Zak’s Daily Round-Up

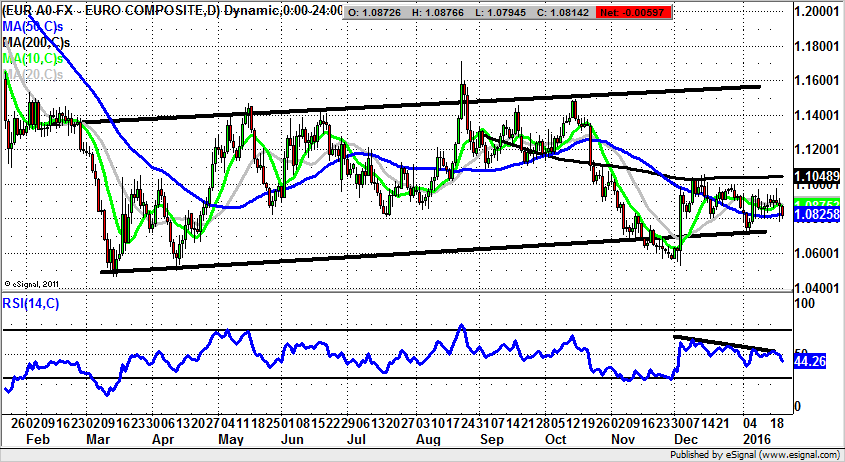

Market Position: Below $1.0828 for Euro / Dollar Risks Under $1.06

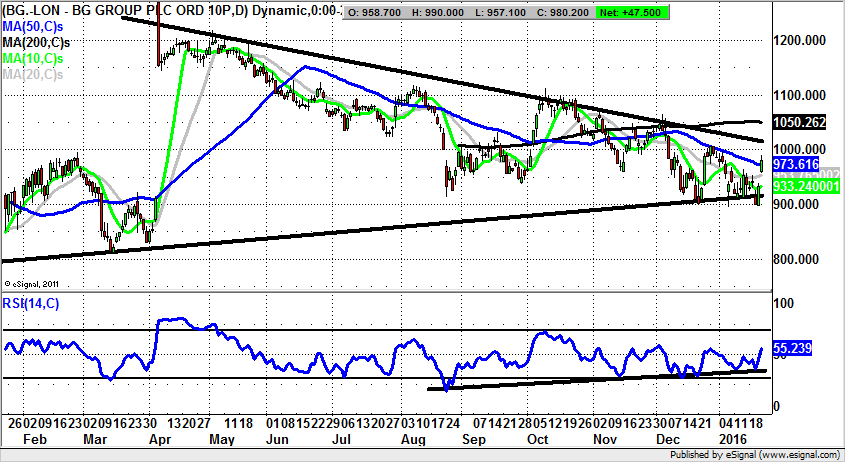

BG Group (BG.): Still Boosted by Shell

I do not think I have charted shares of BG Group since the announcement last year that it was to receive salvation from fellow sector giant Royal Dutch Shell (RDSB). Unfortunately, the problem with almost any M&A outside the realms of the minnows is that it becomes something of a red tape, regulatory, bureaucratic nightmare which seemingly goes on and on. This is very much what has happened in the intervening months – something which perhaps explains why the West is on the brink of a fiscal debt disaster, and the workings of the free market economy have been stifled so much that even in the “good times” we can barely muster 2%-3% growth at best. But getting back to good old BG Group, it is actually the case that while the intervening period since the massive April gap to the upside has been somewhat awkward, we have seen a decent technical / charting setup. This is said in the sense that the time since the spring gap has been dominated by an extended gap fill down to the floor of the feature at 913p. Indeed, the technical trading instruction here since the April move would have been to buy dips towards the gap floor, with only sustained price action back below this zone really suggesting that the fundamental story and the bullish technical move were going to be out of kilter. The position now is that we have hopefully been treated to the final test for support in the 900p zone, and what is the floor of a converging December 2014 triangle. The view now is that even if the stock is subsequently going to disappoint, while there is no end of day close back below the latest January gap floor at 937p, a journey to the 200 day moving average at 1,050p beckons over the next 2-4 weeks.

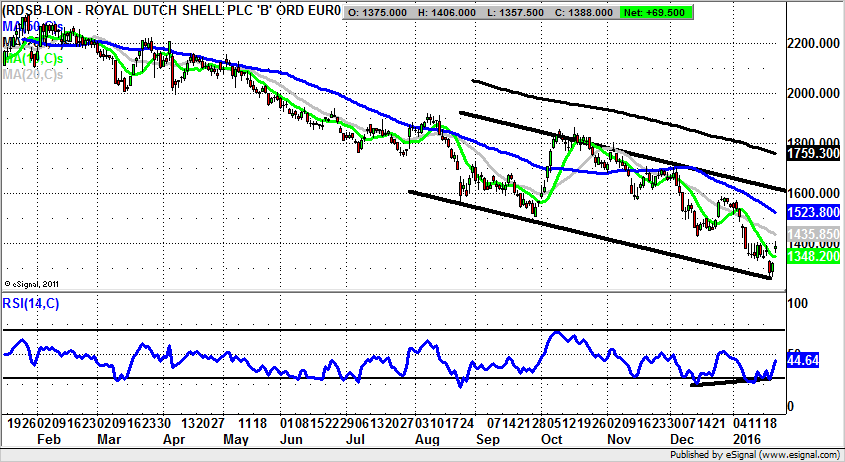

Royal Dutch Shell (RDSB): Island Reversal Targets 50 Day Line

It is perhaps fair to say that even though chart gaps are not exactly the most subtle or the most clever features as far as technical analysis is concerned, they can very useful indeed, and of course, accurate. What also helps is the way that January to date has delivered two gaps to the downside in quick succession – something which is a pretty good indication that even if a stock or market is not at the end of the line as far as a sell off is concerned, it is probably quite close to the sell climax. This point has been underlined by the way that the end-of-week reversal for Shell leaves a two day island bottom reversal, one which can be regarded as a relatively strong signal. It is helped along by the way we can see a triple rebound off an uptrend line in the RSI window, a feature which has been triple tested so far this month. Therefore the message at the moment is that provided there is no end of day close back below the floor of the gap at 1,322p, it would be disappointing if this market did not head up to test the 50 day moving average at 1,523p as new resistance. This is so even if the stock then resumed its Crude Oil / BG Group bid inspired bear run.

Bull Call:

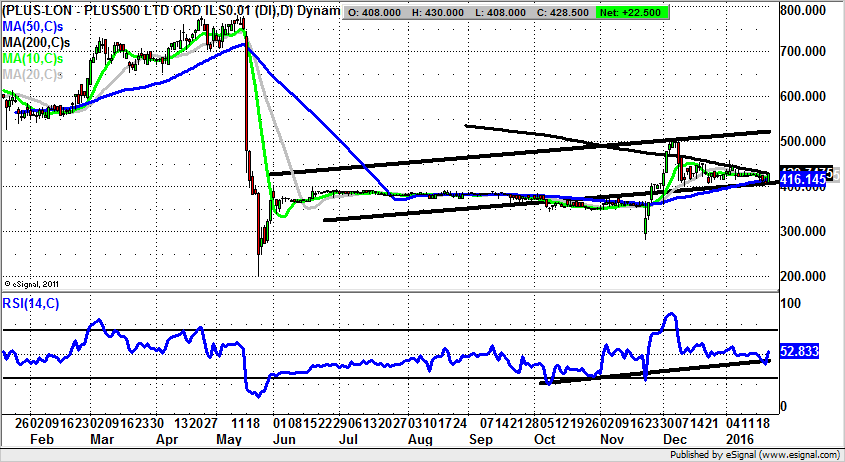

Plus500 (PLUS): Squeezing Higher Despite M&A Failure

After over 30 years of direct experience of the stock market – not all of it pleasurable, I might add – there are a few rules which work particularly well. The most ironic of them is to buy companies that for some irrational reason you might dislike. For instance, those you might feel rip you off, perhaps banks or utilities. I have had no dealings whatsoever with Plus500, and so do not know whether the group offers a decent service to its customers. But the cue for going long here is that despite the exit of Playtech (PTECH) from a possible takeover offer, the stock has been squeezing higher. In fact the rise here has taken place within a rising trend channel which can be drawn from as long ago as June. The most interesting aspect since then is the way that November offered an ultra painful bear trap rebound from below 300p, which could have flushed out all but the most ardent Plus500 fan. This swing low looks to be the governing feature as far as the subsequent price action is concerned, with the message now being that while there is no end of day close back below the June price channel floor at 408p, we could be treated to quite an explosive move to the upside. The favoured destination at this point over the next couple of months is the 2015 resistance line projection at 520p.

Bear Call:

Chemring (CHG): Ultra Bearish Setup

I suppose the only real drawback with getting too bearish regarding the technical outlook for Chemring is the very bearishness we have seen on the daily chart since the massive unfilled gap to the downside in October. The fact that the shares were only able to partially fill the great autumn breakdown, and the way that they have remained below the 200 day moving average at 209p for all of the period that has followed, and even below the 50 day moving average at 180p for much of the subsequent time. The chances are that over the near term we shall see a retest of the October floor at 131p, a possibility made all the more likely by the way that the shares have just gapped down through the 171p level. This makes it valid to suggest that provided there is no end of day close back above this latest gap we can expect to see a retest of the autumn low / 2015 support over the next 4-6 weeks. In the meantime any bounces back towards the top of the January gap are regarded as shorting opportunities.

Comments (0)