Zak’s Daily Round-Up: ULVR, WPP, CHAL, GEMD and NTOG

Market Direction: Crude Oil above $35 Could Still Target $43

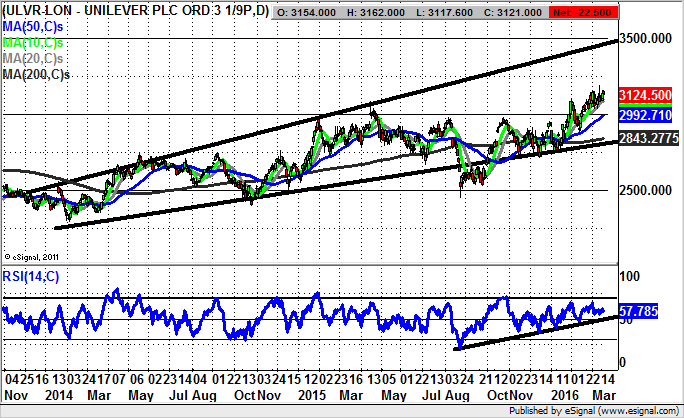

Unilever (ULVR): Extended Build Backs Breakout Argument

What is a standout as far as the two blue chips being charted today is how similar the daily timeframe configuration has been over the recent past. In the case of Unilever it is evident that we have seen an extended build for the household products group from as long ago as the beginning of 2014. Almost all of this has taken place within a rising and broadening formation which was only temporarily broken by the brief August/September bear trap below 2,500p. Since then though the stock has been able to climb back within the parameters of the two-year broadening triangle, with the implication being that we should see a decent acceleration to the upside over the next 1-2 months. The favoured upside destination at this point is regarded as being the 3,500p zone, especially while there is no weekly close back below the 50 day moving average at 2,992p. What helps back the breakout argument is the way that there has been a break above the neutral 50 level to level the RSI at 57 – very much in the low volatility buying zone for the oscillator. Only cautious traders would wait on a clearance of the initial March 3,190p resistance before taking the plunge on the long side.

WPP (WPP): 1,800p Expected

Although it is difficult to forget the £70m payout for Sir Martin Sorrell, the founder of WPP, a company which is a Great British success story and world beater, I have to admit that despite the man’s obvious talents he does appear to be a little on the overpaid side. He also verges on being something of a Davos bore, with his macroeconomic pronouncements. That said, one of the plus points of being worth more than £250m is that you can indulge yourself by being something of a windbag, and people seem to be all ears. As far as the charting position of the advertising giant’s shares are concerned, it can be seen how there has been a rising trend channel in place on the daily chart since the autumn of 2013. This currently has its support line running at just below the 200 day moving average at 1,457p. Nevertheless, for the near term one would be of the view that we are looking at a journey towards the top of the late 2013 price channel at 1,800p. The timeframe on such a move is as soon as the next 2-3 months, and is valid as long as there is no end of day close back below the 20 day moving average at 1,530p.

Small Caps Focus

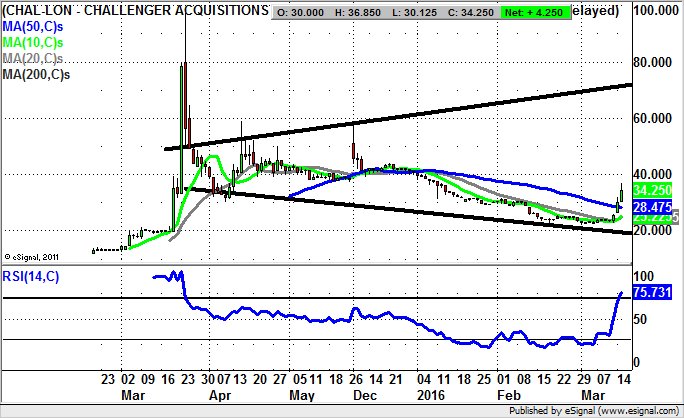

Challenger Acquisitions (CHAL): Triangle Target at 70p

It would appear that the recent hype/positive sentiment surrounding shares of Challenger Acquisitions is on the right track, especially if one looks at the recent price action on the daily chart. This is said in the wake of the latest clearance of the 50 day moving average – typically the starting gun on rallies in small cap/relatively illiquid situations. As for what may happen next, we are looking at possible progression within an overall broadening triangle which can be drawn in from as long ago as March on the daily chart. The big plus point as far as the bull argument is concerned is the way that we have been treated to a full session with the price action wholly above the 50 day line now running at 28.45p. All of this suggests that provided there is no end of day close back below the 50 day line, the top of the 2015 triangle is the logical target. This has its resistance line heading as high as 70p and could very well be hit as soon as the next 2-3 months. In the meantime any intraday dips towards the 50 day moving average to cool off the overbought RSI at 75 would be welcome.

Gem Diamonds (GEMD): Extended 100p Zone Support

We have an interesting, and perhaps rather weird set up in place over recent months on the daily chart where there have been several rebounds of late from beneath the main 100p support zone, but still the stock seems reluctant to make the big lasting break to the upside. This situation is illustrated by the present position for the shares where we have seen a decent bounce from the 100p zone, but then a stalling of the recovery. What one would want to see ideally from now is a relatively swift recovery of the 50 day moving average, now at 112p, accompanied by the clearance of the RSI 50 level, versus 48 at the moment. This would of course be a decent confidence booster for the bulls, and even open up the hope that after the consolidation we have seen over an extended period, the base building should lead back to a lasting breakout. But even if this is not the case one would be looking to at least a journey towards the top of a rising trend channel drawn in on the daily chart from as long ago as September at 135p. The timeframe on such a move is regarded as being as soon as the next 1-2 months. At this stage only another dive below the 2015 support line at 100p would really suggest that there were lasting doubts regarding the bull credentials of Gem Diamonds.

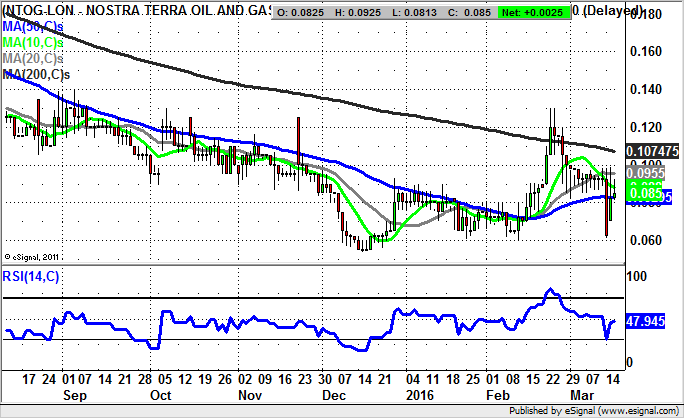

Nostra Terra Oil & Gas (NTOG): Higher Support Points to 0.13p

Finally, Nostra Terra Oil & Gas has been something of a disappointment to say the least over the past couple of years. Indeed, the main highlight over the near term is the way that we have made no less than three higher lows for 2016 above 0.06p versus the December floor. All of this suggests that we should be able to retest post October resistance at 0.13p over the next couple of months, even if the stock fades again after that. Indeed, any weakness towards 0.06p is currently regarded as a buying opportunity.

Comments (0)