Are Presidential Election years ‘up years’ on the Dow?

As we stare down the possibility of Trump becoming the 58th President of the United States of America (they always reference the country as if it’s not obvious), I thought I’d look at the often heard claim that Presidential Election years are good for the stock market. They take place every four years, rather like the Olympics, the World Cup and, well, Leap Years, which is generally what it is when they take place.

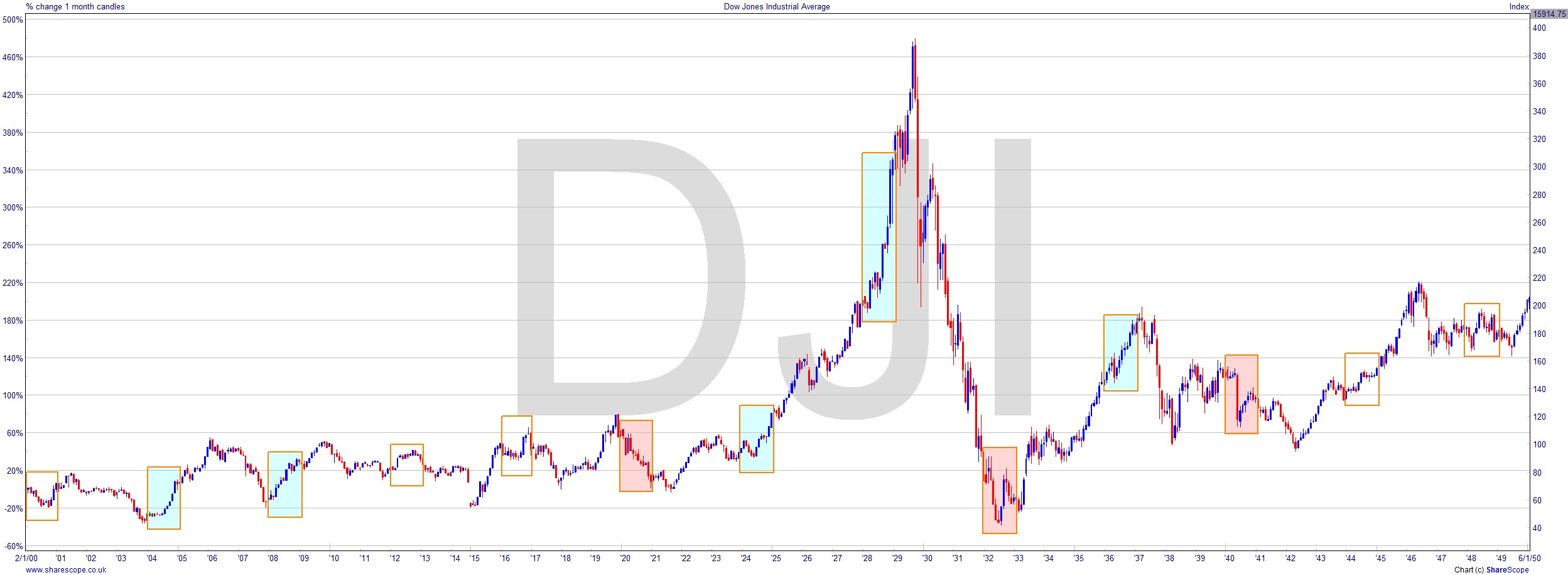

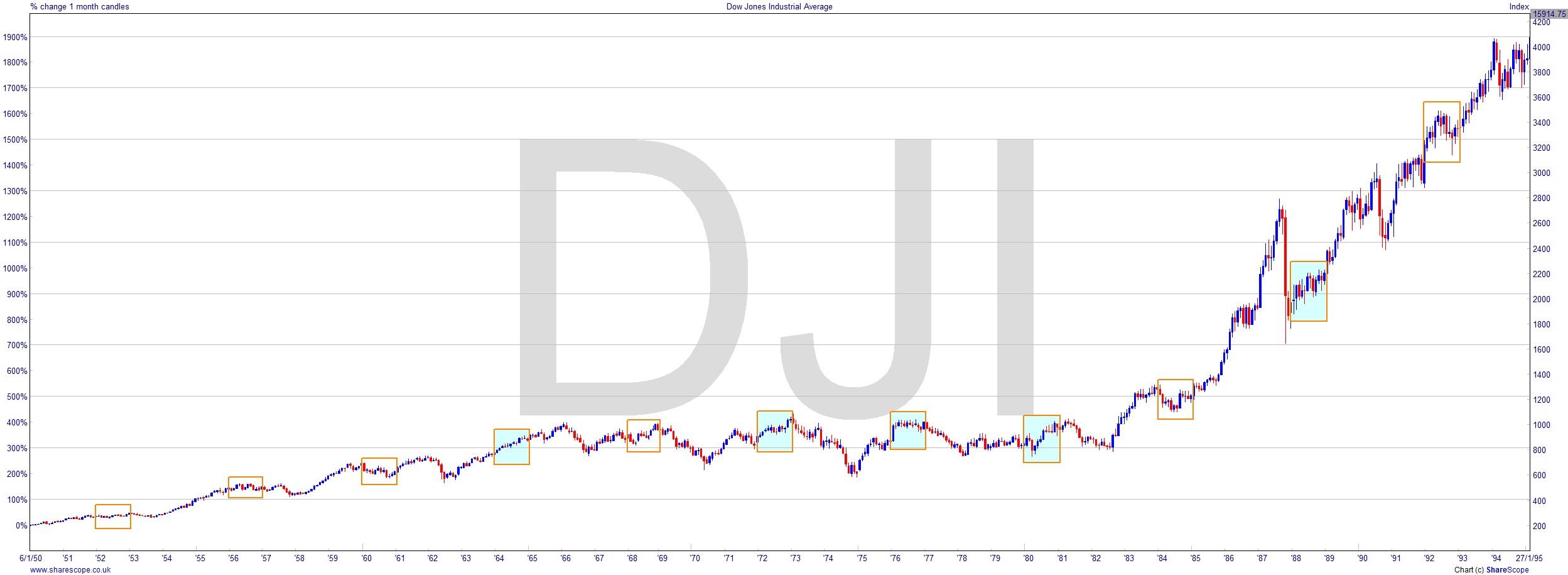

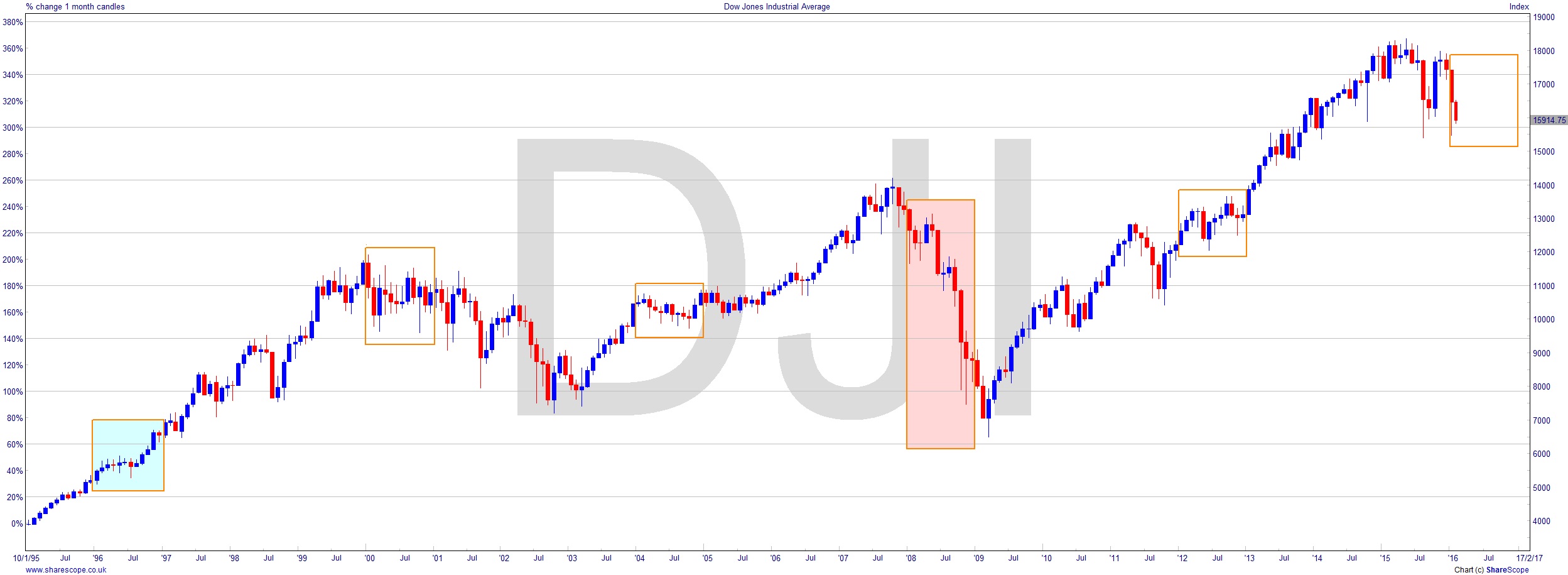

When looking at something that happens only every four years we need to have plenty of data to make a proper analysis. Luckily ShareScope has the Dow Jones price history back to 1900. I’ve identified the 12 monthly bars of each presidential election year with an orange rectangle. If the market rallied or fell a decent amount during that year I’ve shaded the box in pale blue or red accordingly.

Going literally by the annual returns during the period from 1900-2015, there have been 75 up years and 40 down years (using the calendar year). There have been 29 presidential elections during that time, and 20 of those have been up years. With just a cursory glance at the charts we can find much better trading years than the ones with presidential elections. Statistically, presidential years are just a fraction more likely to be up years than any other year. I’ve done analysis in the past, allowing for things like inflation, and discovered that investing in an index like the Dow would, over the long run, lose you money in real terms. Actually, the whole investment banking business is based on making ‘alpha’ – that is the premium you make in excess of the return on the underlying index (‘beta’).

This really makes me wonder where all the claptrap about Presidential election years being up years comes from, as they are basically no more likely than any other year to be up years. It also shows that you have to do due diligence on every detail that may affect your trading. A sanity check: trust no one, as they used to say in the X Files. I did watch the X Files for a few seasons and I agree with their tag line “the truth is out there”. But I stopped watching the show when I realised that although the truth certainly is out there, they had no idea where it was hiding.

As the year begins we are looking at a down year on the Dow for 2016, based on what we’ve seen so far. This isn’t really a surprise as we’ve had a seven-year bull market and we’ve already seen the reversal signals. But you have to be really careful taking what are unresearched ‘factoids’ from anyone. It’s pretty easy to get the data to quickly prove a statement right or wrong these days. I found a list of yearly returns for the Dow with a couple of quick Google searches.

I’ll be doing some more pieces on the election effect in the US, the Land of the Twee, over the coming months.

Comments (0)