Zak’s Daily Round-Up: ITV, LMI, AUE and RCI

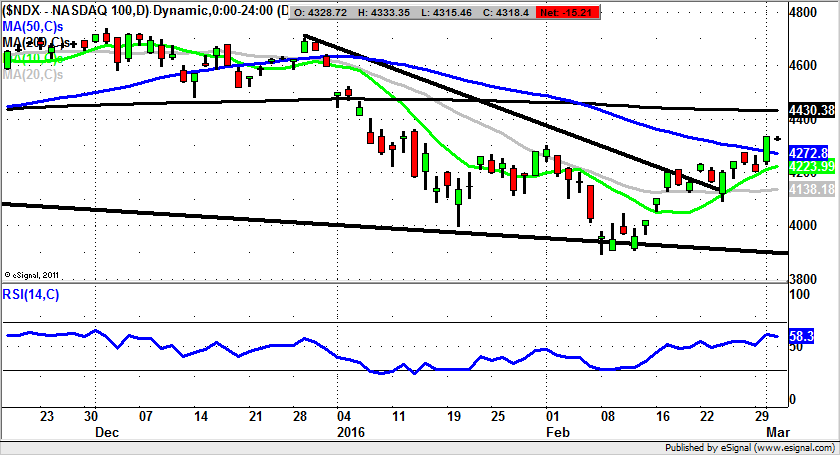

Market Position: Nasdaq 100 above 4,200 Still Targets 4,400 Plus

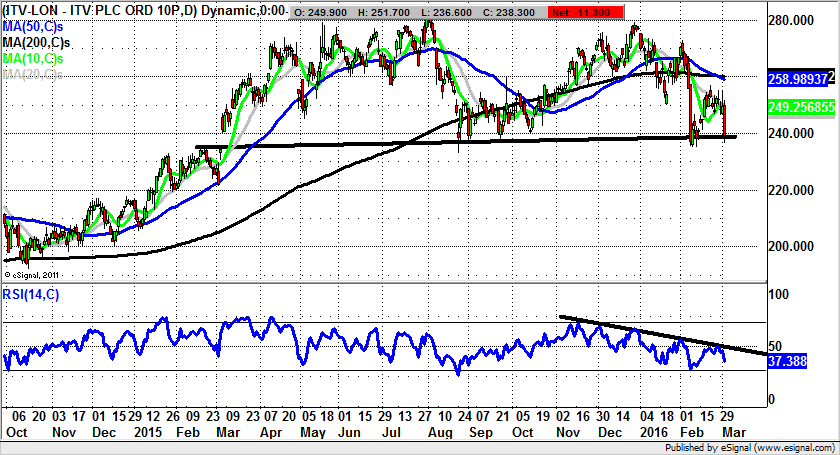

ITV (ITV): Dead Cross Disappointment

One of the things that strikes a long in the tooth stock market observer is that way that companies approach their investor relations, or not. What we tend to have right across the board from the minnows to the blue chips is a divergence between those who get it right, and those who perhaps fall a little short. This looks to be the case for broadcaster ITV, where it can be seen that the shares are languishing near the bottom of their near-term trading range. Of course, for ITV and other companies who disappoint, it can be bad luck as much as bad strategy, which means that the market may punish them. This sense of injustice is amplified by the way that, courtesy of such triumphs as Downton Abbey, the group is still serving up double-digit growth. The only problem here is that there would appear to be headwinds on the fundamental front. To be fair, they do not seem to be killer blows, more rather mild irritants. But it would appear that this has been enough to scare off the more fuzzy longs here. In addition, we have a situation where there is not as much to chase in terms of being a good news story, such as M&A, or a big new blockbuster/driver of growth. This may explain why the stock opened lower today by some 3%, and then kept on retreating. The key here though may be the technical story. This is because ITV shares are trading in the aftermath of the dead cross sell signal between the 50 day and 200 day moving averages, seen in the last week of February. The notional support since then is the initial February resistance at 235p. The risk now is that as little as a weekly close back below 235p would unleash a fresh, sharp breakdown back below the neckline support. We could therefore suffer a fresh leg to the downside and journey to the former September 2014 resistance zone at 220p over the next 1-2 months.

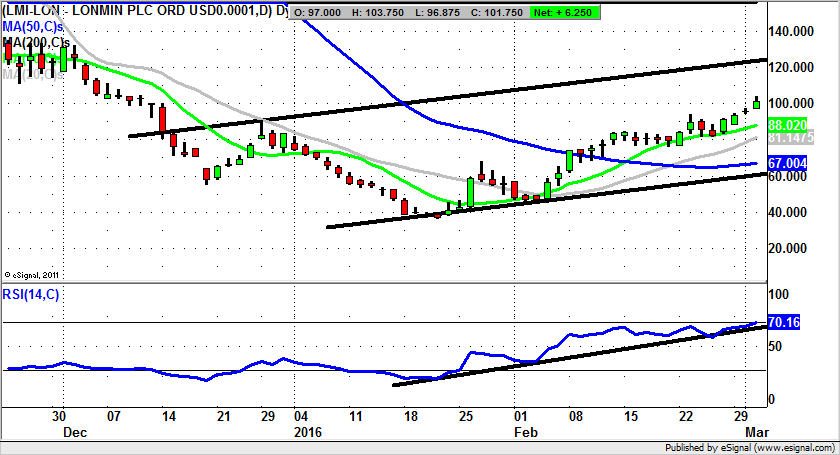

Lonmin (LMI): Extended Base Targets 120p

I suppose I could have offered Lonmin the ignominy of being included in the Small Caps Focus of the Daily Round Up. But I rather feel that even though the company has slapped many fans of the mining sector very hard, the game is perhaps not quite up for the bull argument. This is said, partly on the basis that we are seeing the first signs of revival for the sector, led by Anglo American (AAL) and Glencore (GLEN) as the comeback kids, but also that Lonmin may just be able to restructure itself to a better future. However, the big attraction here for a chartist is the way that there has been such an extended and healthy looking basing attempt in recent months. While there is always the chance of the odd relapse before a sustained recovery for the price action, enough ticks have been crossed, at least in the near term, to provide valid grounds for optimism. For instance, we can point to the rising trend channel which can be drawn on the daily chart from as long ago as the end of December, as well as the main higher low for February versus January. The recovery of the 50 day moving average last month, now at 67p, was a key turning point as far as momentum is concerned. This means we can say that while there is no end of day close back below the February intraday peak at 94p, we are justified in looking for a 120p target at the top of the December price channel. The timeframe of such a move is the next 2-3 weeks. In the meantime any dips towards 94p to improve the risk / reward of going long are regarded as buying opportunities, especially given the way that the RSI is at 70 and now officially overbought.

Small Caps Focus

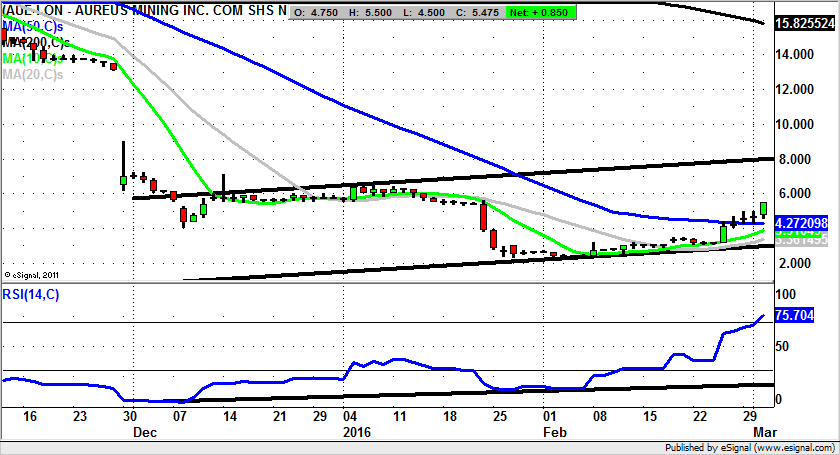

Aureus Mining (AUE): 8p Target While above 50 Day Line

The flow in recent weeks has certainly been in favour of mining minnows, and given how bad the past few years have been for this particular asset class, it is difficult not to be cheered on behalf of those investors who may have been caught high and dry. Aureus Mining is certainly one of these types of situations, where one would now be looking for at least an intermediate recovery. The reason for saying this on a technical basis is the way that there has been a decent reclamation of the 50 day moving average, now standing at 4.27p. This is all the more newsworthy given the way that this positive development comes in the wake of the massive unfilled gap to the downside served up in November. This event still overshadows the technical of the shares, and is likely to do so for quite some time. Nevertheless, the rather simple call here is that provided there is no end of day close back below the 50 day line the upside for Aureus Mining could be as great as the December price channel top as high as 8p. The timeframe on such a move is regarded as being the next 1-2 months at the latest.

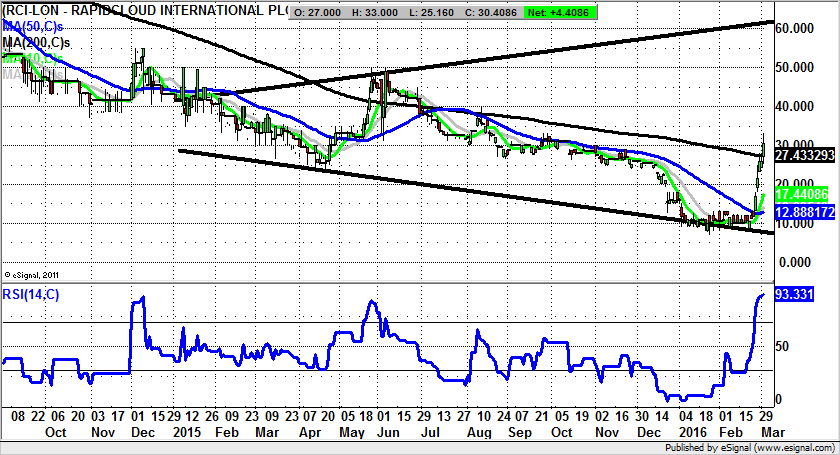

Rapidcloud (RCI): Above 200 Day Line Could Point to 60p

Although the cynics may have suggested that Rapidcloud shares were heading in only one direction – down – as recently as the beginning of last month, it can be seen how the near vertical recovery over the past few weeks has been quite a bear burner. Indeed, the misery for the shorts has been compounded by the way that over the past session we have seen the 200 day moving average at 27p conquered relatively easily. While there is a risk of an initial retracement back to this feature given how overbought the shares are, the overall picture here over the next 2-3 months could be of progression towards the top of last year’s broadening triangle at 60p – an ambitious, but still achievable destination.

Comments (0)