This listed hedge fund could be a port in a storm in 2017

Despite all the concerns about Brexit and Trexit, 2016 turned out to be a surprisingly good year for global stock markets with the Dow and the FTSE 100 starting 2017 at or near to all-time record highs. Some people see this as a really bullish sign, but those with a more cautious attitude might want to put some money into less correlated areas.

One option would be a listed hedge fund such as the Highbridge Multi-Strategy fund (LON:HMSF). This has recently been recommended by the investment trust team at Winterflood as part of their model portfolio for 2017.

HMSF was previously known as BlueCrest All Blue and invested in a master hedge fund run by BlueCrest Capital Management, but in December 2015 the firm announced that it would return all capital to third-party investors and concentrate on managing the assets of its partners and employees.

After consulting with the major shareholders and reviewing different manager proposals, the Board appointed JPMorgan Asset Management to take over the remaining £262m of assets and bring the fund under the remit of their multi-strategy alternative investment arm, Highbridge Capital Management.

As part of the transition process investors were allowed to exit the fund at NAV less costs, but a significant proportion decided to stick with the new manager. Since the end of February 2016 most of the assets have been invested in the Highbridge Multi-Strategy fund with the balance of less than 3% held in various small residual illiquid holdings from the previous strategy that are currently being sold off.

Strong track record with low volatility

Highbridge Capital Management was set up in 1992 and was one of the industry’s first multi-strategy hedge fund managers. The firm has about $5bn in assets under management and in 2004 it entered a strategic partnership with JPMorgan Asset Management, although all the investment decisions are independent of JPM.

The Highbridge CIO, Mark Vanacore, has sole responsibility for the capital allocation within the fund and holds bi-weekly meetings with the rest of the management team to help assess the appropriate asset allocation. The investment managers are paid according to the performance of their strategy, although part of the money is held back and invested in the fund to ensure that they act in the best interests of all investors.

HMSF acts as a feeder fund for the Highbridge Capital ‘master fund’, which is a global multi‐strategy hedge fund that aims to generate returns from relative value strategies with idiosyncratic sources of return. It has about $3bn of assets and targets a return of 7‐12% per annum with 3‐6% volatility and a beta to the S&P 500 of less than 0.25. This means that Highbridge should be able to provide an uncorrelated source of return irrespective of the direction of the main stock market indices.

The fund currently invests in 14 different strategies divided between seven broad investment strategy groups. The largest of these with allocations of 9% to 13% of the portfolio are statistical arbitrage; convertible credit and capital structure arbitrage; sector-focused long/short equity; event-focused Euro long/short equity; merger arbitrage; convertible and volatility arbitrage; and Asia capital structure arbitrage.

Highbridge should be able to provide an uncorrelated source of return irrespective of the direction of the main stock market indices.

Some of these areas are quite complex but they give you a flavour of the sort of strategies that the fund employs. For example, statistical arbitrage is a systematic strategy that focuses on managing equities, futures and the related options contracts, whereas merger arbitrage aims to capture the spread from companies involved in M&A activity.

Event driven strategies attempt to profit from opportunities resulting from industry changing events and corporate catalysts like restructurings and management changes, while long/short strategies allow the manager to capitalise on undervalued sectors while hedging out some of the market risk by shorting the overvalued sectors.

The aim is for each strategy to generate a low level of volatility and high Sharpe ratio – defined as the return per unit of risk – and most of them should be capable of delivering their objective regardless of the overall direction of the market.

Since Vanacore took over the sole responsibility for the capital allocation in 2012 the master fund has returned 6.6% per annum with 3.7% volatility, which equates to an impressive Sharpe ratio of 1.8 with a low beta of less than 0.15 to both the FTSE 100 and the S&P 500.

Steady start

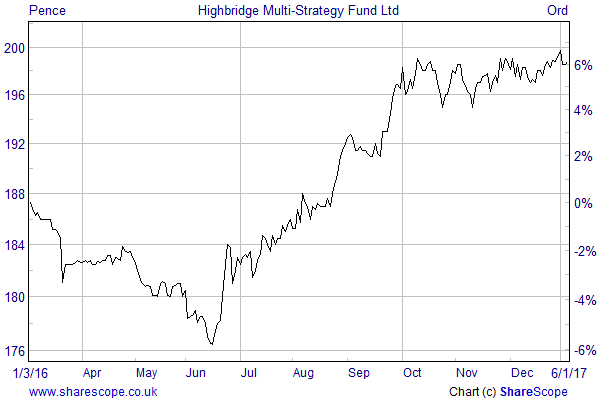

The management of the investment trust switched to Highbridge around the start of March 2016 and since then the share price is up about 6%. HMSF has slightly underperformed the master fund over this period due to the impact of the small illiquid residual holdings from BlueCrest All Blue that are in the process of being wound down.

Given the fairly modest target returns it is important that there is an effective discount control policy in place to protect existing investors. The current discount to NAV is 5%, which is the sort of level that can be controlled by share buybacks, but there is also a quarterly cash exit opportunity for up to a fifth of the shares in issue at NAV less costs, although it is at the discretion of the Board whether to offer this in any given quarter.

Unfortunately the main downside with these sorts of funds is the high charges. HMSF has an annual management fee of 1.5% of NAV up to net assets of £250m and 1.25% above, with a performance fee of 20% subject to a high water mark. This gives it an estimated ongoing charges figure of 1.6% excluding any performance fees, which means they really need to deliver if investors are to get any benefit.

Analysis by the investment trust team at Winterflood suggests that in months when the FTSE 100 or the MSCI World indices were positive, the master fund also generated a positive return, albeit less than the indices. In months when the indices fell it tended to be flat, which is exactly what you want from this sort of exposure.

It is also worth noting that since the master fund took over at the start of March 2016 the biggest peak to trough drawdown in NAV was just 0.25%. This is quite a spectacular achievement given that it covers the period of heightened market volatility around Brexit.

There is a good chance that 2017 could be exceptionally volatile and that there could be a significant rotation within the major indices. If this is the case then a listed hedge fund like HMSF might be a decent core portfolio option that is capable of delivering steady absolute returns at a low level of volatility.

Comments (0)