Zak’s Daily Round-Up: BT.A, DLG, MKS, HUM and RRR

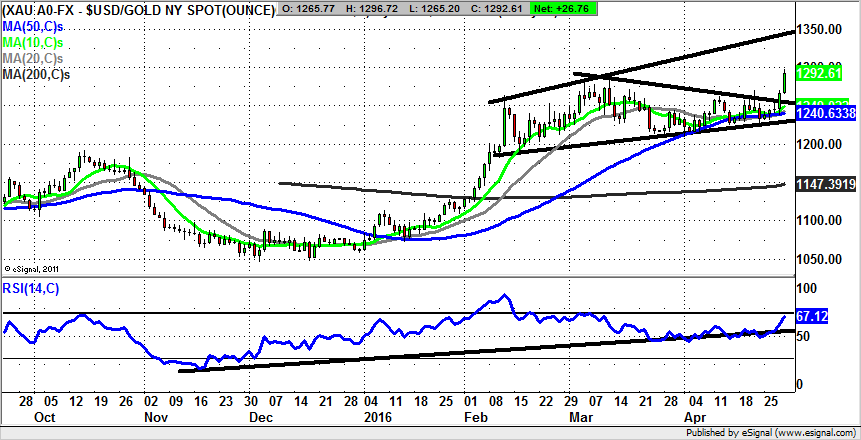

Market Direction: Gold Breakout towards $1,350

BT Group (BT.A): Range Trade Opportunity

The bad news is that BT Group is raising landline costs, something which is all the more irksome for those who, like myself, are only interesting in an internet service rather than a phone line. The good news though, looks as though it is coming from the price action position, which is said on the basis of the tentative rebound off the floor of a rising trend channel which has been in place since July last year. What is interesting about the charting position here is the way that although the shares have essentially been in a trading range since the summer, there is the possibility of an upwards tilt to the price action. This would especially be the case if BT shares managed to deliver a decent end of day close back above the 50 day moving average at 451p. In fact, for aggressive bulls it could be argued that enough has been done already to warrant a bottom fish given the clearance of the neutral RSI 50 level to leave the oscillator at 52/100. But what can now be said is that provided there is no end of day close back below the August uptrend line at 435p, shares of BT can be regarded as having maintained their recent range, with the view being that we could be treated to a 500p target – the one year resistance zone, over the next 1-2 months.

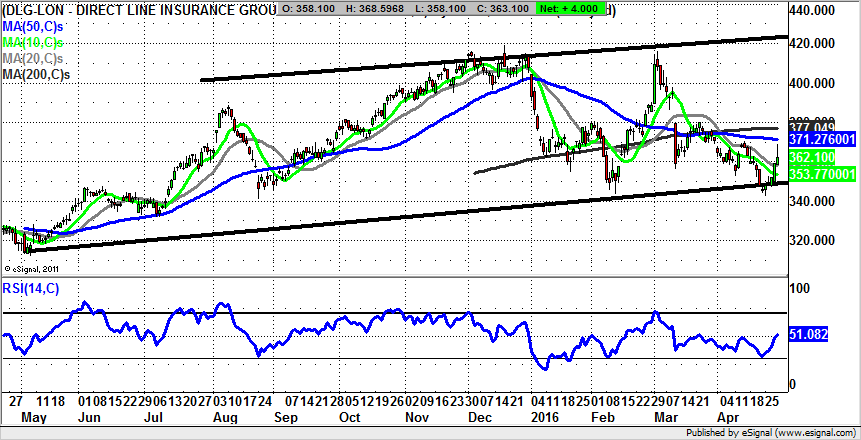

Direct Line Group (DLG): April Bear Trap Targets 400p Plus

For most of the world’s stock markets it was February which marked the low of the great 2016 breakdown, with higher lows in place since then. However, in the case of Direct Line Group eagle eyed technicians will see how for April there was the smallest of bear trap rebounds, with the low of this month just a penny below the 343.29p level of the early part of the year. This may not sound that significant, but in fact it is the case that the narrower the trap, the greater the possible rebound can be, as traders of all shapes and sizes will have been caught out by the false break to the downside. We are now in the wake of what has been quite a decent initial recovery back above the 10 day moving average, now at 353p. Indeed, it is likely to be the case that provided there is no end of day close back below the 10 day line we should be looking at a “minimum” move back to the 200 day moving average at 377p. Above the 200 day line on a weekly close basis the chances are that there will be a full blooded return to the top of the post 2015 range at Direct Line Group – back to 400p plus. This could be achieved as soon as the end of next month.

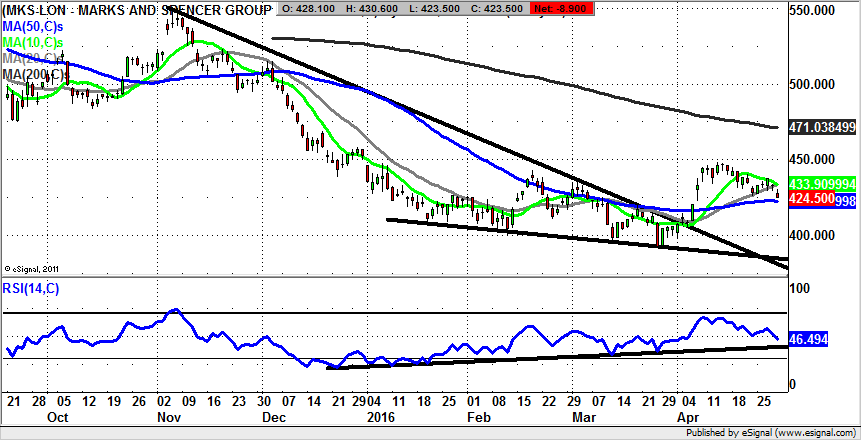

Marks & Spencer (MKS): Risk of Sub 400p Retest

M&S may be something of a backwater stock, but alas, this does not make it an easy situation to get a handle on. The present position on the daily chart is a case in point given the way we are trading in the aftermath of a wedge breakout at the beginning of April. Unfortunately, the upside here was not perhaps as much as we may have hoped for. The risk now is that as little as an end of day close back below the 50 day moving average at 422p may put us on the receiving end of a retest of the main 2016 support zone below 400p.

Small Caps

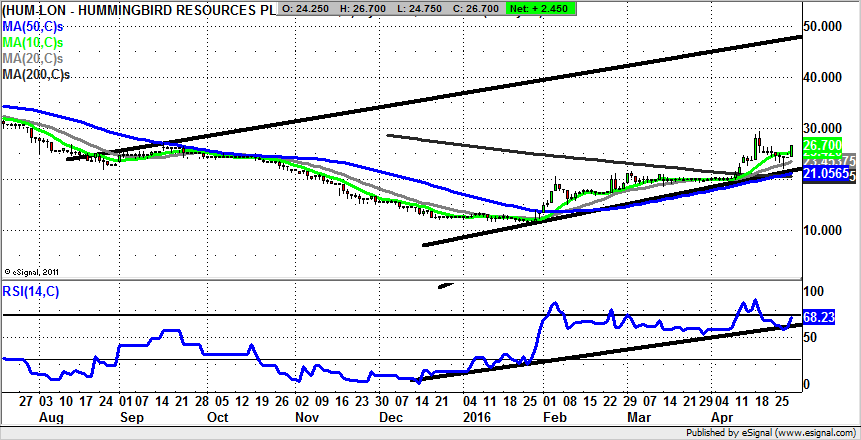

Hummingbird Resources (HUM): Technical Target towards 50p

While it may be the case that blue chips appear to be wobbling a little as we go into May, for the minnows in the resources space things still appear to be relatively buoyant. If nothing else we are witnessing the fight back which has been underway since the start of the year continue apace. One of the better examples of such recoveries comes from Hummingbird Resources, where the first major sign of a turnaround came with the recapture of the 50 day moving average at the beginning of February, and the second the bounce back above the 200 day line earlier this month. The latest here is that the shares have put in a higher low above the floor of a September rising trend channel at 21p. The implication is that provided there is no weekly close back below the 2015 price channel floor we should be looking for further significant upside. Just how high this could be is suggested by the 2015 resistance line projection heading as high as 48p. This may appear to be a long way away, but considering the way that the shares nearly tripled from the end of January to earlier this month, it may be wise to look on the bright side in terms of how high Hummingbird could stretch over the near term.

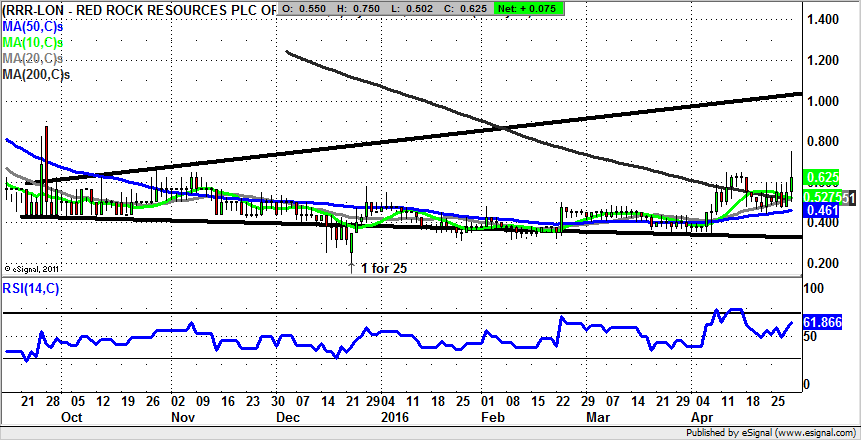

Red Rock Resources (RRR): Broadening Triangle Targets 1p

Given the way that we have just heard news that Red Rock Resources has been bought into by stock market darling Metal Tiger, it is not too surprising that the shares have been on the front foot of late. This is especially the case given the overall restructuring of the business model, which coincided with the general positive turnaround in the mining sector. What can be said now is that even though there has been a significant recovery here over the past month, we should be prepared for further gains. This would especially be the case while there is no end of day close back below the 50 day moving average at 0.46p. At least while the 50 day line remains unbroken the upside here should be as great as the top of a broadening triangle which can be drawn from as long ago as September last year.

Comments (0)