Preparing for Recession in Switzerland

Switzerland is a great example of how it doesn’t matter all that much whether a country is a member of the EU or not, even when it deeply depends on trading with it. It is also shows that under such a scenario, it doesn’t really matter whether or not the country chooses to keep its own currency and central bank or to adopt the union’s own. After all, the Swiss National Bank (SNB) and the franc are still alive but both have been arrested by the ECB. All the SNB currently does is import deflation and recession from its main trading partner while allowing the complete destruction of Switzerland’s businesses and economy. All in the name of independence! If 2015 was a tough year for the Swiss, I guess 2016 will be and even harder one, as the country risks a recession and market collapse. Growth in Switzerland is still positive but has been decelerating since the beginning of 2015, exactly when the ECB adopted its bond purchasing programme. Despite being down 10% YTD, the SMI index is still steeply overvalued. This is a situation that will tend to deteriorate over time, as businesses are experiencing a quick decline in their profit margins while the economy is sinking.

Unfortunately, the EU’s tale has lately been one more of sorrow than of joy, as the club has turned into a nightmare for many of its members and neighbours. Unable to align country interests, policymakers have been relying solely on Draghi’s tricks; and unable to miraculously boost an economic recovery, Draghi has been relying on desperate measures that seem to be doing more harm than good. First, we have the case of the banks, who cannot survive much longer with negative rates imposed by the ECB; second, we have the Eurozone neighbour-countries that are being dragged into recession.

When Switzerland, Sweden and Denmark opted out of the euro to keep their own monetary policy while routing 50% of their exports to the European bloc at the same time, they were somewhat deceiving themselves. They may not share the euro, but they do share the same kind of monetary policy, as they were all pushed by the ECB into negative interest rates. Fearing an ECB move, the Riksbank has pushed its repo rate to -0.50pc this year, the SNB has kept its sight deposits rate at -0.75pc since last year, and the Danmarks Nationalbank has its certificates of deposit rate at -0.65%. Independence? What independence? This is a game of master and slave in which the Riksbank, the SNB and the Danmarks Nationalbank play the latter role, as they just follow the ECB to keep their exports flowing.

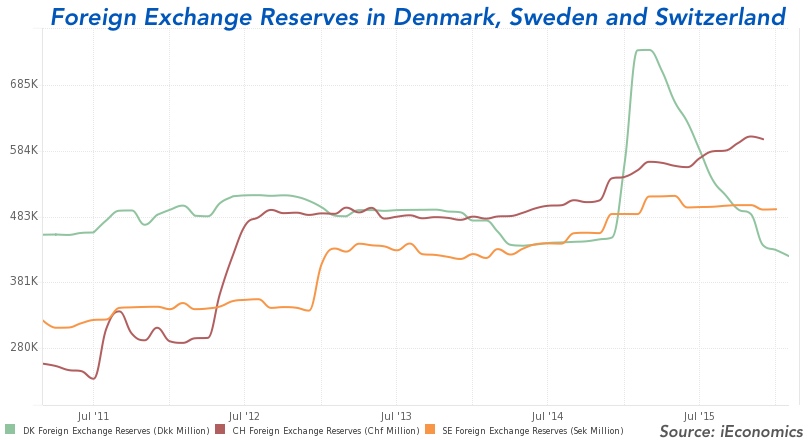

When the ECB cut its key rates and unfolded a massive asset purchase programme, capital started flowing away from the core Eurozone members in the direction of strong neighbour countries like Sweden, Denmark and Switzerland. Foreign reserves could only accumulate.

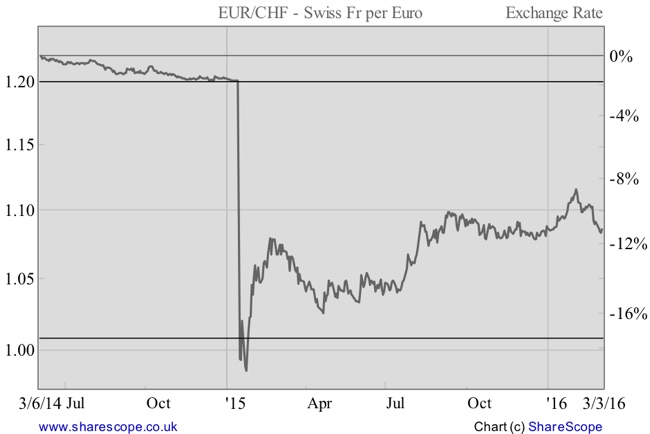

To deter the capital inflow and the accumulation of reserves, these countries had to cut interest rates. But if that was more than enough for Denmark, it fell short of the mark in Switzerland, forcing the SNB to abandon its three-year peg to the euro, and thus allowing for a huge franc appreciation. Sweden and Denmark have their own monetary policy, which is tied to the Eurozone’s monetary policy. The SNB is trying to reassert some independence, but is threatening to sink the Swiss economy in the process.

This would always be a choice between pegging the currency to the partners’ currency (and then losing independence) or allowing a pure fluctuation (and seeing exports derail). Switzerland opted for the second. While the pressure on the franc has alleviated a little since the time the SNB abandoned its peg to the euro, it still trades at 1.09, which is 9.2% below the 1.20 peg level. Many trade organisations in Switzerland claim that prices rose 20% for Swiss exports when compared with trading partners within the EU and Eurozone.

Exports to the Eurozone account for around 50% of Switzerland’s total exports. With the franc rising against the euro, it comes as no surprise that exports to the Eurozone fell 7% last year. So far, Swiss companies have been playing with margins, cutting costs (including wages) and trying to improve efficiency in order to absorb part of the impact of the stronger franc. But with the ECB planning further moves, the country will need an alternative plan for this year, as the above tweaking won’t be enough. Borderline cities are struggling at the Switzerland side and prospering at the German and Italian sides. Swiss companies like Nestle and Roche, which have a lot of customers in the Eurozone while having most of their costs in Switzerland, are already feeling the negative impact. In the future these and other companies may decide to relocate to cheaper places. If this situation perpetuates indefinitely it would most likely completely destroy the business community in Switzerland.

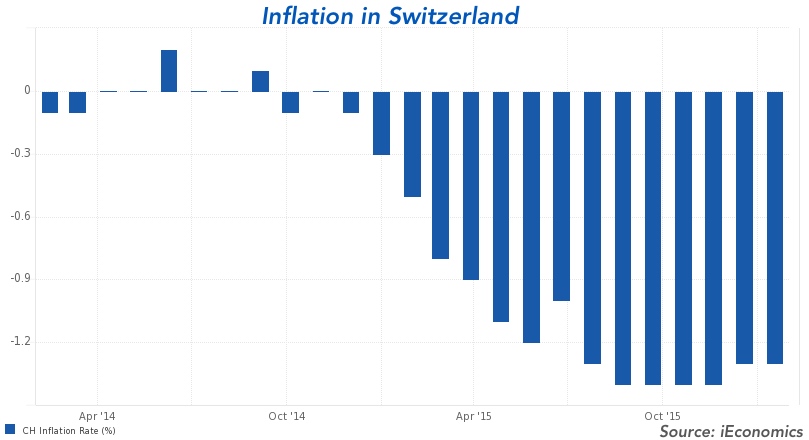

All the SNB has achieved is to import deflation from the Eurozone. Prices are currently decreasing at an annual pace of -1.3%.

The higher franc is causing a contraction in manufacturing due to the negative impact on external demand. Papers, plastics, electronics, metals, watches and food are among the products that have contracted the most. GDP is still growing but at ever lower rates. If the ECB expands its bond buying next week, the Swiss problem will aggravate and the country will most likely enter recession this year. To counter this trend, the SNB will need to further cut its rates, but with them now deeply negative I’m not sure if the central bank will be willing to do that.

It’s an experimental world, and the Swiss have been turned into Guinea pigs by the Eurozone. All eyes will be on what happens to the Swiss economy to see how far we all can go.

In the meantime, the SMI index is down 10% for the year, underperforming wider European markets. But rather than being an opportunity to buy, it seems an opportunity to sell. According to data collected by Star Capital, the Case-Shiller Price Earnings (CAPE index) for Switzerland currently stands at 21.3x, which is a huge value. In fact, Star Capital ranks Switzerland at the 37th of 40 positions in terms of valuation, which means that financial markets in Switzerland are largely overvalued. With a recession on the horizon and further SNB experiments likely to occur, I would stay away from this market.

Comments (0)