Zak’s Daily Round-up: RRS, SHP, MIO, HAWK and SAV

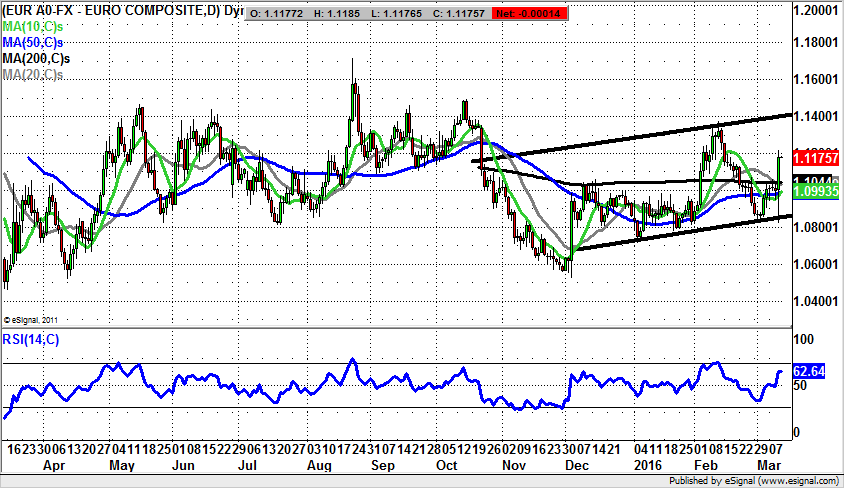

Market Position: Euro / Dollar Above $1.1050 Targets $1.14

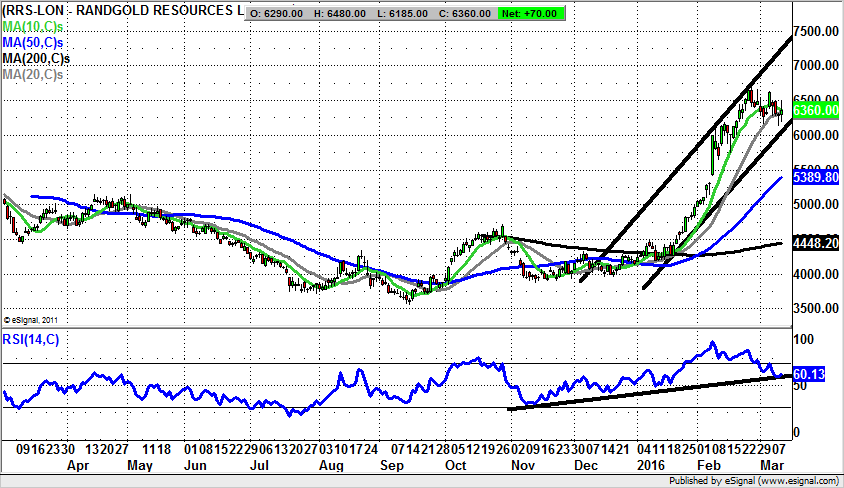

Randgold Resources (RRS): Above 6,000p Targets 7,300p

There are likely to be few who disagree with the idea that shares of Randgold Resources have been one of the few real highlights to date among stocks which have not been involved in M&A so far this year. This is even though this week was somewhat blighted for commodities related stocks by Goldman Sachs questioning the validity of the sharp recovery we have seen.

What seems to be the best aspect here for the West Africa focused miner is that while the price of gold has risen in a relatively steady and consistent fashion over the past few months, it may be seen how the progression of Randgold to the upside has been even better. This point is underlined by the way that the mid January to mid February move to the upside here was far smoother and less volatile than with the underlying metal, and continues to be the case. As far as what the position over the next month may be, we can see decent progress within the rising trend channel from December, with the floor of the channel currently running at 6,000p. All of this would suggest that provided there is no weekly close back below the three month uptrend line, we can regard the present consolidation by the stock as being that of a mid move variety. This should resolve itself to the upside over the next 1-2 months. The favoured destination at this point is regarded as being the top of the rising 2015 price channel at 7,300p. Only cautious traders should wait on a clearance of the recent initial March intraday high at 6,635p on an end of day close basis before taking the plunge on the upside.

Shire Pharma (SHP): 50 Day Line Trigger Awaited

I have to admit that Shire Pharma was, for the longest time, a company which I was hoping would be a decent M&A target, if only on the basis that in order to really flourish on the world stage it might be best if it was taken over by one of the larger international players. Alas, due to issues over tax inversion, and the understandable desire of Shire itself to grow into being an international player in its own right. What we can see on the daily chart is the way that the shares are trading in the wake of a mid 2015 quadruple top for price action through 5,500p. The position now is that we are in the middle of a descending July price channel, one which has guided the stock down by over 2,000p at worst. While it may be tempting to think that we are simply looking at a rebound opportunity right now. The reason for saying this is the way that the RSI remains below the neutral 50 level, and has done so even as the shares have attempted to recover over the past couple of months. Therefore it may be wise to wait on at least an end of day close back above the 50 day moving average at 3,952p currently, and ideally a higher low above this feature, before assuming that the target zone of former December resistance at 4,600p plus can be achieved any time soon.

Small Caps Focus:

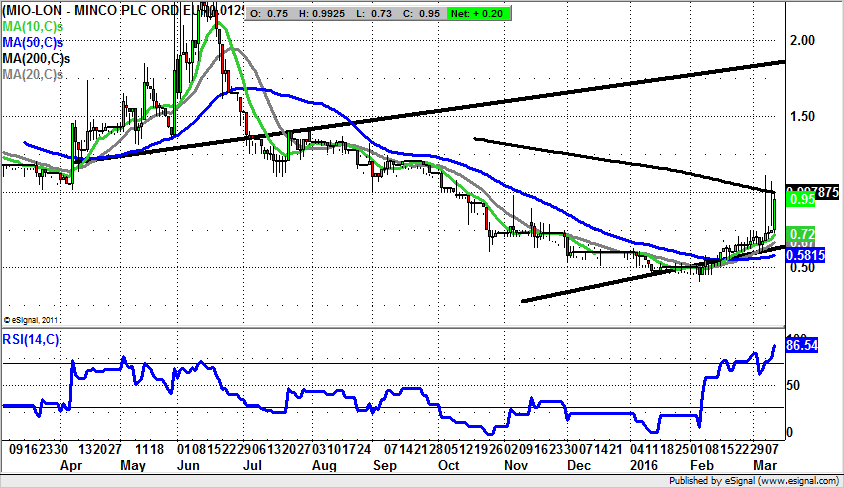

Metminco (MIO): Above The 200 Day Line Leads To 1.8p

For Metminco we can see the kind of recent recovery which is not only typical of what we have seen for many mining minnows, consisting of an extended base, followed by a melt up through the 50 day moving average now at 0.58p. This would suggest that we now have a rally which will have leg, and indeed, start to accelerate quite sharply. The present position shows how there has been a triple approach of the 200 day moving average now at 0.99p. The view is that as little as an end of day close back above the 200 day line could unleash a quite an aggressive fresh leg to the upside. The implied destination of such a move may be as great as the top of a very wide rising trend channel in place on the daily chart since April last year. This has its resistance line projection heading through 1.80p. While such a target feels as though it is a long way away, the assumption being made at this point is that it could be achieved as soon as the next 2-3 months. The fact that this is a stock which has shown itself to be a fast mover in both directions on occasion. The notional stop loss is back below the present position of the 10 day moving average at 0.72p.

Nighthawk Energy (HAWK): Extended Base Points To 2.6p

It may be said that Nighthawk Energy is something of a private investor favourite, although given the rather painful share price performance over much of the recent past, possibly not as much of a favourite as it used to be. However, what can be seen from the present charting configuration is the way there has been an extended and quite robust looking base in place since the beginning of December. The big transformation since the start of last month was the recovery of the 50 day moving average at 0.99p currently, with the 50 day line traditionally the start of new uptrends in such situations. The view at this point is that an end of day close above the initial February peak at 1.36p should be enough to get the shares on a journey towards the top of a rising trend channel as high as 2.6p over the next 2-3 months, just below the 200 day moving average at 2.84p.

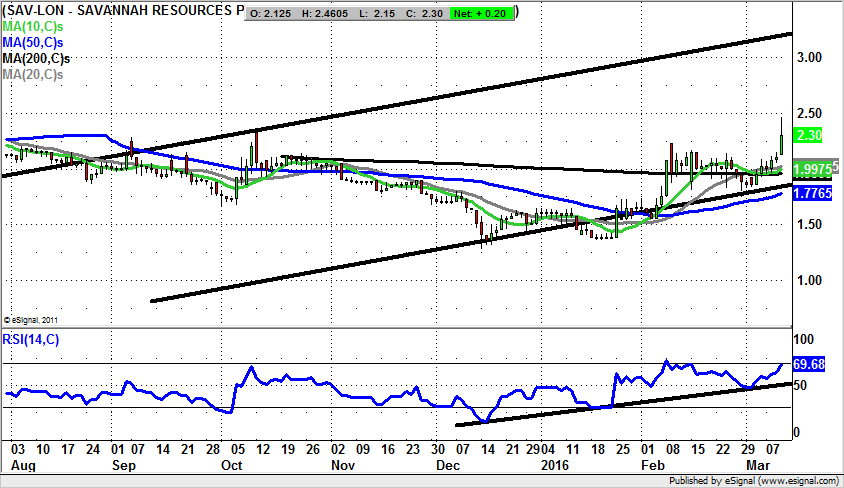

Savannah Resources (SAV): 200 Day Line Bear Trap Suggests 3.2p

Although we were on the receiving end of a false dawn spike for the shares in June, the overwhelming feeling associated with the price action of Savannah Resources in the recent past has been that of disappointment – until now. This is because March to date has delivered a bear trap rebound from below the 200 day moving average currently running at 1.95p. The chances now are that, at least while there is no end of day close back below the 200 day line, the upside here is expected to be the top of a rising trend channel drawn from August last year at 3.20p.

Comments (0)