Does Mariana’s merger with Sandstorm Gold stack up?

Among the four main ways to make money from mining gold or silver – exploration, development, streaming or financing a mine – it is streaming (or royalties) that can often be by far the most profitable.

I showed in my earlier streaming coverage how streamers tended to make much more profit from a mine than did any other participant. But from the would-be producer’s point of view, they are a much more expensive way to finance a mine than any loan or any third-party equity investment. And the streamer usually leaves the poor old owner to take the operating risk.

So what are we to make of it when a gold explorer seeks to turn itself into a streamer? As in the case of Mariana Resources (LON:MARL) who just last week agreed (subject to shareholder approval) a ‘combination’ with Sandstorm Gold (TSX:SSL).

Mariana Resources I have avoided mentioning so far, despite that its gold prospect at Hot Maden in North East Turkey is developing into a far richer grade, albeit smaller, potential copper/gold mine than is Solomon Gold’s at Alpala in Ecuador. That was because, even though holding shares myself, Mariana Resources only has a 30% share of Hot Maden, against local Turkish company Lidya who is managing the exploration. So MARL could never control how the prospect is developed, while its shareholders could never be sure how their interest might eventually benefit them.

And so it was turning out, with MARL’s £76m market value (at 59.5p) lagging well behind its 30% share (about £330m) of the $1.4bn NPV8 that a January PEA, conducted only 20 months after Hot Maden was first discovered, came up with for its initial more than 4Moz resource. This also exhibited a staggeringly profitable internal return of 153% p.a., against an initial capital cost of only $169m. Given that subsequent high grade drilling results have not been included in the PEA, that estimate is likely to prove rather conservative.

(Note that, while most of my coverage has explained why NPVs usually greatly exaggerate the true value of an owner’s stake in a mining project, in a case like Hot Maden’s extremely high IRR, where the initial capex is low compared with the NPV, the true value to the owner can more nearly equate to the latter because financing will be so low as not to require equity dilution or too much borrowing.)

Against Mariana’s 59.5p share price, Sandstorm has come up with 28.75p in cash, plus just under one of its shares (listed on TSX and NYSE) for every four Mariana shares – worth 110p at $1.28/£.

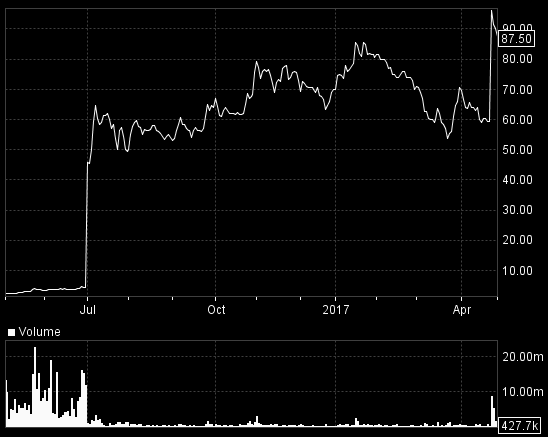

But on the announcement Mariana’s shares only rose to 92p, while Sandstorm’s fell by 10%.

So although Sandstorm thrives on its streaming – and this deal, due to Hot Maden’s rock-solid prospects, ought to be more profitable and even less risky than most – it obviously hasn’t attracted universal joy.

That is because not only is the deal not yet done, but also that its merits are considerably more difficult than most to evaluate. Certainly I myself can’t quite get my head around the difference between the profit shareholders could expect if staying with Hot Maden (as a minority holder) as part of an independent Mariana Resources (not to mention its other exploration prospects) and that to be expected if they share in the usual super-profitable streaming deal that Sandstorm says it hopes to sign with Lidya to help get Hot Maden into production (not to mention the other 155 streaming deals that Sandstorm now has and due to expand usefully in the next three years).

In fact Sandstorm has actually said that it only ‘hopes’ to convert what, with its existing holding, will be 37% of Hot Maden into a streaming deal. But it doesn’t look that simple.

Hot Maden’s high profitability will stem from the exceptional 11% grade for its gold and the equally exceptional 1.9% for its copper, which means that its mining and production cost is expected to be well under $400/gold oz. That means that as a stand-alone company it probably won’t need the likes of Sandstorm to supply its capital. Sandstorm mainly comes to the aid of miners who can’t fund their developments, in return for which they pay an immense premium (as my initial article on streamers showed) in the form of foregone revenues from their gold, which works out well above what a bank, or equity investor, would expect. In its latest year for instance, Sandstorm made a staggering $1,000 per oz profit by reselling what its streaming clients diverted to it – in a year when gold’s realised price averaged below $1,250/oz, showing just how low a price Sandstorm is paying for its gold streams.

So therein lies the rub! On Hot Maden’s exceptional profitability Lidya won’t need any such streaming deal. Sandstorm hasn’t as yet said that it has agreed any such deal – merely that it will negotiate once Hot Maden has passed various development milestones.

As a result of this uncertainty there appears to be plenty of opposition to the deal, not least from gold guru Sprott who is bullish on gold’s prospects and has a 4.5% Sandstorm stake. Sprott’s vote, alongside other naysayers, will be set against the 17% or so of its own and its shareholders that Sandstorm has secured to vote for the deal.

Bearing in mind the difficulty (without a lot of effort which, no doubt, brokers better paid than me will be feverishly going about right now) of working out the pros and cons for Mariana shareholders, it seems likely those major investors in favour are merely wanting to take their money now and run, rather than wait to see how the deal pans out in the unpredictable medium term. Other reasons for Mariana shareholders to vote yes would be removal of the uncertainty stemming from their lack of a control of Hot Maden, as well from uncertainty about Turkey’s politics. Sandstorm would also give them a 19% share of the 30% increase in the highly profitable streaming revenues it expects over the next three years – although whether that would be earlier than the profits they might expect when Hot Maden goes into production is yet to be seen.

Against that, Mariana holders tempted to stay with the shares (instead of taking their money and running) but to vote against the deal would be supported by the conspiracy theorists who are atwitter suggesting that Mariana only agreed to proposing the deal in order to flush out another buyer. They would also point to a recent hiatus in Sandstorm’s earnings which caused weakness in its shares even before the Mariana announcement.

And the attempted deal will certainly raise Mariana’s profile (although already listed on the US over-the-counter market) among American investors.

But other tweeters wonder why the parties want the deal structured as a merger (needing 75% shareholder agreement by each company) rather than as a straight take-over requiring only 50% of Mariana’s holders. That will only become clearer later when the date for a vote is announced.

So although the respective shares have behaved rather calmly since the initial adjustment (smoothed perhaps by automatic arbitraging between the various markets), I wouldn’t be surprised to see rather more volatility developing in the run up to the vote. Meanwhile, I have taken my profit on Mariana but would buy back depending on the extent of any fall if the vote is a ‘no’.

Comments (0)