Aggressive Trades – Low-Risk Trade Management (Part 1)

Trade management is a bit like flying. Things mostly go wrong on take-off or landing. To some extent opening a trade is less problematic. After all, you don’t actually have to make a decision at all. If you don’t then nothing happens: you simply miss the trade. Exiting a trade is the more critical because you are committed to making a decision. One of the reasons people lose money is because they struggle to make a decision to exit a profitable trade. Perhaps because doing nothing feels like no decision has been made but it is in fact a decision to stay in. What they’re actually doing is letting the market decide. And that generally doesn’t work out too well as a strategy. Be really careful of that trap.

So let’s start with the ‘easy’ bit – entering the trade. If you aren’t sure why you’re entering a trade, or at least couldn’t explain it to someone else, then don’t enter the trade. Instinct is not your friend when opening positions. That’s instinct not experience I’m talking about, and the instinct is often used when a lifetime of evidence would be a better way of putting it. You need sound reasons to justify entering a trade. I’ve written before about owning your own trades – in fact in the very first Master Investor magazine last April. In it I cover why you need to do your own research and not rely on tips, or really any set up where you can deny responsibility if it goes wrong.

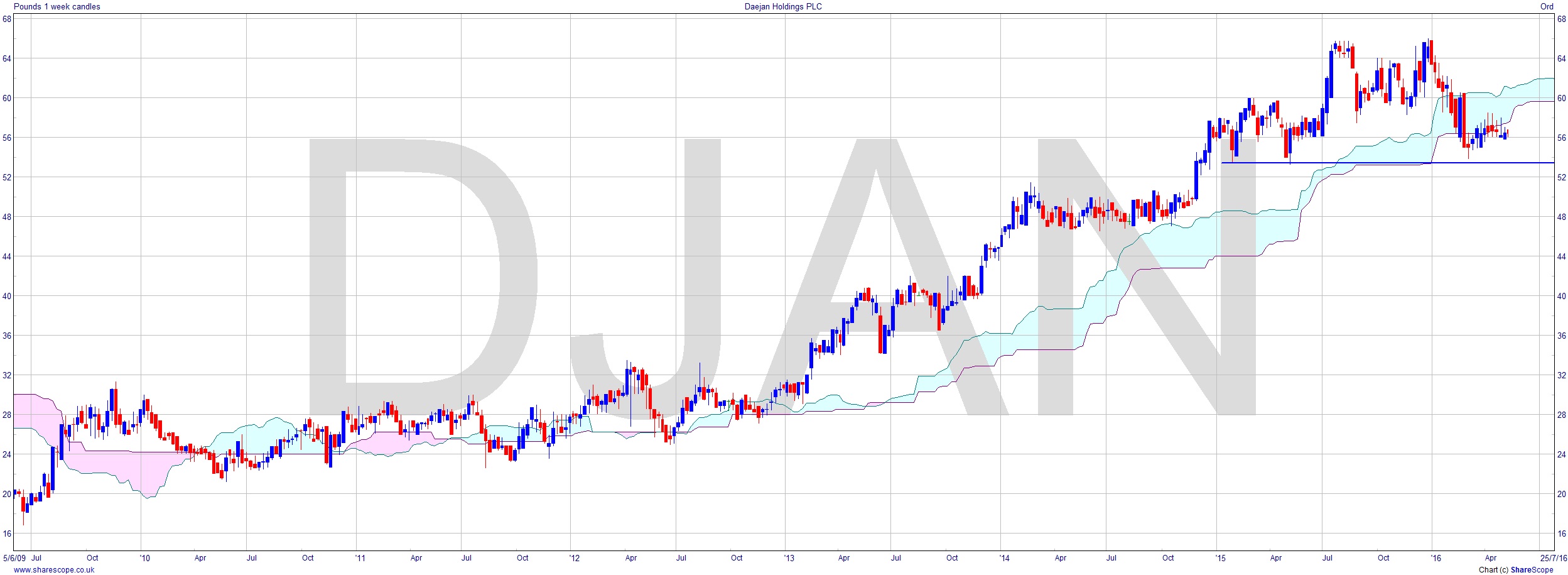

If you have a good set up and good reasons for entering, then the question is how much of a (full) position to put on. In the example, you can see on the Daejan Holdings plc (DJAN) chart that we could take an early entry now on a short trade. There’s a double H+S with a still forming low right hand shoulder, which is particularly bearish. We’ve seen a drop out of the cloud and a failed rally at it, which effectively means that support has now become resistance. We might not want to wait for the breakout at just below £54 because the whole world will know about the support level there. So an early entry here at around £56 might be the thing to do. But in this case maybe just put a half position on. This way if it drops through the support level at £54, and then rallies to bounce down off it again, you can put the other half on knowing that the risk on the first half position is gone. You’re using one position to springboard the next, IF it is successful, and halving your losses should it go wrong. Risk remains the same on the first half in mathematical terms, but not monetary value.

If you don’t manage to get the second half on and it drops like a stone then you are likely not going to see support until around £48. You’d be quids in at this point so hardly unhappy! If a chance to extend the position developed then you could add to it then. The point is you must have a valid reason for staking money on a trade. If you’re feeling rushed by events to make a decision, then don’t. Chances are you’ve already missed the boat. There are thousands upon thousands of things you can trade these days, and opportunities present themselves every day. Don’t get attached to a particular trade, in fact if you begin to feel emotional about it then definitely walk away!

In the next post I’ll talk about exiting trades.

Comments (0)