Zak’s Daily Round-Up: BP., FRES, RRS, DKL and ENQ

Market Direction: Pound/Dollar below $1.45 Risks $1.40 Again

BP (BP.): Above 50 Day Line Targets 400p

As we are allegedly at the dawn of an extended recovery for Crude Oil, it seems fair to be going with BP to see whether some of this renewed interest in the commodity has fed through to the share price. What can be seen here on the daily chart is that there has clearly not been the big rebound for this oil major, as there has been for some of its smaller counterparts. All of this goes to suggest that if you are a fan of the company’s chunky dividend, then you would not be buying into the stock too far off the main base towards 320p. As far as what the upside here may be, the view is that the shares are heading higher within a rising trend channel from December. The floor of the channel currently runs level with the 50 day moving average, with the message at the moment being that provided there is no end of day close back below this notional double support, we should be treated to significant upside. The favoured destination at this point is seen as being as high as the four month price channel top at 400p. The timeframe on such a move is regarded as being the next 1-2 months. At this stage only cautious traders would wait on a momentum signal such as an end of day close above the 200 day moving average at 370p, even though the latest break for the upside back above the neutral 50 level to leave it at 55 is regarded as a leading indicator on potential upside.

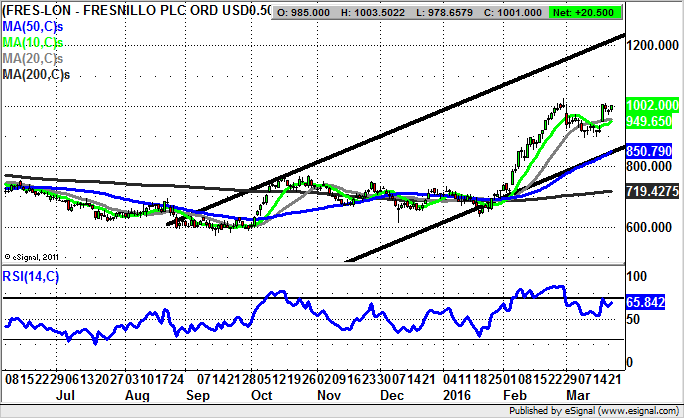

Fresnillo (FRES): Gap towards Resistance Targets 1,200p

While it may be said that shares of Randgold Resources (RRS), covered next, have grabbed all the attention for being one of the FTSE 100 shining lights for 2016, it can be seen how silver/gold miner Fresnillo is not too far behind in the bullish stakes. This is because we have been treated to a rampant performance over recent months from the Mexico focused miner, and, if anything, it would appear the technicals here are continuing to improve. This is said in the aftermath of the gap to the upside last week for the stock through its 10 day and 20 day moving averages, currently at 949p. All of this goes to suggest that we are most likely in the middle of a mid move consolidation ahead of an extended fresh push to the upside, a gap which echoes the one seen at the beginning of last month which pulled the stock up from the 750p zone to 1,000p plus. What can be said now in terms of the upside is that while there is no end of day close back below the 10 day line we could be looking to a top of August trend channel target as high as 1,210p. The timeframe on such a move is seen as being the next 4-6 weeks.

Randgold Resources (RRS): 7,800p Late 2015 Price Channel Destination

Randgold Resources has effectively been the number one gold play, and in many ways, rather better than having a few ingots delivered to your house. This is because the shares have the liquidity and the gearing, and are rather easier to barter than your average gold bar. Getting back to the charting position here, it can be seen how there has been a rising trend channel which has its floor running level with the 10 day moving average running at 6,378p. The assumption to make now is that at least while there is no end of day close back below this notional double support we could be on the receiving end of decent further upside, even after all the gains to date. The favoured destination as soon as the end of next month is 7,800p at the December resistance line projection.

Small Caps Focus

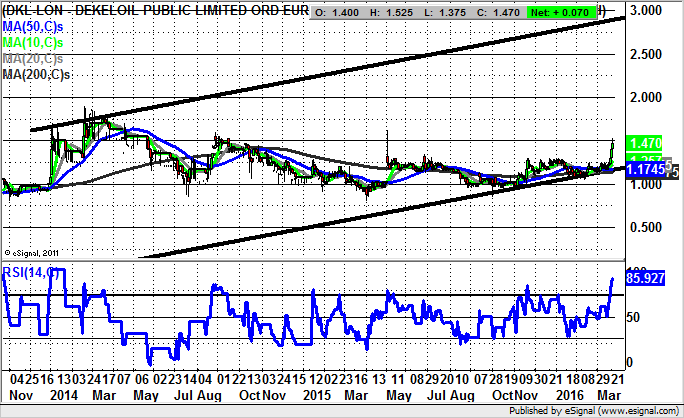

Dekeloil (DKL): Above 1.5p Targets as High as 3p

For some reason the stock market has been relatively slow to cotton onto the attractions of Dekeloil. This may have been a straightforward PR issue – people feeling gun shy regarding investing in a company based in the Ivory Coast, not understanding what Palm Oil is, and not even piling into the stock after star fund manager Gervais Williams. However, the fundamentals have actually been consistent and compelling, with the share price chart very much reflecting this at the moment. This is said in the wake of the clear break of the main post November resistance at 1.3p. Above this level on a weekly close basis it is possible to look for considerable upside. Just how the shares could fly is suggested by the top of a wide rising trend channel in place on the daily chart which has its resistance line projection heading as high as 3p. This is the 3-4 month target for Dekeloil while the main autumn resistance remains as support. Only cautious traders would wait on a clearance of the former 2015 peak at 1.50p plus before taking the plunge on the upside.

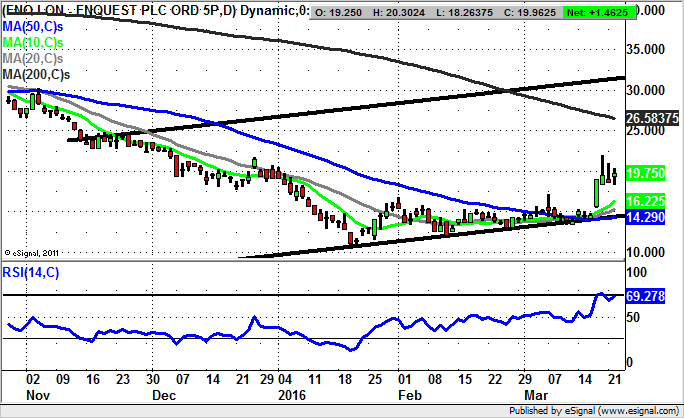

Enquest (ENQ): Above 20p Targets 30p

Even though shares of Enquest are well off the bottom given the rally since the end of January, it would appear that there is still plenty of momentum behind the recovery. This is said on the basis of the latest gap to the upside through the 50 day moving average at 14.29p – also level with the floor of a rising trend channel from the end of November. All of this would suggest that as little as an end of day close back above post December resistance at 20p could lead to the November price channel top at 30p plus over the following 4-6 weeks. At this stage only cautious traders would look to buy into any weakness back towards the initial March peak at 17.1p before taking the plunge on the upside.

Comments (0)