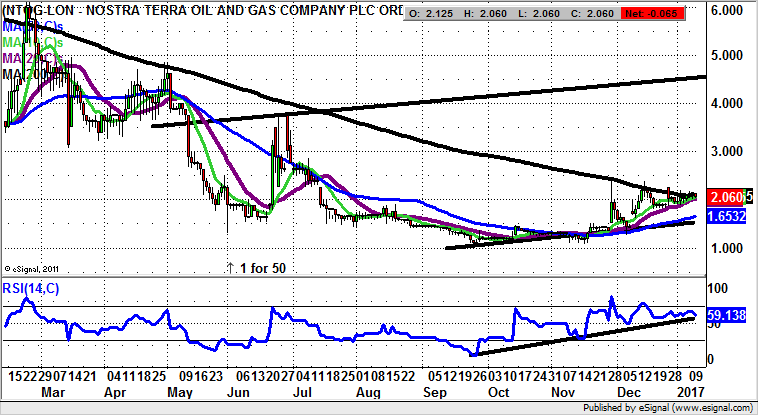

Nostra Terra Oil & Gas: Break of 200 day line could lead to 4.5p

It has been a long journey for shareholders of Nostra Terra Oil & Gas (LON:NTOG). The big question is whether or not the enthusiasm of its CEO, Matt Lofgren, will be able to take the company to the promised land.

The Nostra Terra story has been a rather challenging one for its arm of loyal shareholders, with the company shifting from being a sometime private investor favourite, to a source of frustration.

The situation has not of course been helped by the volatile position of the oil price, while the company continues its own efforts to gain critical mass in its quest to be a significant exploration and production play.

That said, over recent weeks and months it can be said that the bulls have finally looked to be back in the game, a point underlined by the story of Nostra managing to gazump Mosman in getting its hands on the Pine Mills oil field in Texas, which was purchased for just over $1m.

Even better, the company was on the receiving end of $600,000 as it disposed of its Chisholm Trail Project. All this should mean that the market upgrades Nostra Terra, a point which is backed up by the latest stirrings on the daily chart.

The big barrier here to a new leg to the upside is the 200 day moving average, now at 2.06p. If this can be achieved over the next couple of years one would be looking to the rest of 2017 serving up a 4.5p target at the top of last year’s price channel.

Comments (0)