Zak’s Daily Round-Up: RIO, SHP, HGM and PLUS

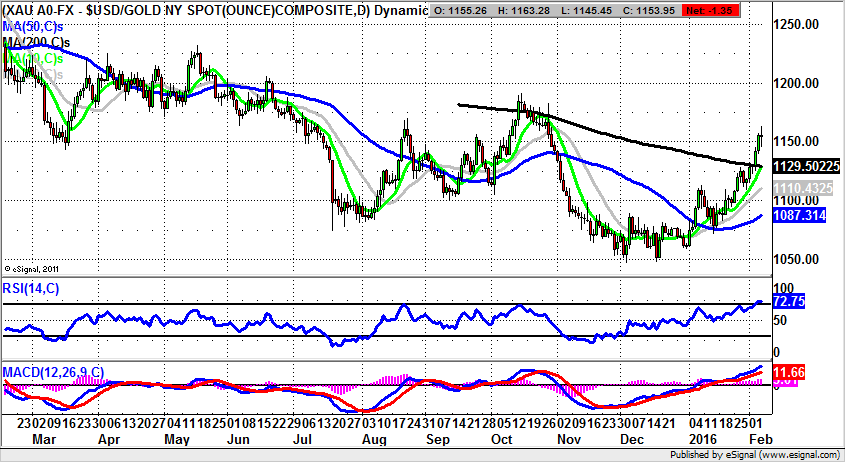

Market Position: Gold above $1,232 Targets $1,300

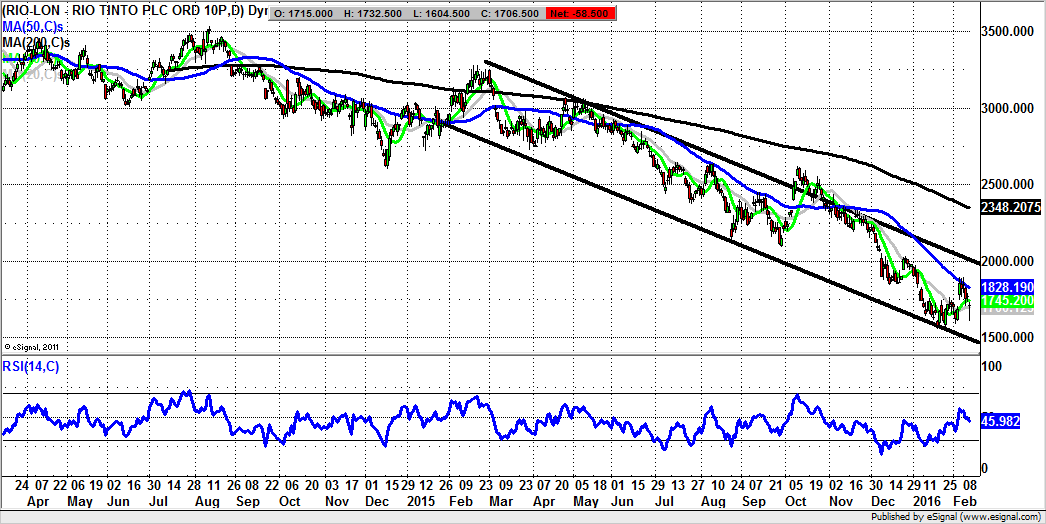

Rio Tinto (RIO): The End of the Progressive Dividend Policy

While it may be somewhat unfair to suggest that Rio Tinto’s management have been somewhat behind the curve with regard to their fundamental strategy, there was rather little in the way of forward planning here – especially as a reaction to the fall in precious metals prices, a process which has been in place for the best part of five years. One might have thought that after a couple of years of retracement, moves to address the issue of overproduction and defend against the risk of the type of bear market we have seen in this sector would have been on the cards. This is particularly so given the way that unlike the rest of us amateurs, in the mining sector those with decades of experience should have bene able to anticipate the prospect of a bear market in the wake of a China slowdown. The latest news from the company reminds us of such issues in the sense that the aftermath of an annual loss has forced the group to abandon its progressive dividend policy. It may be said without the fear of being criticised too much, that this policy should have been reviewed at the first sign of a slowdown, rather than after all the metrics of significance had already gone south. In particular, the announcement of massive impairment charges of $1.8bn renders the concept of being generous with cash totally redundant. As for what happens next, it can be said that the planned cost reductions of up to $5bn are too much, too little and too late for 2016 and 2017. It is ironic that by the time Rio Tinto completes its slimming down process, a new upturn may actually be on its way.

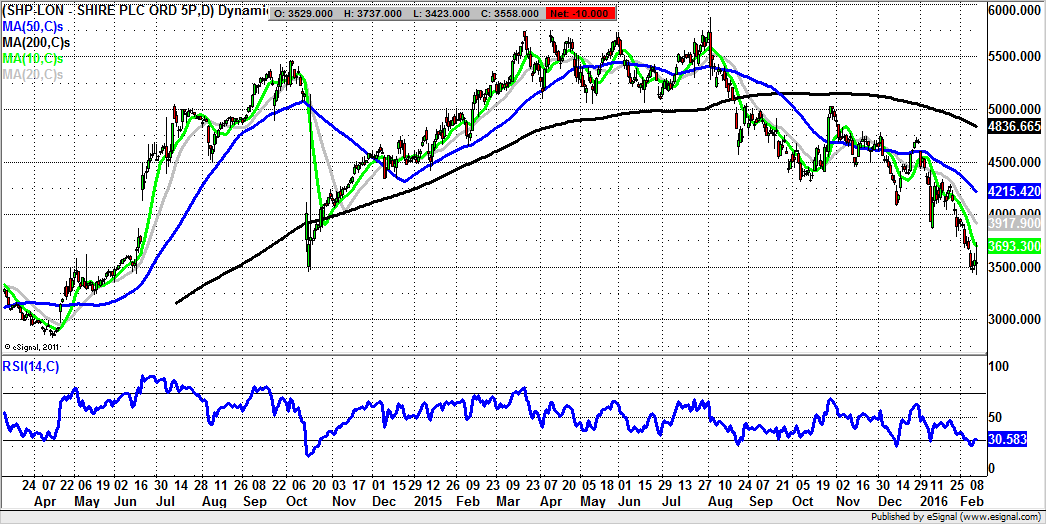

Shire Pharma (SHP): Share Price Weakness despite Double-Digit Growth

On the face of it we were treated to a good-news overload on the fundamental front at speciality drugs giant Shire Pharma. The headline is that the company has unveiled double-digit gains in revenues and profits, which is not something too many FTSE 100 companies have been able to say over the past year. But the point is that this sector, and particularly this company, should be more immune than most in terms of being able to ride out the headwinds being offered by the present economic uncertainties. This is particularly so in the wake of the latest offering from Fed Chair Janet Yellen in which she may have backtracked on the amount of interest rate hikes in the U.S. by the end of the year, but the hint was that there would be tightening. This suggests that the stock market is not going to be a happy place for the bulls unless they are very selective. Therefore the likes of Shire where there is earnings growth, and perhaps as importantly, pricing power, should be disproportionately in favour as compared to many other blue chip contenders. This is particularly the case when compared to the resources space and other sectors like retail where, in general, deflationary effects mean that it is the law of diminishing returns for those looking for gains in earnings per share or dividends. As for the detail in the latest announcement from Shire Pharma, it can be said that the way has been led by Vyvanse with its 21% rise in sales. Overall though, it may be the drugs pipeline at Shire which is the key aspect. It was revealed to be the strongest ever for the group, which provides reassurance in terms of the latest bumper numbers being sustainable. Indeed, the main negative here is arguably the state of the daily chart. Here it can be seen how the stock is back at October 2014 support in the 3,500p zone. The ideal scenario from here is that there is no weekly close back below the 3,471p autumn 2014 floor. While this is the case, an initial rebound back towards the 3,855p January floor is expected over the next 4-6 weeks.

Small Caps Focus

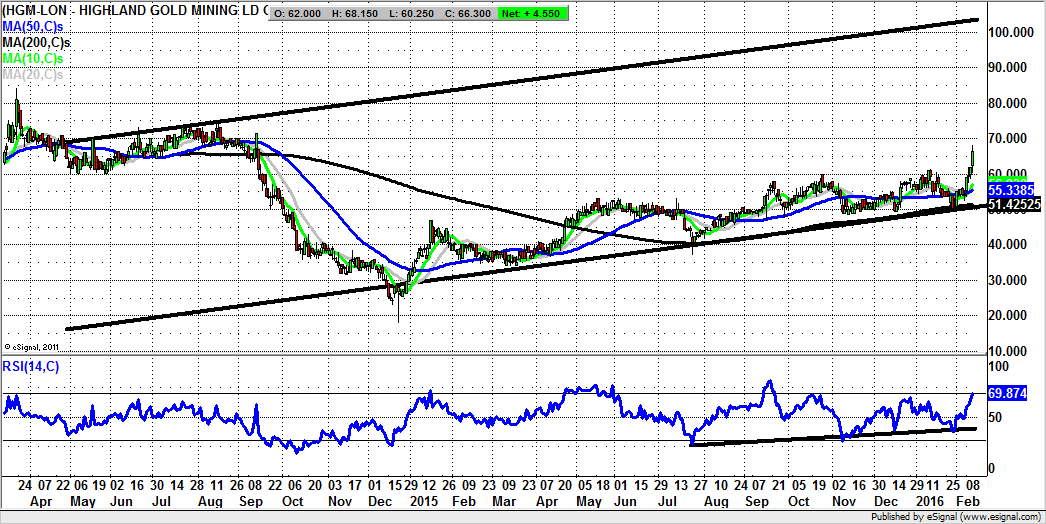

Highland Gold Mining (HGM): A Solid Looking Gold Play

Quite understandably, it is not as if we are exactly overloaded with bullish opportunities in the small caps arena, with the UK stock market languishing at four-year lows. While it may of course be the case that it turns out that the present sea of red on the trading screens turns out to be a sea of opportunity, what we have for Highland Gold Mining is a momentum situation based upon a risk off appetite for Gold as a store of value. The overall charting configuration here is that of a rising trend channel which can been drawn from as long ago as April 2014. This is a particularly wide feature, with the suggestion being that the setup is therefore that much more positive. Indeed, the upside here is regarded as being as high as 100p. This is especially the case the longer the shares manage to remain above the 50 day moving average, now at 55p.

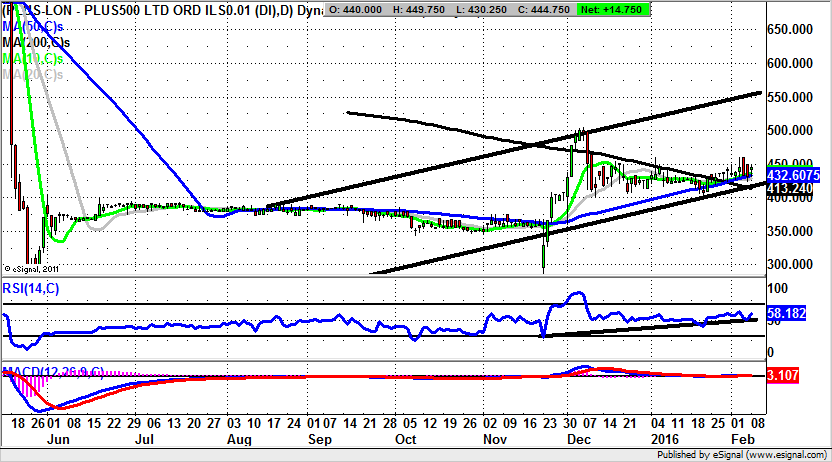

Plus500 (PLUS): The Squeeze Higher Continues

As I have stated before, it takes a degree of open-mindedness, or at least detachment, to regard a stock as being bullish if you do not really understand what edge the business model may (or may not) have. Indeed, the irony of Plus500 is that the best plus point I can think of is the cliché of there being no such thing as bad publicity. Looking at the daily chart it can be seen how there has been decent progress since the last update here. All of this would go to suggest that, provided there is no end of day close back below the 50 day moving average at 435p, we should be treated to a relatively easy journey towards the top of a rising trend channel at 550p from May last year.

Comments (0)