Zak’s Daily Round-Up: GLEN, RR., HOC and PDL

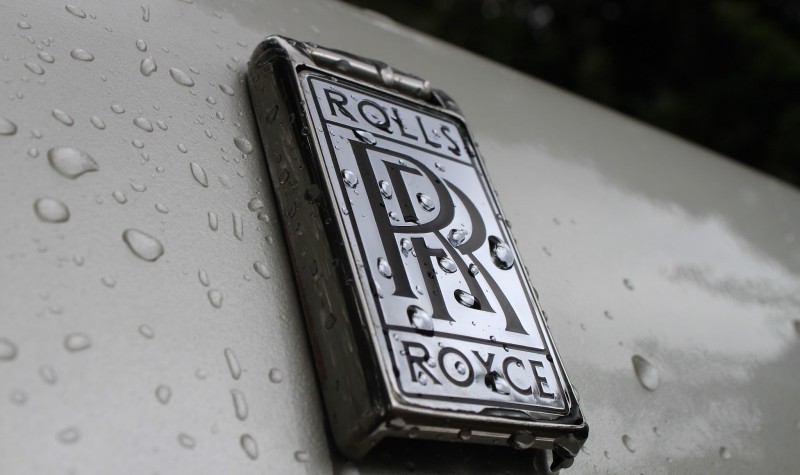

Market Position: Sterling / Dollar above $1.4350 Targets $1.48

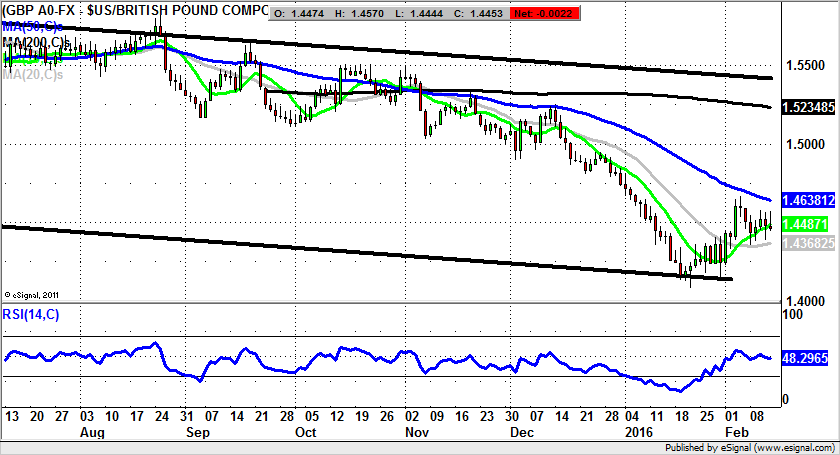

Glencore (GLEN): Above Latest Gap Could Lead to 140p

I have to admit that I feel a little disappointed by the recent recovery at Glencore. To give you a clue as to my stance on the company, it is one that I refer to affectionately as Glenron. However, rather irritatingly, it would appear that the mining giant is intent on attempting to save itself. The latest newsflow centres on a $500m facility to reduce debt, and to get the overall debt pile down to $18bn. This is roughly comparable to the current market capitalisation which is riding high at £13.6bn. Therefore, the ideal scenario over the near term is that the rebound in precious metals prices will get Glencore shares back above 100p and perhaps even as high as the present share price target of 125p. Of course, the restructuring of the group looks like it could be a long, drawn out process, and it should be remembered that even if metals prices rise on risk aversion fears, the demand for the commodities may not necessarily rebound in sympathy. Indeed, given the way that Japan has taken 25 years not to recover from its bubble, one would hope that the same scenario is not repeated. But bulls of this situation may take heart from the charting picture, which actually looks to be quite positive. It centres on the as yet unfilled gap to the upside based at 86p from earlier this month. What has been key here is the way that the low since the gap was made was 87p – despite the torrid stock market conditions. This has to be regarded technically as a bear failure to deliver downside, and theoretically positive divergence against a falling market. Indeed, we have seen the stock rocket with the FTSE 100 on Friday. This would suggest that, at least while there is no end of day close back below the gap, the upside here could be towards the 106p initial February. Above this would break the near-term falling wedge formation and could promise a 130p/140p target – higher even than the target of our friends at Deutsche Bank.

Rolls Royce (RR.): A Lack of Fresh Bad News

Rolls Royce is perhaps a prime example of how no bad news is really good news. Given the way that the jet engine maker was in danger of serving up its sixth profits warning over the recent past, even the doomsters might have reckoned that the fundamentals may have been overstretched to the downside. In the end there was no new profits warning, guidance was maintained, and there was even a rise in reported full year profit to £160m from £67m. This meant the market could swallow a 50% cut in the dividend, which to be fair, after the trials and tribulations the company has been in, can be regarded as par for the course. From a charting perspective it can be seen how there has been something of a bumping along the bottom feeling here since the November low was made at 504.5p. What we were treated to for February ahead of the latest massive spike was a narrow bear trap reversal, after the intraday support came in at 497p. In fact, Tuesday unveiled a hammer candle with the daily close at 507p – a technical buy signal for aggressive traders. The position now after the big gap through the 50 day moving average at 557p is that while there is no end of day close back below the top of the gap at 585p (today’s low), we could see the shares head back up to the top of a November gap at 664p over the next 2-3 weeks.

Small Caps Focus

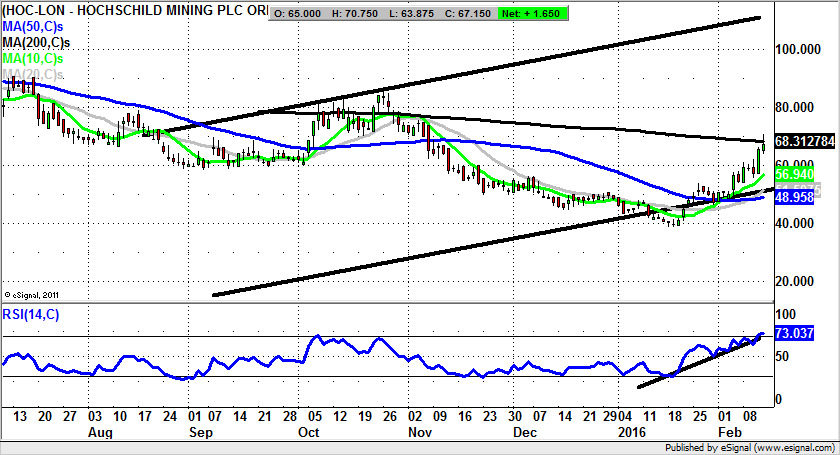

Hochschild Mining (HOC): Break of 200 Day Line Targets 110p

Given the massive gains in mining stocks over the past few weeks, all of a sudden it does not feel quite so clever to be calling shares up higher, when they have already outperformed in a significant way. However, it may be the case that those contenders with the most robust charting formations are worth investigating as momentum situations. This can be seen on the daily chart of Hochschild Mining, where there has been an approach of the 200 day moving average now at 68.31p. While it has to be admitted that in the first instance one would expect to see the 200 day line broken over the next 1-2 weeks. If this is the case then the potential upside is currently seen as being as great as the top of a rising trend channel drawn on the daily chart. This has its resistance line projection currently running as high as the top of last year’s rising trend channel with its top running as high as 110p. This is a target which could be achieved over the 1-2 months after a weekly close through the 200 day moving average. Ideally, such a clearance would happen next week or the week after.

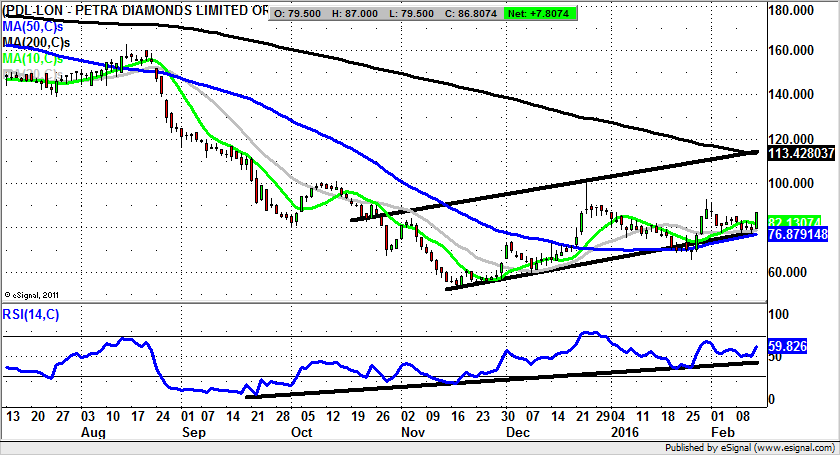

Petra Diamonds (PDL): 200 Day Line Target in Sight

What has been interesting for fans of the mining area is that even though the metals have been on the back foot for the best part of five years, diamonds have at least been on an even keel for the most part. This concept is underlined by the way that diamond prices have remained relatively consistent. However, it can be seen that for Petra Diamonds we are coming off the back of a two year decline, with the bargain hunters back in business. Indeed, the present charting configuration shows how there has been a rising trend channel in force since October. The floor of the channel currently runs level with the 50 day moving average at 76p. This implies that, provided there is no weekly close back below the notional double support at 76p, we should be treated to reasonable upside from present levels. The favoured destination over the next 1-2 months is as great as the top of last year’s price channel with its resistance line projection heading as high as 113p – the present level of the 200 day moving average.

Comments (0)