Growth, value and income – CareTech provides it all

Internet bulletin boards can be a good source of new investment ideas. They regularly draw highly informed investors and interesting insights. But they also have their downsides. Prone to attracting the more passionate retail punter, popular bulletin board stocks can often experience extremely volatile price movements on the back of certain comments. And then there is the darker side of targeted market abuse, which bulletin boards provide a medium for.

When doing research into a company I often find that stocks with very quiet bulletin boards can turn out to be long-term winners. Many firms fail to attract the chatter of the investment crowd, but nevertheless consistently and quietly get on with running their businesses and delivering growth. One such company is AIM listed CareTech (CTH).

Care in the Community

Founded in 1993 and listing on AIM in 2005, CareTech is a social care services business, providing children and adults below retirement age with a range of solutions to complex needs. With a capacity of over 2,100 places the firm provides over 250 specialist services around the UK through the divisions of adult learning disabilities, mental health, young people residential services, foster care and learning services. Its customers are local authorities and health service commissioners.

The UK social care market in which CareTech operates is estimated to be worth £10 billion a year and is growing at an annual rate of around 3%. This is being driven by increased outsourcing by local authorities, shortfalls of specialist beds and higher regulatory burdens. Yet, the industry remains highly fragmented, with CareTech’s market share being around 1.25%. Thus, there is plenty of room for expansion for ambitious companies with strong financial backing.

Funding growth

CareTech has seen steady growth over recent years, building up a business which now earns a predictable stream of ”annuity” like income. The firm is continuing to look for growth, with the current strategy being focussed upon consolidating the market via earnings enhancing acquisitions and also on improving its current facilities.

A key point in the company’s recently history came in February last year when it completed a £21 million placing in order to support its current properties and fund further acquisitions. Notably, the amount raised was ahead of the initial £15 million target due to strong demand from investors. All the funds have since been deployed on a number of “earnings enhancing” deals which are said to be performing in line with expectations.

Then in February this year CareTech raised an additional £30 million via a so called “ground rent” transaction with fund manager Alpha Real Capital. This has seen the freehold to 41 of the firm’s properties transferred to Alpha for a 150 year term (while CareTech retains the “virtual” freehold”) in exchange for release of the funds. In return CareTech will pay rent of £1.07 million per annum, equating to what seems a very reasonable interest rate of c.3.4% – although it will rise based upon changes in the Retail Price Index (RPI). The cash will be put towards further expansion opportunities in the care sector.

One deal has been done since the ground rent transaction, with CareTech buying Oakleaf Care, a Northampton-based specialist in the care and rehabilitation of men with acquired brain injury. Oakleaf was bought for an initial £18.3 million and made pre-tax profits of £0.7 million in 2014. The deal is expected to be immediately earnings enhancing.

Trading Up

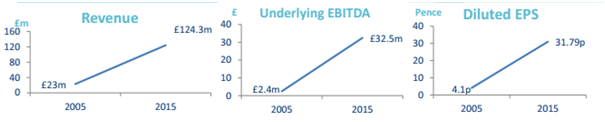

CareTech has a good track record as a public company, with underlying EBITDA and diluted earnings growing at a compound annual rate (CAGR) of 30% and 25% respectively since IPO. This has been achieved under difficult circumstances, especially during 2011/12 when the industry came under severe pressure from UK public sector funding cuts. These years saw the demise of care provider Southern Cross, and CareTech itself was subject to an abortive management buy-out.

Source: Company presentation

The latest set of numbers, covering the financial year to September 2015, revealed revenues up marginally at £124.3 million. Underlying pre-tax profits rose by a more pronounced 11.7% to £22 million, with earnings up by 2.5% at 31.8p per share – these being diluted by the February placing.

Notable about CareTech is its strong operational cashflow, with the inflow before exceptionals standing at £30.7 million for 2015. This enables the firm to use internal funds for further expansion, to pay the substantial interest payments on its borrowings and to afford a decent dividend payment.

Net debt stood at £158.5 million at the period end, with total facilities standing at £195 million. During the year CareTech negotiated improved terms on these facilities, with their expiration being extended by two years to January 2019, the interest rate reduced from 4.33% to 3.96% and four loan repayments amounting to £21.6 million being deferred.

At the AGM at the start of March CareTech confirmed that trading was in line with expectations. Encouragingly, fee rate discussions with local authorities, while at an early stage, are said to be consistent with the company’s own positive expectations. This is all the more positive given that the discussions incorporate the UK Living Wage, due to come into effect on 1st April this year (more on that below).

Risks and Opportunities

With its large financial resources and a growing and fragmented market to take advantage of, I believe that CareTech looks well positioned to make steady long-term progress. But the industry is not without its risks.

These came to light in 2012 when London listed care provider Southern Cross Healthcare went into administration. This came after the firm sold the leases on its properties to finance expansion. But Southern then suffered a perfect storm of higher rents and sharp public spending cuts. CareTech is a completely different situation however. While the recent ground rent transaction may bring back memories of Southern Cross’s strategy, CareTech is a financially sound business which owns the majority of its properties and is thus protected from rent increases.

While pressure on government finances remains, social care looks to be high on the agenda. Last November’s Comprehensive Spending Review announced a range of measures to finance the industry including a 2% social care levy on council tax, along with an extra £1.5 billion for the sector’s Better Care Fund by 2019-20 and an additional £600 million for mental health care.

Putting further pressure on the industry is the planned introduction of the National Living Wage this coming April, which will see a rate of £7.20 per hour set for workers aged 25 and over. In reaction the country’s five largest care operators said this could cost the industry an addition £1 billion by 2020, although this will be offset by the council tax levy. But for CareTech the Living Wage could actually be an opportunity. The vast majority of its staff are already earning above the Living Wage and it may cause lower quality providers to go out of business.

One other company specific factor which investors should take note of is CareTech’s debt and the related interest rate risk. The company estimates that a 100 basis point rise in rates would reduce annual pre-tax profits by around £400,000. But given that underlying profits were £22 million last year the potential damage looks to be small. In addition, the company’s financial position looks comfortable, with loan to value estimated at 50% just after the ground rent deal and a net debt to EBITDA ratio of less than 4 times. Net interest payments of £6.7 million in the last financial year were covered 4.6 times by underlying operating cashflow.

Undervalued and overlooked

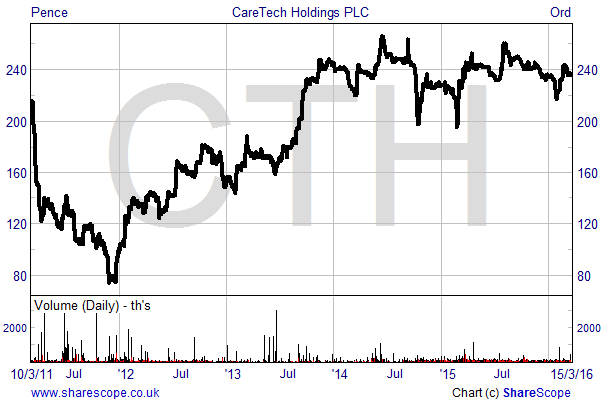

Currently trading at 235p shares in CareTech look good value according to a number of metrics.

On forecasts for 32.8p of earnings for the 2016 financial year the shares trade on a multiple of just 7.2 times. The markets are also pencilling in a dividend of 8.6p per share (up from 8.4p), giving a decent yield of 3.66%. However, given that the payment grew by a CAGR of 8.8% between 2010 and 2015 I see scope for it to be higher, especially given that coverage for last year was high at 3.8 times earnings.

One of the other attractions is CareTech’s strong asset backing. The firm has a significant freehold portfolio, which at last count comprised of more than 190 properties. In February this year the portfolio was independently valued at £282 million, a figure £25.4 million higher than the balance sheet valuation as at 30th September (the company records its tangible assets at book cost). Add this additional value to net assets as at 30th September and we get £159.1 million – a figure higher than the current market cap of £147 million.

Comments (0)