The US Economy Is Slowing… Again

I feel sorry for Janet Yellen, I really do. Since coming to office as chairman of the FED in 2014 she has been unable to do what she knows must be done: hike interest rates. But her predecessor Ben Bernanke flooded the market with so much money and pushed interest rates so low that every time Yellen sneezes, the market gets a cold. Two years after being nominated as chairman, Yellen was able to hike the target funds rate by a tiny 25 basis points. But even those 25 basis points were too much, it seems. For the last four months, FED officials have been downplaying the prior hike in order to reverse the negative effects it has had on markets. While at the December meeting four rate hikes were expected for 2016, now the likelihood stands at 50% for just one hike. The changing numbers reflect the trouble in which the world is submerged and the potential problems the US economy may face in the near future. Despite the good numbers coming from the jobs market, the general economic outlook may be darker than many believe, as the odds of a recession are now increasing. I wouldn’t be surprised if during the next few quarters the US economy dives into cold waters. Investing in the US equity market is currently unattractive, as the market is still near record highs while corporate profits are declining, leverage is increasing and economic growth is disappointing. Current prices are the result of monetary policy and are at risk of experiencing a loss of momentum as the FED loses policy margin.

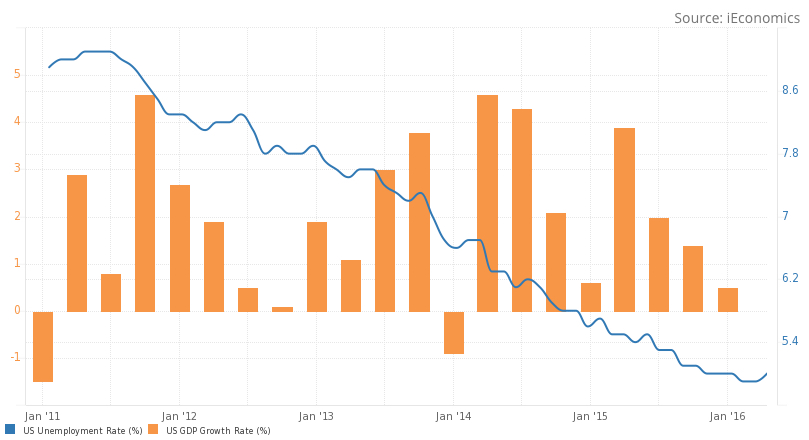

While the unemployment rate continues its declining trend, GDP growth seems to be struggling to keep pace. For the last four quarters the US economy has been growing, but at declining rates, culminating in a disappointing first quarter growth rate of 0.5%. Last year a similar trend occurred and then a positive shift in the numbers brought some relief to the market. But with the central bank now looking to tighten policy, the bullets left in the barrel may be too few to offset any deceleration.

The latest GDP numbers clearly show that the US economy is not as healthy as many had thought. The number was far below expectations and came in at a pale 0.5% mainly due to declining corporate investment, lower exports and a deceleration on consumer spending. These three factors deserve some reflection, as the current financing and employment conditions would point to a strengthening in investment and consumption, not the opposite.

Against traditional wisdom, the interest rate is not the main investment driver. A company allocates money to capital expenditures for a reason – e.g. to expand output in order to accommodate increasing demand. If the installed capacity is enough to fulfil the expected demand, there’s no reason for the company to invest more. When the company doesn’t need to expand its capacity, there is no demand for credit, and thus the interest rate has no impact on investment decisions. The interest rate only becomes an important decision variable when a company needs to invest more. At that point, the company would weigh the benefits of increasing capital expenditures (e.g. extra sales) against the costs of doing it (e.g. increased interest expenses). But since the financial crisis, the US economy never expanded enough to push companies to allocate more resources towards capital expenditures. Corporate investment has been tumbling because supply is still in excess of demand.

The lower exports reflect the effects of a rising dollar that came with the expectations of further rate hikes. But now, with those expectations vanishing, the next GDP numbers to be released should improve the exports picture. But falling exports is not only the result of a rising dollar; it is also the result of slower global growth. While the dollar movement was reverted during the last few months, global growth has remained weak. Corporate America will need to rely more on the internal market in the near future, which may lead to a reduction of corporate profits.

Regarding consumer spending, I believe that to some extent, when interest rates decline consumer spending rises. But when the central bank purchases assets left right and centre, the consumer starts believing that economic conditions are weaker than he had previously thought, and starts to put more money aside each month in response. At some point, the lower the rate, the higher the savings, and the lower the inflation, in a vicious cycle leading the world into massive deflation. I wouldn’t be surprised if at some point in the near future we see negative interest rates in the US.

Central banks went too far and distorted the global economy. They are purchasing almost all existing safer assets, allowing riskier assets to now yield the same as the safer ones did previously. This incentivised companies to spend more, but, unfortunately, to spend doesn’t always mean to invest. What I mean is that companies have not taken the low rate opportunity to allocate more money to capital expenditures but rather to pay higher dividends, repurchase shares and to engage in debt-funded mergers.

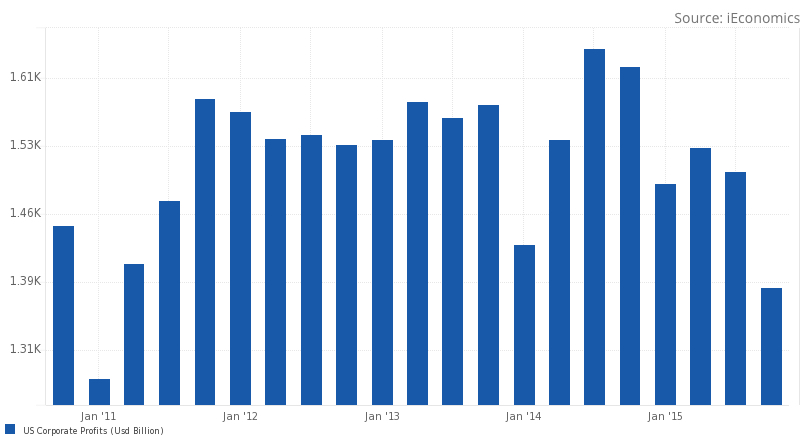

To some extent, paying dividends and repurchasing shares is a good sign. A company may be generating so much cash that it doesn’t need it all and then decides to return part of it to its shareholders. But when this behaviour perpetuates without a corresponding increase in net profits, investors start scratching their heads and asking: how are companies financing dividend payments and share repurchases? Are they generating enough cash flow for it?

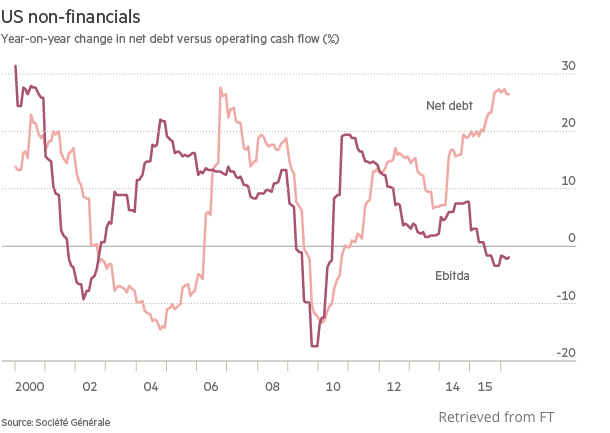

The short answer is no, US companies aren’t generating enough cash flow but rather financing disbursements with debt.

With liquidity being so cheap, companies started replacing equity with debt. While that is partially the rational consequence of a change in the cost of capital, it is also a consequence of an artificial incentive given by the central bank.

With corporate profits increasing at an ever lower pace, the ability of companies to repay the accumulated debt is questionable. Companies need to generate an ever greater cash flow to repay an ever greater debt pile. But what we currently observe is rising net debt on a decreasing cash flow. With the global economy growing just moderately and the US economy showing signs of weakening, the disproportionate rise in net debt in relation to operating cash flows is a cause for concern.

It is very likely that corporate America will disappoint this year in terms of reported profits, which is expected to limit the upside potential for this market. At the same time, this will also limit the FED’s action, as it will struggle to hike its key rate again. In the meantime, the US dollar will continue on its downtrend. One way of playing the trend is through the PowerShares DB US Dollar Bearish ETF (UDN). This fund tracks the value of the dollar against six major currencies, profiting from the downfall of the dollar.

Comments (0)