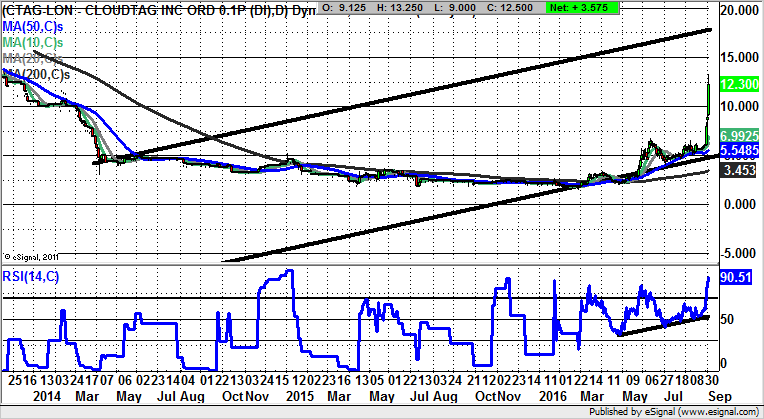

Chart of the Day: Cloudtag

One of the notable issues with bear bloggers, and indeed those who make negative calls on shares, is that unlike those who are on the buy side one rarely hears anything in terms of a mea culpa if the call turns out to be wrong. Cloudtag, where the bears have just been blown away, is a good example of what happens when a shorting conspiracy fails.

Cloudtag (CTAG): 2 Year Trend Channel towards 18p

I have to admit I do love it when a small cap which has been under siege manages to stand defiant, or in the case of Cloudtag, heads sharply higher. The rally is all the more impressive given the way that when a company is hit in this way weak bulls tend to head for the exit, “just in case”, and the story of doom becomes self-fulfilling. This situation looks to have shaken off the curse of the bears on the basis of the strong newsflow of recent weeks – including the £558,000 funding for the health focused wearables group and a major U.S. distribution deal. All of this would suggest that no one can seriously argue that this is a jam tomorrow tech group. As far as the charting position is concerned, it can be seen how the stock is progressing within a rising trend channel which is two years old, and has its resistance line projection heading as high as 18p. This may take a couple of months, once the overbought RSI at 90 has cooled off, but is valid while there is no break back below the key 10p support on the way down in 2014.

Comments (0)