Sell in May?

As seen in the lastest issue of Master Investor Magazine

“Sell in May and go away, do not return until St. Leger’s Day.”

There’s generally a perception that there was lots of wisdom in times gone by, but the reality is there wasn’t. Mostly it was statistically unsound superstition with the very occasional gem thrown in, probably more by luck than judgement. People used to live more by stock phrases than they do now. I remember when I was first working the older employees used to repeat the same lines day in day out. Emetic classics like “what day is it?” To which the reply was “Tuesday”, or whatever day it was, followed by the inevitable cringe-worthy “Tuesday all day”. Delays would inevitably be described as “we’re all behind like the cow’s tail”. There’s no wisdom in sayings like “if your aunt’d had balls she’d have been your uncle”, and “if the wind changes your face will stay like that”. Some of these sayings were delightfully inappropriate. Generously proportioned women were described as “once round her, twice round the gas works”. My Nan used to come out with something you never hear these days: if something was annoying her it would be “stop doing that it’s giving me the palsy”. I could go on.

So my general expectation is that the old adage “Sell in May and go away, do not return until St. Leger’s Day” is probably complete bollocks. Most useful information is hard to put into one line. This is why Twitter is a more or less complete waste of time: not enough characters to qualify a statement.

The saying, it seems, is an old English one. Stock brokers would toddle off on their holidays for the summer. I imagine there was a lot less market activity overall, and evidently very little at all in the warmer months. Lack of activity may tend to depress prices so perhaps once upon a time it was sound advice. The St Leger is the classic horse racing meeting in Doncaster, a week or so into September. This year it’ll be on September 10th. Communication and information would have been at a premium in years gone by. Nowadays we can sit on a beach somewhere and check the alert email we’ve just received telling us a stop loss has been hit. Not up Mount Everest though. The line about being able to do business literally anywhere is literally not true. You can do business figuratively anywhere, not literally.

Being as the saying is English I’m going to look at the FTSE 100 and see whether it tells us to support, or trash, the saying. I’ve used the periods from the first trading day of May to around St Leger’s Day and from St Leger’s Day to the last trading day of April.

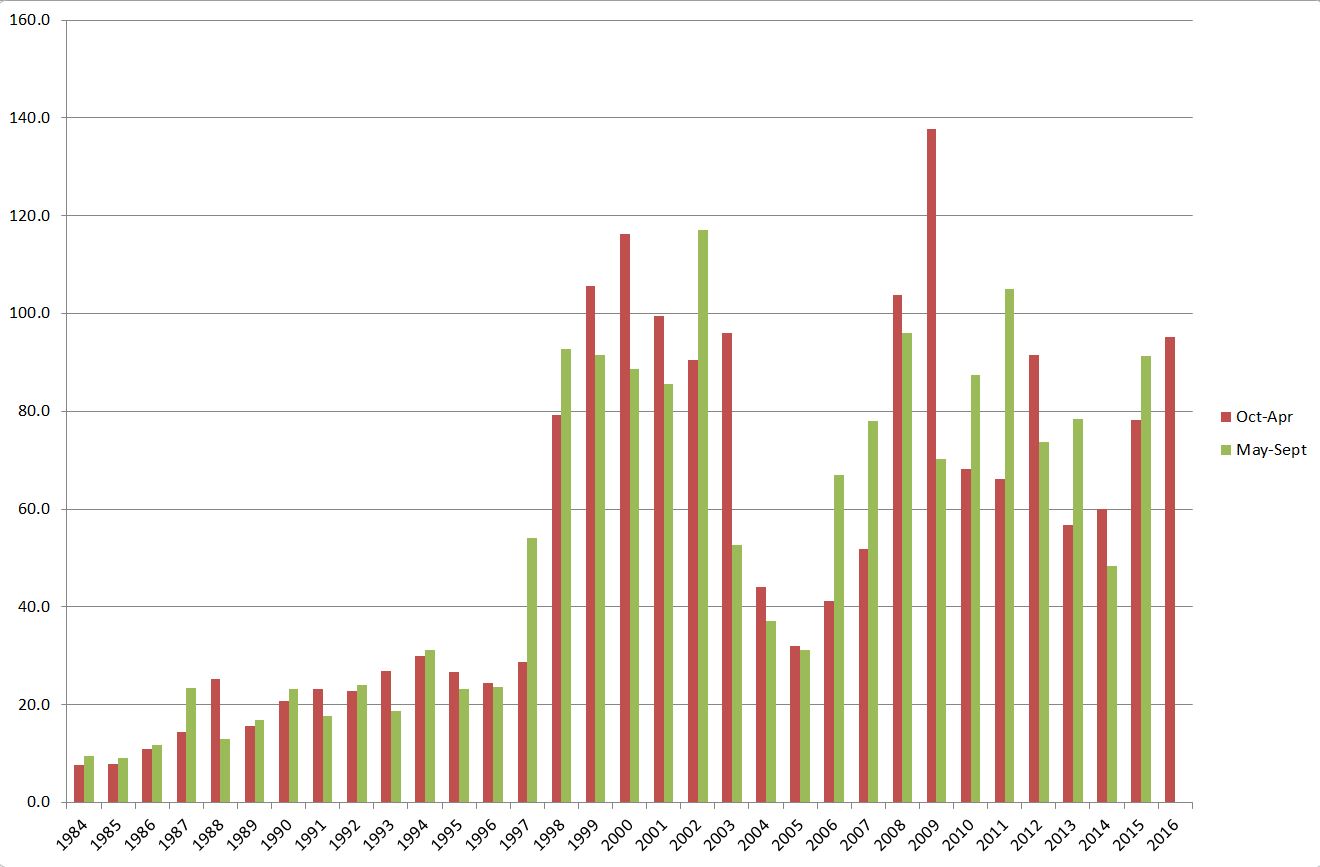

Firstly then, we want to know whether volume changes perceptibly in the summer months. ShareScope offers volume data on the FTSE 100 (UKX) going back to 1999. I’d like a bigger dataset, but it’s not too small to use. I’d say there’s no clear correlation to suggest lower volumes during the summer months. I’ve taken the average daily volume traded during each of the time periods each year. You can see from the chart that it’s really six of one, half a dozen of the other, which of course is yet another of those lines everyone used to say, but it is at least quite a good one. Interestingly, volume has fallen significantly since 2008 and not really recovered. But the two periods have moved in tandem with time nevertheless.

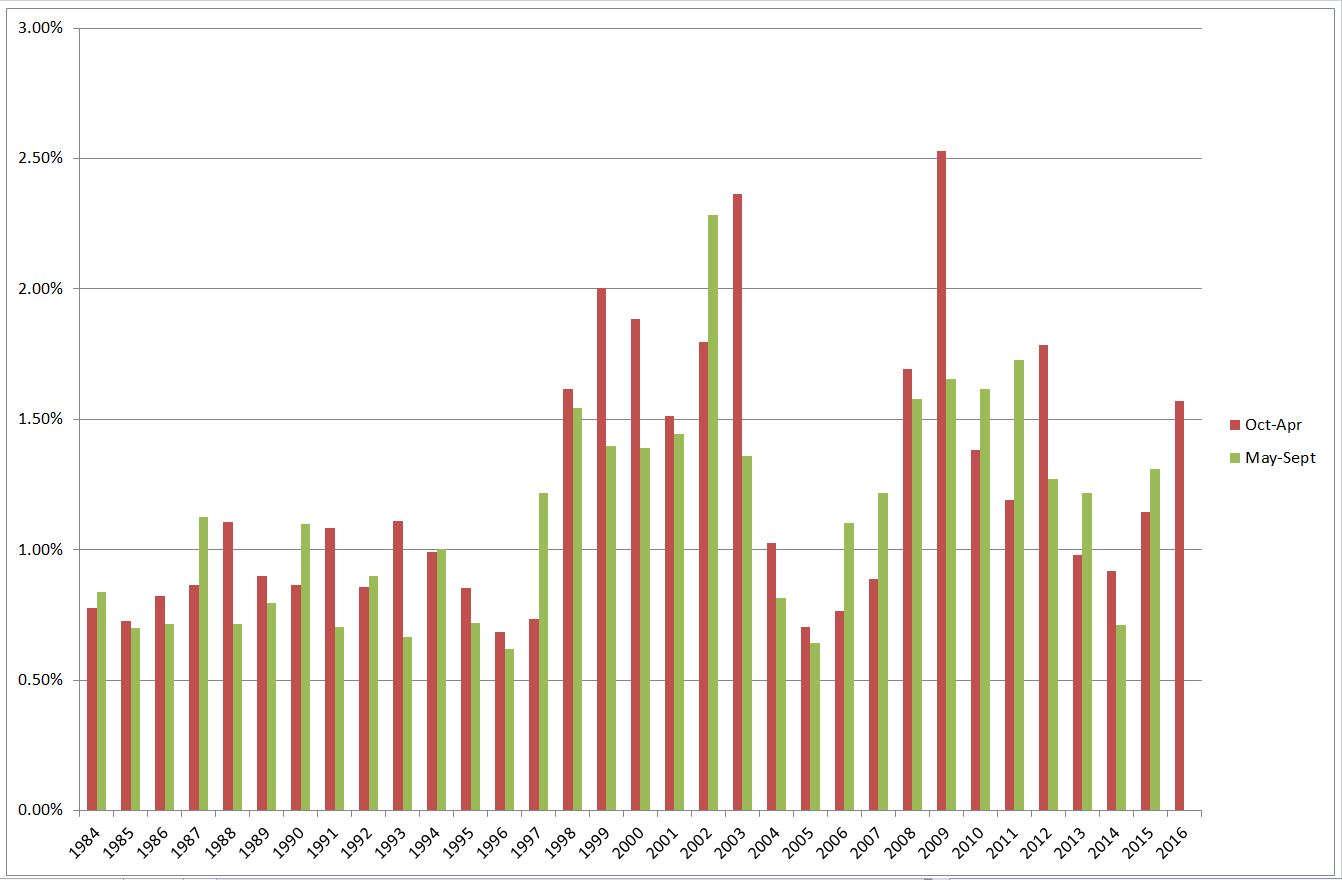

Secondly, then, let’s look at the average daily range on offer during the two periods. We’d expect volatility to be lower in the summer months, if there is any wisdom in this phrase. Again it’s a mixed bag. Any significant change in the average daily range is usually preceded by a volatile May-September. We see this in 1987 and in 1997 and so on. It’s worth noting that October 1987 was the 1987 crash. How wise would it have been to buy back into a market about to crash? It was the same in 1929. October 2008 wasn’t too rosy either. But of course these are absolute values for the daily tradable range.

Let’s look at the average daily trading range for these two periods, but this time expressed as a percentage of the opening price (i.e. early September and the first trading day of May for each year). We can see that volatility was much higher during the 90s and 2008-2012. It’s starting to creep up again. It’s still a mixed bag. That said, most of the highest values occur in the winter session. But that’s just telling us there was a trading opportunity. We know some of those periods were bearish.

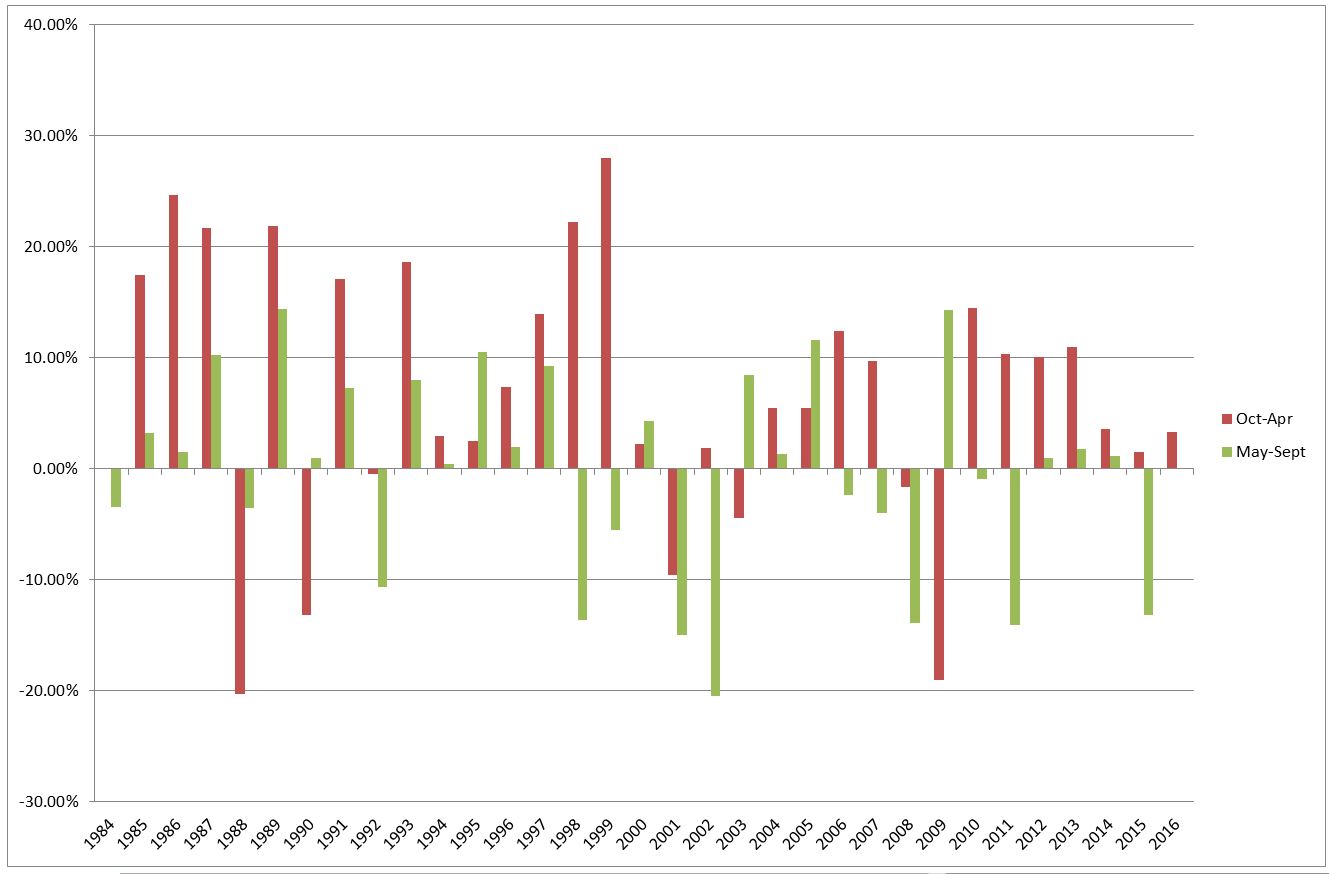

So the final chart is the one that shows gains and losses during the two periods. We’re used to being able to make money from volatility and not from just market rallies. Certainly in the US shorting has been around for a very long time, but it’s not so popular here though, so let’s have a look at actual returns had you bought and sold your long stock portfolio each September and May.

It would be fair to say that most of the winter sessions have been profitable. However the drawdowns in the bad years, happening three times out of 32, were pretty significant loss makers, with 1987 losing over 20%. However, there’ve been 11 bad summers, seven of which saw losses of more than 10%.

So how about our portfolio if we’d followed the advice, as opposed to simply staying in the market? Had we bought the market in early September 1984 and held on to it we’d have made 568% up until 29th April 2016. If we’d followed the advice and stayed out during the summer months then we’d have made 690%. A reasonable amount more. The bad summers seem to come along about every three to five years. Last summer was a bad one. But that doesn’t mean this summer can’t be worse! After a seven year bull market I’d have to err on the side of caution for the next couple of years until we see a real downturn. It’s well overdue.

Perhaps part of the reason it used to be true was simply because stock brokers took such long holidays. If the stock brokers were away people might have been less inclined to place orders. In effect the market was on holiday. Bear in mind though that in those days they would have been Bed and Breakfasting on 5th April anyway. Did people really then buy back in for a few weeks and sell again? Seems ‘Sell in April and Go Away a Few Weeks Later’ might have been better advice. Anyway, we can say the old saying has proved to be true at least for the last 30-odd years, and if you’re sitting on some gains now then prudence might suggest selling in May.

Comments (0)