Vipera: Run-up to golden cross targets 10p

Vipera (LON:VIP) is one of many stocks with decent prospects which was originally flagged to me by a Twitter follower – and a decent chap to boot.

Vipera is a company which has so far managed to keep a rather low profile, something which always causes me to scratch my head with reference to any small cap listed company. Luckily for me, the company was brought to my attention by a Twitter follower a couple of years back and I occasionally take a peek at progress.

This seems to be of the nature of a slow burn for the mobile payments group, with deals which speak of revenues, rather than profits, just at this stage. However, given the undoubted growth in the area, and with partners like Mastercard, one would believe that Vipera will turn the corner in terms of getting into the black.

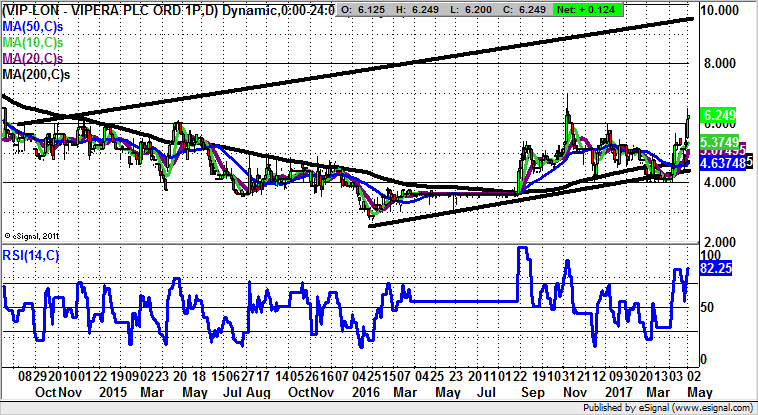

Judging by the daily chart it would appear some in the market are expecting the company to hit profitability quite soon. This is said as we are just a couple of weeks or so from a likely 50/200 day moving average golden cross signal. Typically, the most bullish period for a stock or market is in the run up to such a charting configuration.

The notional upside while there is no break back below the floor of a 3-year rising trend channel at 4.5p, the upside here over the next 3-4 months could be as great as 10p. Ideally, there is no break back even before last month’s 5.65p peak.

Comments (0)