looking like a H+S could be forming there. A fall from this level and we’ve got ourselves a right shoulder and the pattern is almost complete. I would take a move below the cloud as a completion of the signal. We’ve that left shoulder at $110, but also a left shoulder further back and lower down at $100. A right shoulder at the $100 level after one at $110 and this could mark a reversal for the stock.

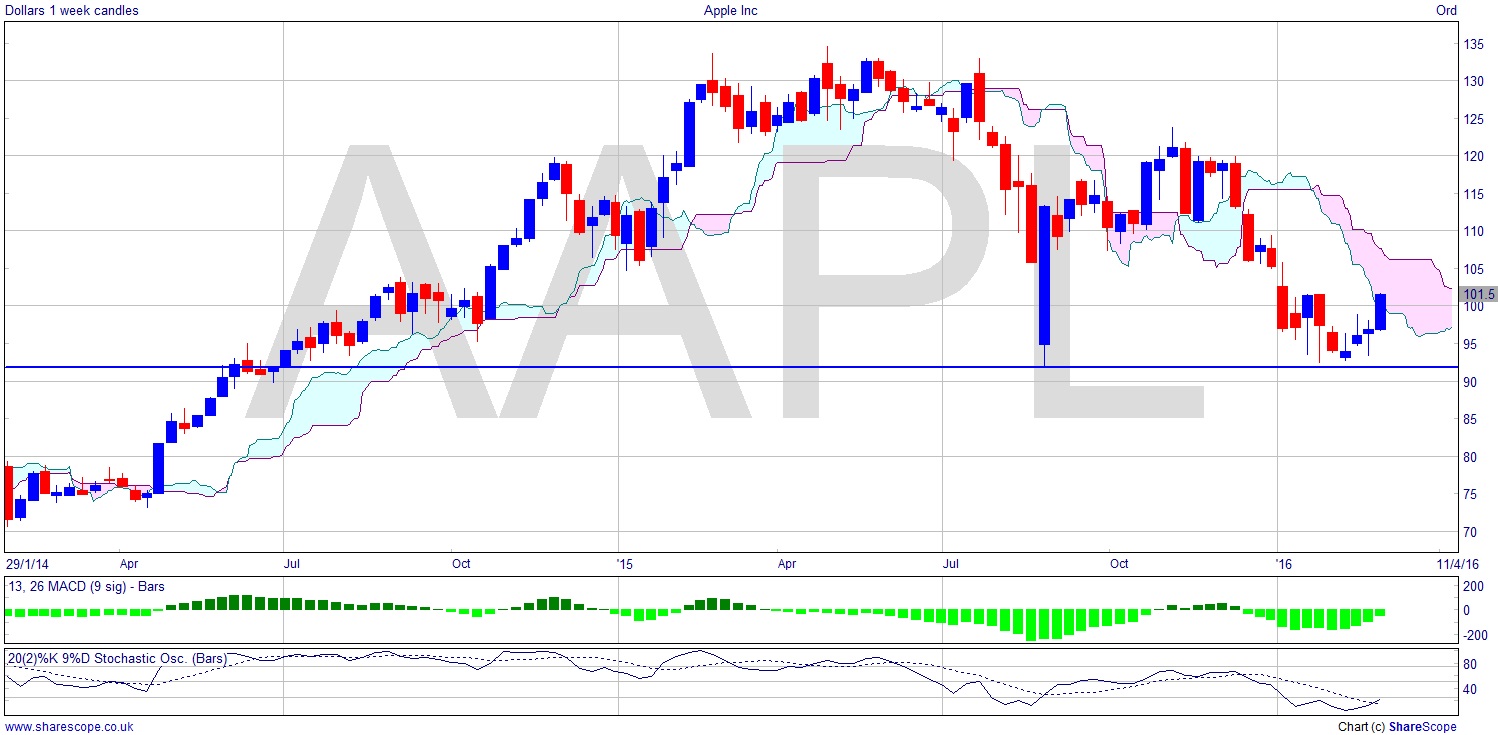

We’re seeing similar patterns, only more developed, in other Tech stocks. Apple (AAPL), for example, is looking not only weak, with the H+S having formed back in the last part of 2015, but also it’s only found support at the level it sold off to in the late summer panic. It’s off 25% since a year ago. MACD supports a small rally but it’s still in the cloud, rather like its index, the NADAQ.

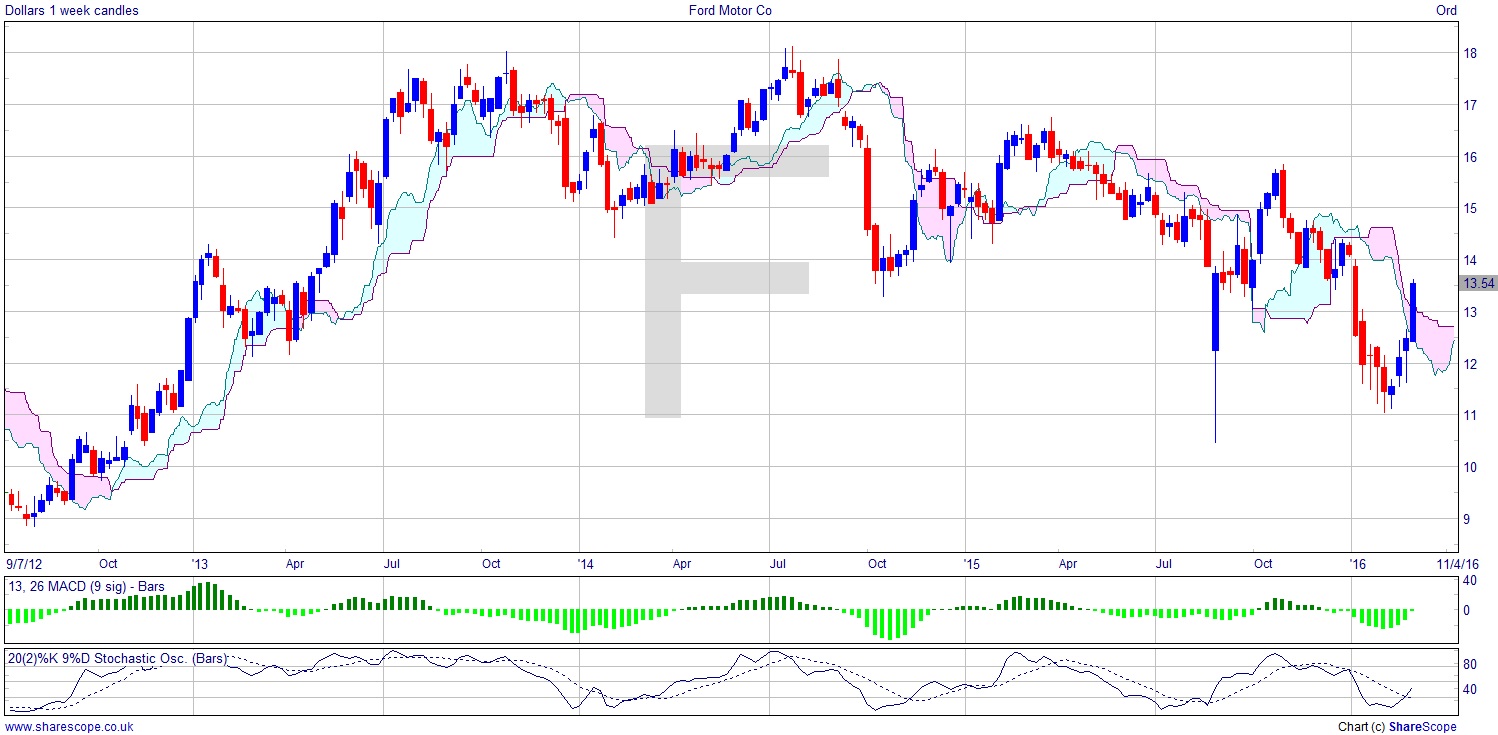

So much for Tech stuff… how about a more traditional manufacturer? Ford (F) is probably as good a yardstick as any. Well this looks considerably worse at first glance! It’s 30% off last year’s high, but it is over the cloud, has a bullish MACD, and a higher low already this year. It’s quite volatile though. For a $14 stock to have a weekly range of a dollar is 7% volatility. You’ll have to be really slack with stops and limits to ride this bucking bronco, but there could be a reward if you can.

Comments (0)