Who’s Next? Debenhams? Next? Bonmarche? Mothercare?

In the wake of the BHS and Austin Reed collapse, who else could be in line for failure? BHS should probably have gone bust in 2008/9, but low interest rates have allowed zombie companies to thrive, or at least give the impression of thriving, and this in turn has cost us a lot of start-ups which they should have made room for by failing in a timely manner. Who will be the successful suitors for these companies remains to be seen, but there will no doubt be some more household names to fail or disappear completely in the coming months and years.

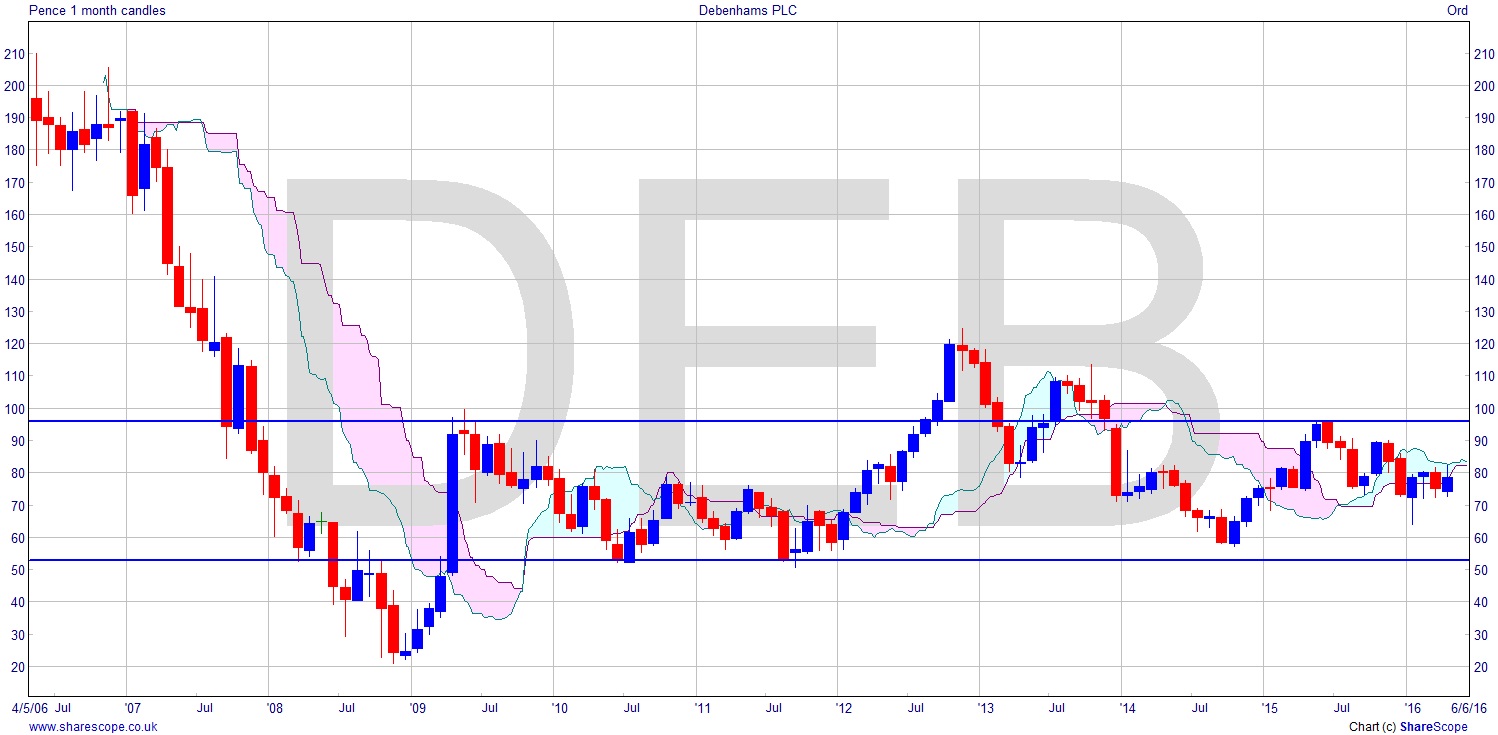

What about Debenhams? I’m sure someone would want to buy their brand. Unlike BHS, which has been really undifferentiated for a long time, Debenhams (DEB) has a distinct brand. But their chart looks very sorry for itself. The price traded off into the financial crisis, not after it, before it. The price collapse from 200p started in early 2007. Since ’09 it’s been broadly in a trading range between around 50p-100p. A failed breakout in 2012 and an even less impressive second failed breakout in ’13 tend to imply that there is trouble at Debenhams.

It looks set to fall off a cliff. The 50p support level has been unbroken since it was established in 2010. But what an abysmal stock to have been holding at almost any time since the IPO.

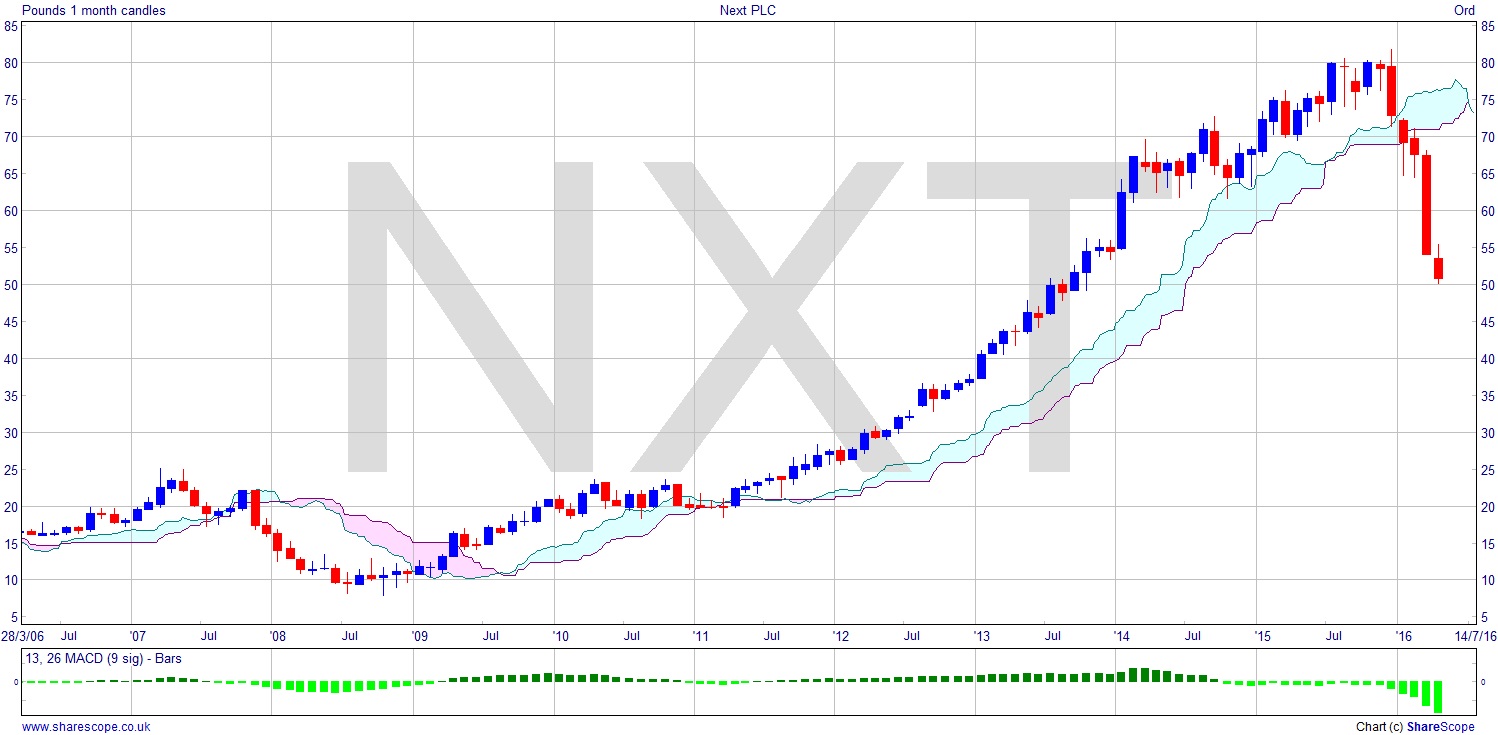

Just for fun what about Next (NXT)? Oh my word! Well they have fallen off a cliff. What is going on in the High Street? After a solid rally from 2009 from around £1, gaining 8 times value up to £8 in 2015, this year it’s lost £3 (-40%). It’s fallen so far it’s hard to justify an entry on the short side, but what a catastrophic fall. One to keep an eye on either for a recovery or a complete collapse. Maybe a straddle type trade. It’s hard to imagine it will flat line at £5 for long after such a sharp fall.

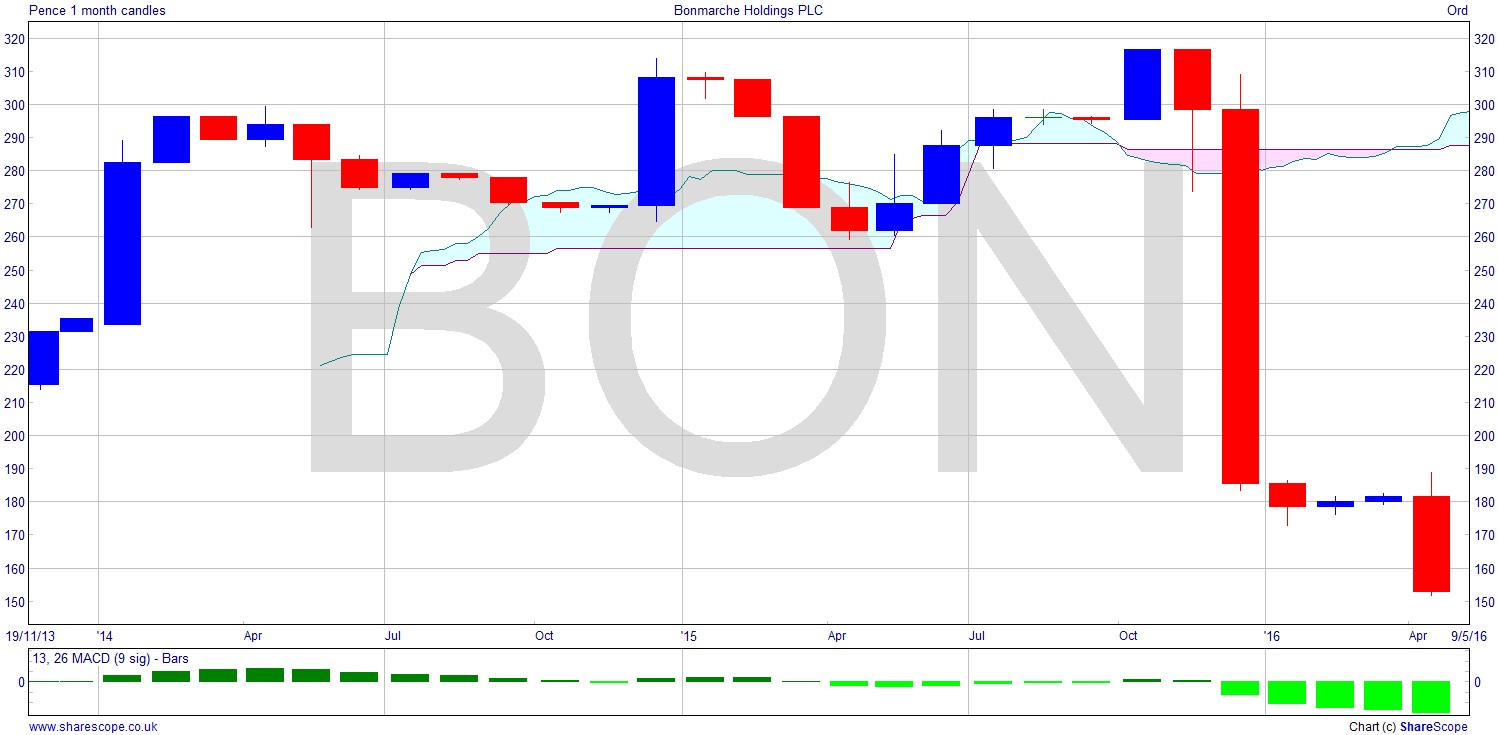

There’s a Bon Marché (BON) in many towns where people will struggle to pronounce the name properly. In any case they’re a clothing store and wow does their chart spell failure. 50% wiped off the share value since last November and you’ve got to start thinking there’s something very wrong there too. Again so far down that it’s not really an entry point. New CEO in March and the price then traded off further, from 180p to 150p (-17%). They sell plus size women’s fashion, and we know there’s no shortage of eligible customers in this part of the world, Britain being a world class act in the obesity department.

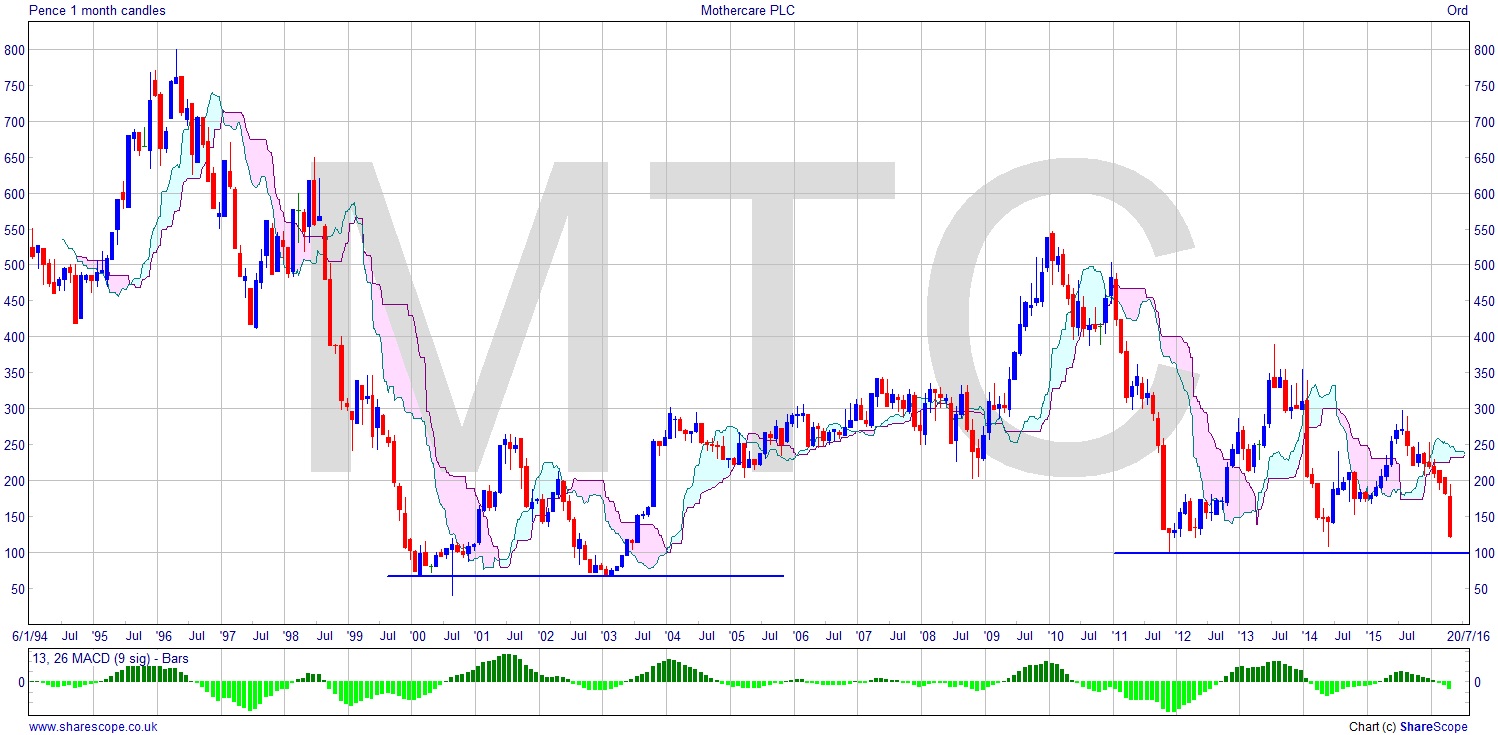

Another long timer on the High Street that isn’t really cutting the mustard is Mothercare (MTC). There’s a bit of a baby boom on, and parents will usually pay through the nose for stuff for their kids, so how come Mothercare aren’t coining it? Heading down towards 100p again, where there is a support level, and below it at 67p. Could this be another relic of the past? Are they just old hat? Haven’t they moved with the times? There’s certainly money in selling stuff to parents. Push chairs at £500 and all that. So they’re doing it wrong.

By the way, Feds Funds futures show a 52% probability on a September hike in interest rates of 25bps. That has to have a knock on effect here even if rates in the UK don’t get hiked. We don’t live in a vacuum.

Comments (0)