Zak’s Daily Round-Up: HSBA, RB., COMS and TRAK

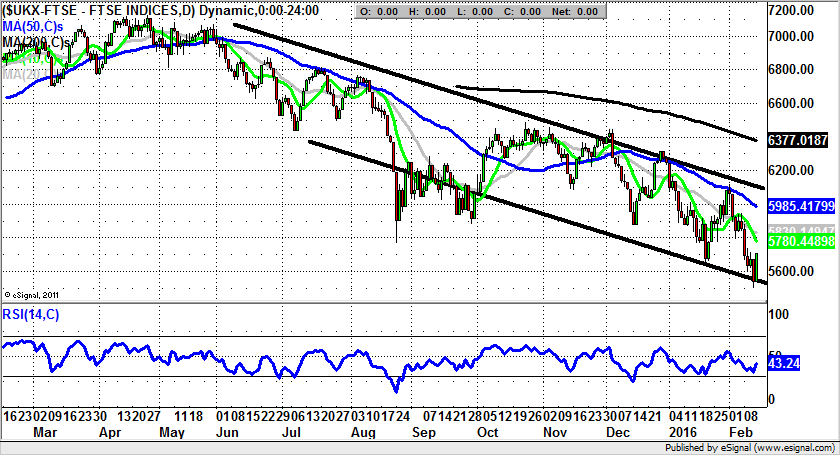

Market Position: FTSE 100 above 5,790 Targets 6,100

HSBC (HSBA): Intermediate Recovery

Anyone looking to be cheered up after a less than satisfactory Valentine’s Day need look no further than the ugly contest between HM Government, largely in the shape of George Osborne, with his Anrtonio Banderas hairstyle, and HSBC (HSBA), the world’s local money launderer (fines have been paid for this). These two undateables have a rather bad track record of late. In the case of Osborne, the recent triumph over Google paying a 3% tax on a notional 20% corporation tax figure means that he will be looking to raise cash from pensioners, benefits recipients or any other weaker members of society. This is even more so after he caved on the £1bn a year banking levy which was ostensibly the reason for HSBC threatening to leave the UK. In fact, it probably first thought of leaving this country off the back of the H1 2015 stock market boom in China, combined with the banking tax. However, the collapse in the economic miracle for the communists of Beijing means that HSBC going to Hong Kong would be very foolish indeed. Therefore HSBC’s announcement is effectively an admission that they have nowhere to go. On this basis if Mr Osborne had any backbone he would charge them the banking levy again – but as we have seen from Google, he does not. As far as the price action of HSBC is concerned, it can be seen how there has been a tentative rebound off the floor of a falling trend channel, one which has been in place on the daily chart of the bank. The favoured scenario over the next couple of weeks would be for a test of resistance at the 20 day moving average at 461p. However, only back above this feature on an end of day close basis would really suggest a lasting floor had been made here. As things stand, it would be surprising if this were to be the case.

Reckitt Benckiser (RB.): August Price Channel Target at 6,750p

Although it might be admitted even by the management of Reckitt Benckiser that there are perhaps rather more exciting companies in the FTSE 100, the good thing about the present state of the stock market is that investors prefer consistency rather than, say, stellar growth. In the case of the household products group we have what are described as tough conditions, but at least sales over the past year have been ahead of expectations. Given the way that the current market place situation is far from ideal it can be said that the 6% rise in like for like sales was a decent result, as was the £82m rise in profits to £2.2bn. All of this is enough to explain the present setup on the daily chart and its relative bullishness. This is all the more so given the way that the market has clearly been caught on the hop after what was a torrid start to the year, even for the most stable of blue chip companies. What can be seen here over the past few weeks is the way that last week delivered a one day bear trap from below the former January support at 5,935p. Then Friday saw the shares close back at 5,966p for a technical buy signal on end of day acceptance back above the old support. This might explain why we have seen such a sharp gap to the upside for the start of this week, with the narrow bear trap effect accentuated by the aftermath of the latest results from the company. The expectation now is that provided there is no end of day close back below the 50 day moving average at 6,135p we could be treated to a full blown move to the top of a rising trend channel which can be drawn from as long ago as August with its resistance line heading as high as 6,750p. The timeframe on such a move is regarded as being the next 1-2 months.

Small Caps Focus

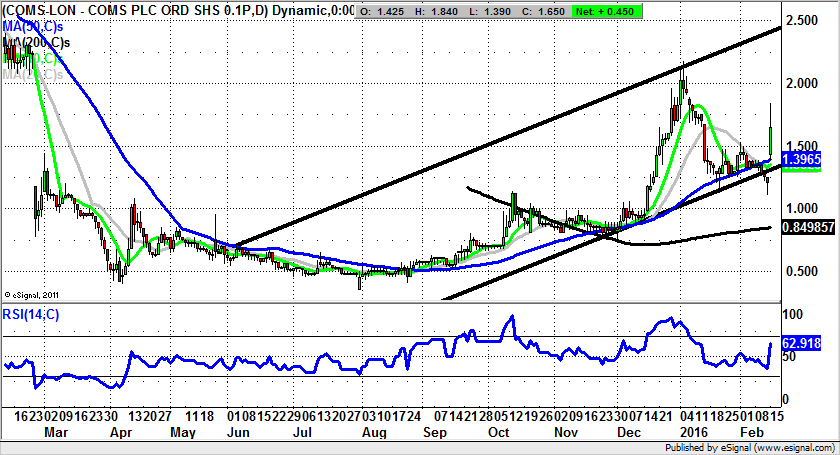

Coms (COMS): Above 50 Day Line Points to 2.5p

It can be said quite fairly that the recovery as far as shares of Coms has been concerned over the past couple of months was not exactly a quick affair. This is hardly surprising given the way that the rebound came in the wake of the massive February 2015 gap to the downside, a feature which was only finally filled last month with the spike up to as high as 2.18p. This event effectively served up a gap fill reversal, something which was relatively disappointing given the way that the turnaround in the wake of the early 2015 gap to the downside was so sharp. The key now will be if decent ground can be made up from the floor of a rising trend channel, one which can be drawn from as long ago as June last year. The floor of the channel currently runs just below the 50 day moving average at 1.39p. While there is no end of day close back below the 50 day line, the upside here could be as great as the 2015 resistance line projection at 2.50p. The timeframe on such a move is regarded as being as soon as the end of next month.

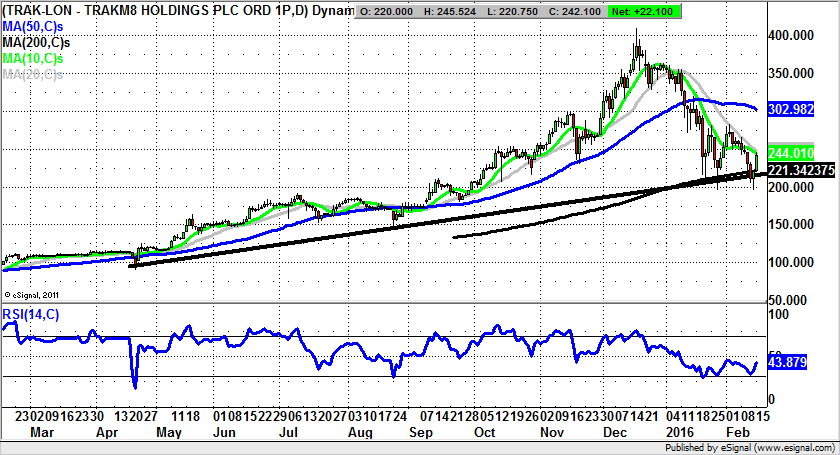

Trakm8 (TRAK): 302p Target above the 200 Day Line

It has certainly been a rather torrid start to the year for shares of Trakm8; but then again this has been the case for the stock market as a whole. But at least we can gain some satisfaction from the way that over the past few sessions some support has been coming in towards the 200 day moving average now at 221p. Indeed, it is typically the case that even for the most bombed out stock or market we can see an intermediate recovery around the 200 day line, even if a breakdown continues after that. In this case one would be looking to the 50 day moving average at 302p over the next 4-6 weeks as a realistic destination.

Comments (0)