Zak’s Daily Round-Up: EZJ, WPP, AMC, HNL and HUR

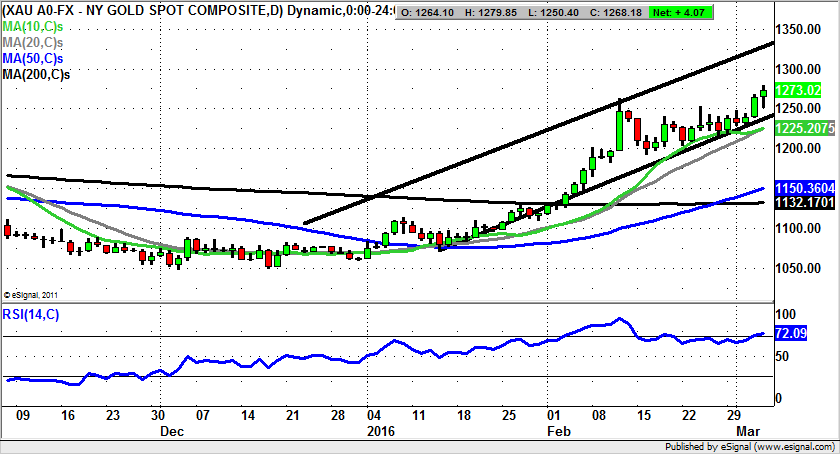

Market Direction: Gold above $1,250 Targets $1,340

EasyJet (EZJ): Higher Low Suggests 200 Day Line

It may be said that it has been a rather rocky ride of late for shares of EasyJet, with the obvious benefits of the low Crude Oil price not quite delivering quite the type of high octane bull run that one might have hoped for. As far as the present charting position is concerned, it can be seen how there has been a double gap down from the beginning of the year, with only recent weeks serving up the start of a basing process. The hope at this stage is that we shall be treated to a relatively prompt break of the 1,582p February intraday peak, say over the next couple of weeks. This would complete a higher low and higher high setup, which should be strong enough to lead up to the 200 day moving average area of 1,682p. However, at this stage one would be cautious on calling shares of the no frills carrier up any higher, given the way that we are still trading in the shadow of those January gaps down.

WPP (WPP): Going With the Bear Trap Reversal

The problem with the current position on the daily chart of WPP is that we are understandably rather wary to be looking for significant near-term upside. This is because the shares have already done a good job in recovering from the sub 1,350p February bear trap gap reversal. This is a particularly strong technical setup, and one which suggests that the bullishness of this situation should not be underestimated. Therefore, even though the week has ended on a key reversal to the upside, the view to take here is that provided there is no end of day close back below the 10 day moving average at 1,495p, it may be worth giving the benefit of the doubt to the long argument and a target as high as the November price channel top of 1,700p as soon as the end of April.

Small Caps Focus

Amur Minerals (AMC): 200 Day Line Target Zone

Amur Minerals has always appeared to be one of the best of the minnows, at least on a fundamental basis. Clearly, the pullback from the 40p zone was disappointing, but from an opportunistic perspective, the bumping along the bottom over recent months is a setup on a technical basis which is difficult to resist. The view at this stage is that we are looking at a possible extended turnaround here, since the recovery of the 50 day moving average mid-month in February. The position now is that we would be hoping that the shares will hold the 50 day line at 6.65p over the near term, as above this the implication is that at least while there is no break back below the 50 day line, we should be treated to a decent push to the upside. This is said particularly on the basis that the post February price action is a bull flag based at the 50 day line, with the idea here being that a prompt clearance of the top of the flag through 9.5p over the next week should be enough to lead the stock up to the implied 1-2 months technical target at the top of a rising trend channel from October heading for 13p, just below the present position of the 200 day moving average at 13.74p.

Hague & London Oil (HNL): Above January Peak Targets 18p

It has to be admitted that given all the enthusiasm there was in the market regarding the prospects for Hague & London Oil when it delivered a sharp spike in the share price through 20p, the game was up, at least for the near term when the October neckline support at 10p was lost. This brings us to the present position, where after the recovery of the 200 day moving average at 8.05p it would appear that the trend has changed back to positive for the first time since December. All of this goes to suggest that provided there is no end of day close back below the former January intraday peak at 8.79p, we should be looking to a target as high as 18p which is the top of a broadening triangle from the end of September. The time frame on such a move is seen as being the next 1 – 2 months.

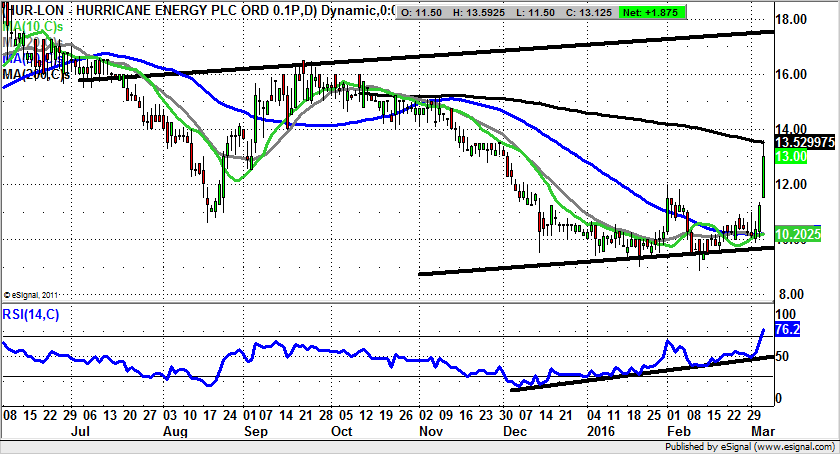

Hurricane Energy (HUR): Price Channel Heading For 18p

Hurricane Energy is another former private investor favourite, former because the stock price collapsed with the crude oil price, among other reasons. What is quite a stand out in recent months is that the shares managed to deliver a set of four lower lows – narrowly, before the latest turnaround came through. All of this implies that the higher support we have been treated to from the middle of last month could be significant for the bull argument, given how much time it has taken for this situation to base out. Perhaps the best way forward for technical traders to tackle this situation is to look to buy any dips towards the initial February peak – something which is not only sensible as an old resistance / new support entry point, but which would also cool off the overbought RSI reading. As far as what the upside may be, we are anticipating a journey up towards the July price channel top currently pointing as high as 18p, on a 1-2 months timeframe. Only cautious traders would wait on an end of day close back above the 200 day moving average now at 13.53p before taking the plunge on the upside.

Comments (0)