Technical Recession

If anyone remembers the Market Sector Cycle that goes through the market ‘seasons’ – early expansion, late expansion, early contraction to late contraction and so on – then why don’t we see much of it these days? Well, probably because like all ‘economic’ theories, once they’re discovered they don’t work anymore – but also because it doesn’t fit anymore. With commodity prices bucking the trend the whole thing falls apart. You’d have to say after seven years of the bull market that the cycle must have been in late expansion for some time now. That means that Technology, Industrials and Commodities should have been doing well. As we all know the arse has fallen out of the commodities market, so that’s not right for starters. However, one thing that probably is true to form is the Technology Sector. It should start declining as we go into Early Contraction and that’s exactly what’s happening. It’s basically saying that the consumer cycle of spending is over, and therefore we can expect to see the markets rationalising.

Financial reports are awash with hard luck stories for technology giants like Apple, Ericsson and many others. Even Spotify are holding out their hat for $500m to fend off competition. Maybe they’re worried about rising interest rates and are trying to fix in a low cost loan, but that sort of implies that their 2016 New Year campaign of “three months for 99p, then £9.99 standard per month” has fallen flat on its face. That’s worrying for them if that is the case, as it says their business model is not scalable. In turn it means that people aren’t even prepared to pay peanuts for music, meaning even less in royalties and distributions for artists and songwriters. At least no peanuts.

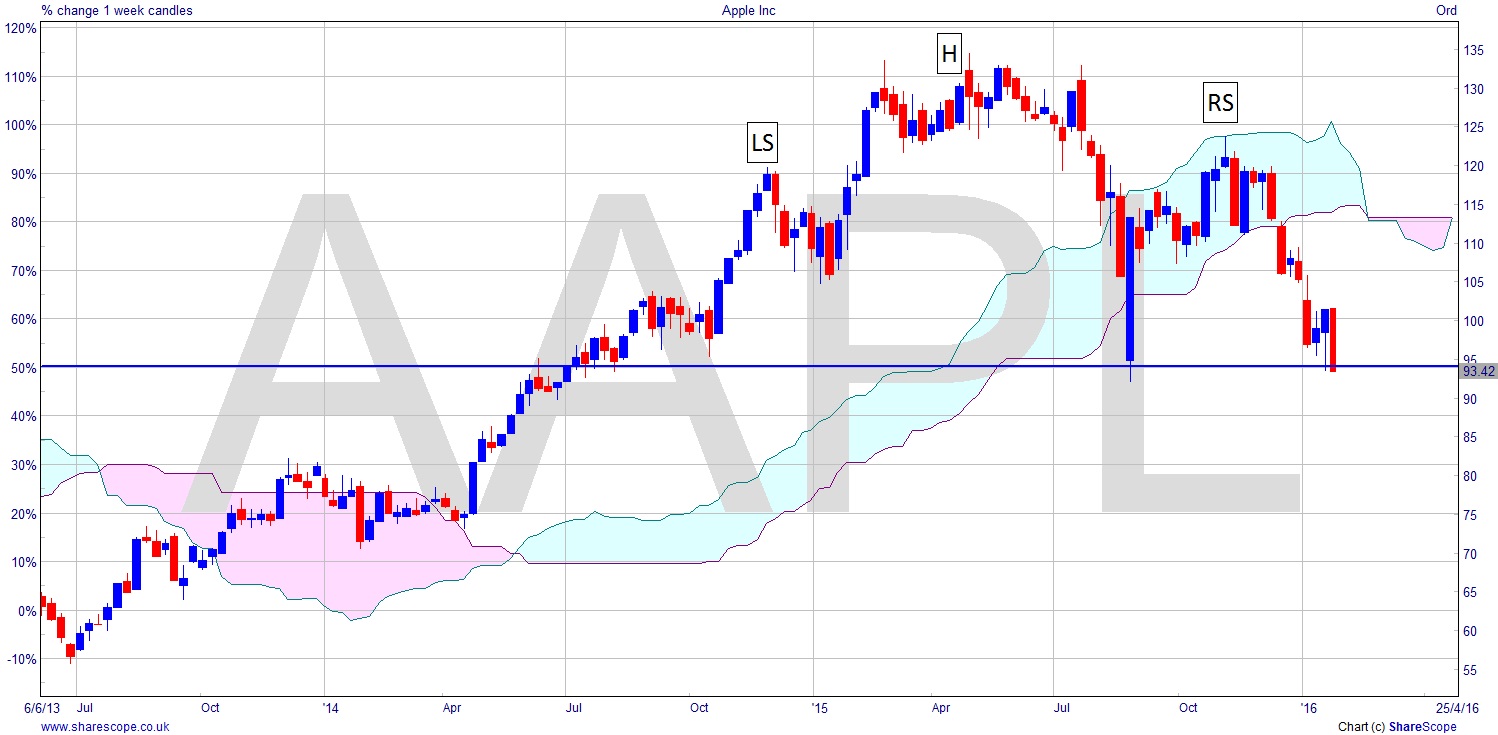

Apple (APPL) has completed a H+S and is poised for a fall. Given that, apart from the privately owned Catholic Church worldwide, they are the biggest corporation in the world, this has to be significant and they could easily lead markets lower. Of course, they’re listed on the NASDAQ, which as I’ve said before is the most flighty of the markets as it’s based on hot air, not capital assets. The pattern is so clear on the chart that it needs no explanation.

Defence stocks don’t really feature on the average Market Sector Cycle, but as my regular readers will know I’ve been championing defence for months now. Even Germany and Japan are increasing their defence budgets. It is the zeitgeist moment for armaments. Like everything else it’s a cycle, but over a much longer timescale.

Apple is blaming a slowdown in iPhone sales for the trepidation over profits, but they could simply make the price of iPhones more terrestrial than astronomical. I wouldn’t consider spending £500 on a phone unless it has several inviting orifices and could cook.

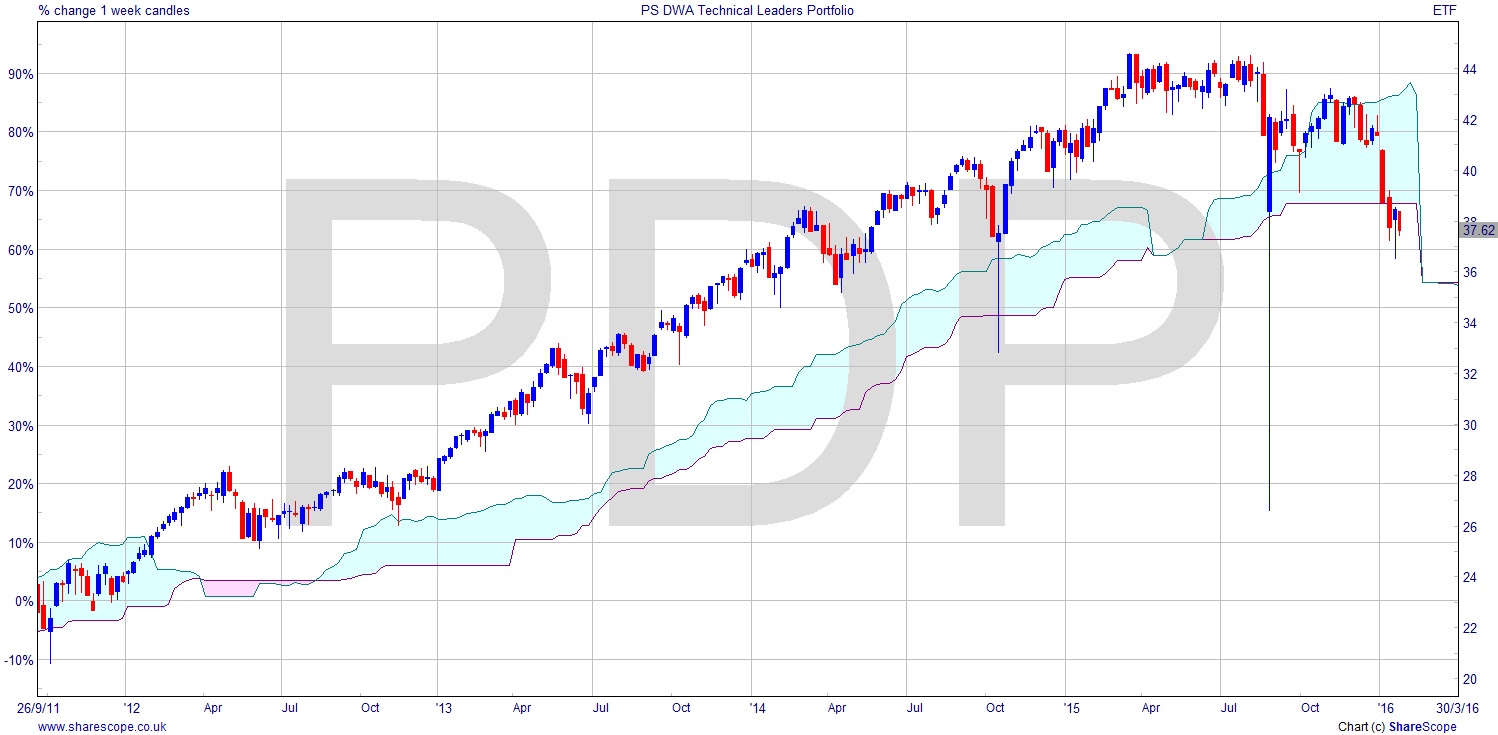

As an illustration of how volatile the non-capital stocks are, here’s a chart of PowerShares Technical ETF [NYSE:PDP]. Just look at those dips. What a blip that was last summer. More than a third of the price in one day’s range last 28th August. The H+S is there too, just like on Apple.

Apple isn’t a dog though; it’s a Tamagotchi.

Comments (0)