Is This the Most Exciting Chart around Right Now?

The worst thing about Bank Holidays, apart from the fact that they commit most people to time off that may not suit them – particularly if the date is governed by some Bronze Age lunar thinking, producing a double holiday in the middle of the spring showery season – is that it messes up all your weekly charts. It could be argued that ‘monthly chart’ is a misnomer to start with because they are of unequal weight – and that disparity is worse between markets of course, given those holidays are on different dates and not equal in number. Most charting packages offer four-week charts, which is better at least.

Consistent, reliable data is the basis of Technical Analysis. So if your candlesticks, or whatever you use on your time-based charts, have the odd day missing here and there, perhaps they’re not equal. There are certain statistics that apply to the different days of the week when it comes to which ones are more likely to be up or down. If a day is missing though, it skews all of your bell curves, and for what? I would prefer a 20 day chart that only moves on when 20 days have completed, rather than a four-week chart. But most trading packages are not sophisticated enough to do that, at least not without a bit of programming.

So, as we stare down a rainy waste of days off, here’s a sector you can look at when you’re sitting around wishing the sun was out: the Oil Equipment, Services & Distribution sector. Oil has bottomed out and started to rally – at least for now, as I wrote in my last blog post – we might expect a recovery in oil companies. But the best gains are usually to be had not in the obvious sectors, but in the support services to those sectors. After all, an oil company has to commit to reinstating platforms, exploration etc. So the support services are usually less volatile and more resilient to market fluctuation, especially in a recovery.

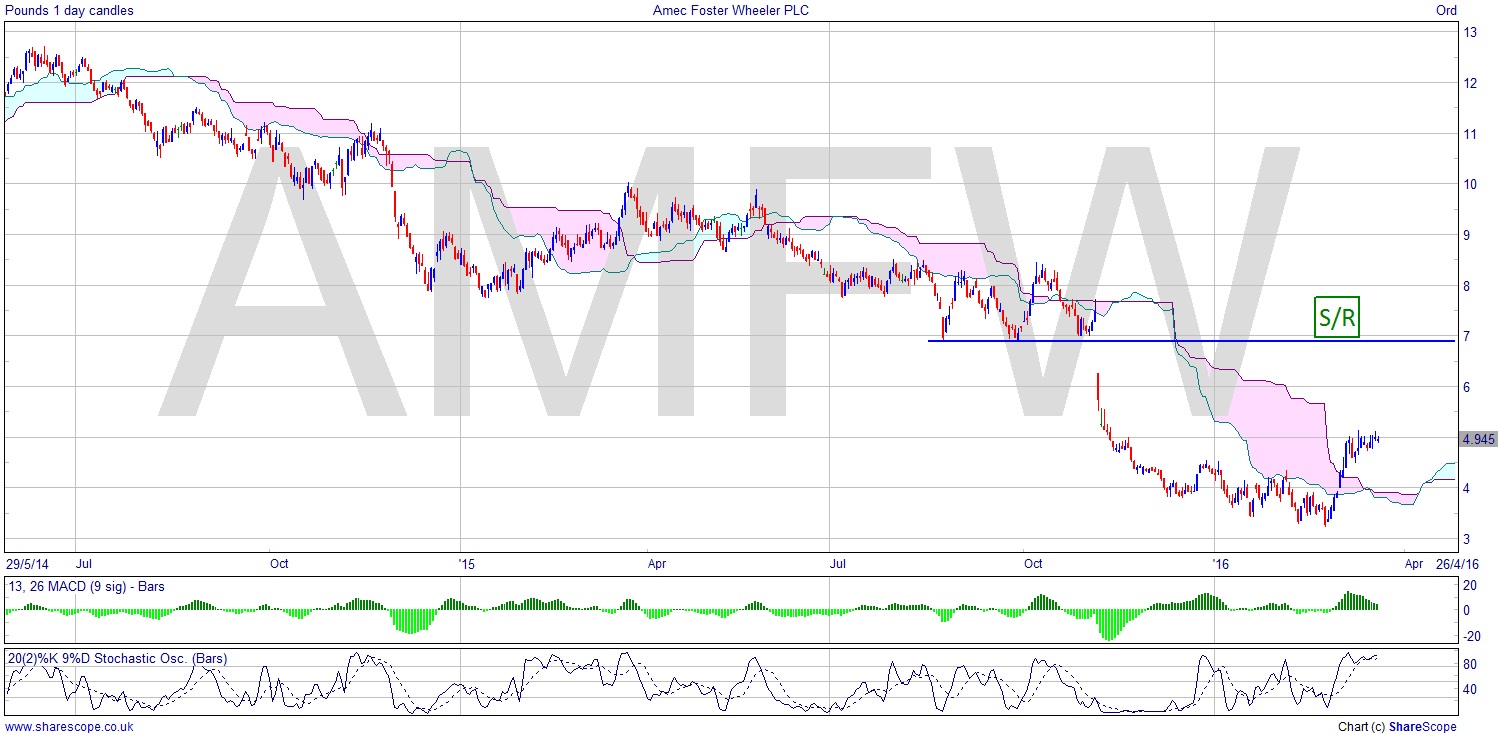

One LSE listed company that is looking interesting is Amec Foster Wheeler plc (AMFW). They provide a broad spectrum of services and the chart is a very interesting animal. The gap down and subsequent turnaround is what makes it interesting. It doesn’t show up on the weekly. I expect a lot of people think gaps happen on weekends, and there is probably more chance of it, since a couple or three days’ break is more likely to produce a jump than an overnight break. But they happen, and proponents of the standard charts will miss these unless they look at the daily, and then, who knows, they may yet dismiss it since the weekly appears not to support the importance. Don’t let your charts dictate to you!

So where are we? A gap up and you’ve got an island gap reversal, which is one of the strongest reversal signs there is. But even without that we have what is known as a ‘u’ move. It’s a literal description of what we see. It inevitably takes us up over the cloud and the lower moving averages, bullish to start with. It gives us an entry point without needing to wait for a pullback, and although we can wait, we run the risk of missing a good part of the move. A good case for a starter position, say half size.

The trade management does itself: we have a congestion area right now at around £5, so we can have a stop a bit below that. There’s a good case for a measured move to over £6. If it falls then rallies, then we might regard that as the higher low and get back in. If it carries on up then we manage at £6. We might expect congestion there, and it’s certainly a decision point. It might be worth tightening the stop around that level as it draws equal to the gap down. If it does break up then it will almost certainly fill the gap, which means £7. That’s a resistance becoming support scenario, and we might want to have a looser stop there as a result. This is a very exciting chart and one which offers so many possibilities to different kinds of investors.

Comments (0)