How to Trade Global Warming

As seen in the latest issue of Master Investor Magazine

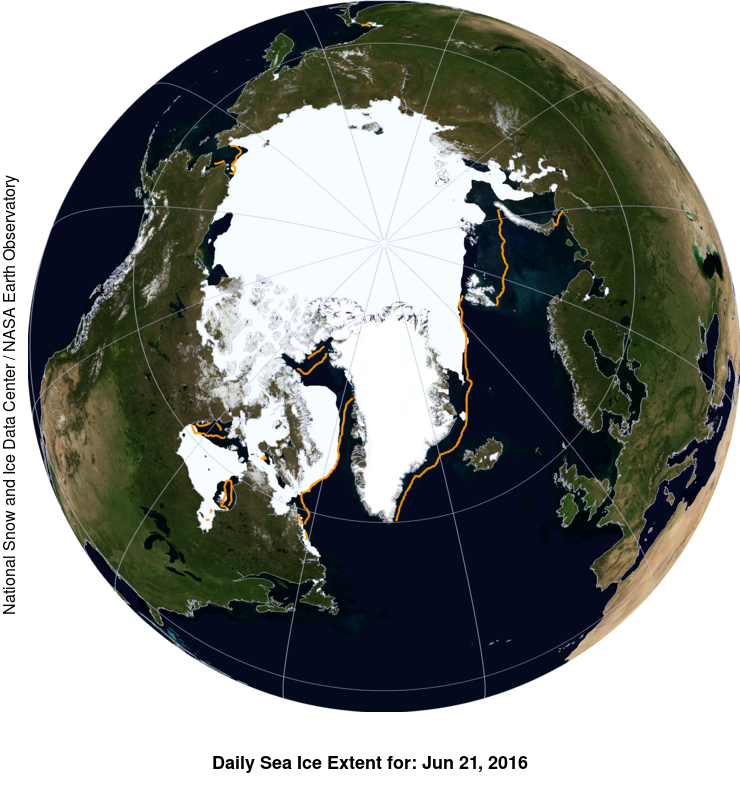

It’s 100,000 years since the North Pole was ice free. The ice cap grows or shrinks on a daily basis, depending on the season, and you can watch it unfold if you want to at http://nsidc.org/arcticseaicenews/, where they have a daily updated image of the extent of the ice. This year Ocean Physics Professor Peter Wadhams (Cambridge) has predicted that it will be ice free this year by extrapolating data from the National Snow and Ice Data Center. It’s sort of snow and ice Technical Analysis. He’s short ice. There is a vast amount of data on the site and lots of images like the one here which shows the extent of the sea ice on 21st June ‘16.

We’ll know in mid-September if he was right, as that’s the time when the ice recedes the most. And even if he’s not this time around it is surely only a matter of time before it is ice free in summer. This would change the global balance of power on a level akin to physically moving countries around the world. The countries with North facing coasts in the Arctic are broadly winners: Denmark, Norway, Russia, Canada and the US. With this becoming a reality I wonder just how long Denmark will stay in the EU. They’ll be as rich as Norway thanks to oil and shipping from Greenland, plus the fact that Greenland, the world’s largest island – and, if it were a sovereign state, the 12th largest country in the world – would presumably become more habitable.

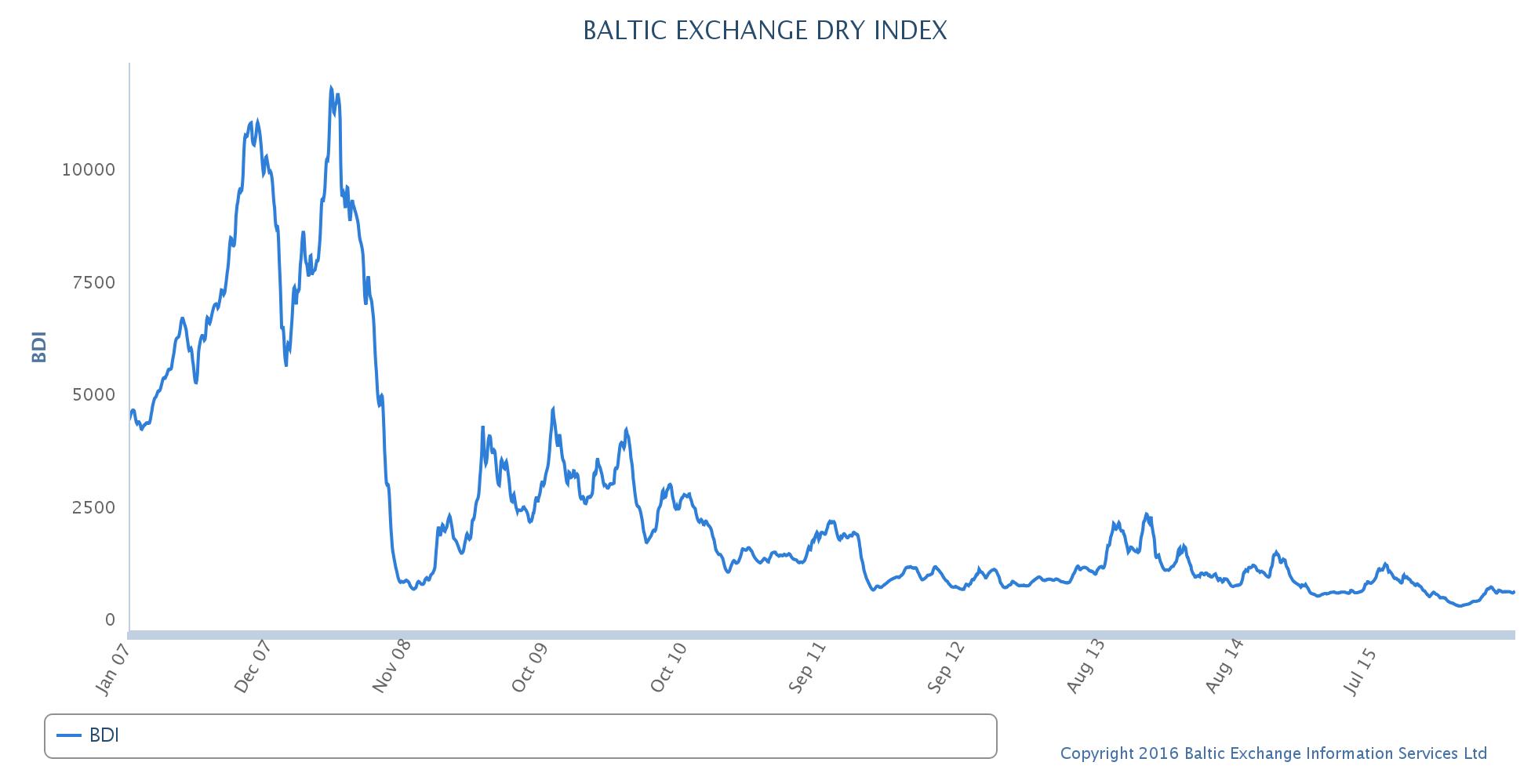

The first thing that would happen is that some shipping could avoid Panama and Suez and simply flit across the top of the globe. So goods could be delivered more quickly, and as the window of opportunity would be short then demand for vessels in that region would rise sharply. The Baltic Dry Index shows the change over time in the cost of shipping raw materials by sea. The index is relatively low at the moment compared to the last few years as you can see on this five year chart, [insert chart if I can get it] which The Baltic Exchange has kindly allowed us to reproduce. The basic formula is that if the index is rising it means global economic conditions are good, and vice versa. So with a lot of sudden demand for shipping across the pole, it’s reasonable to assume it would rise.

In the long run Panama and Suez would lose out to a fair amount of shipping as the polar route would be shorter, albeit only in the summer months. It would also be a little unpredictable, at least in the early years. But if the ice isn’t thick then some ice breakers could keep shipping lanes open for regular vessels.

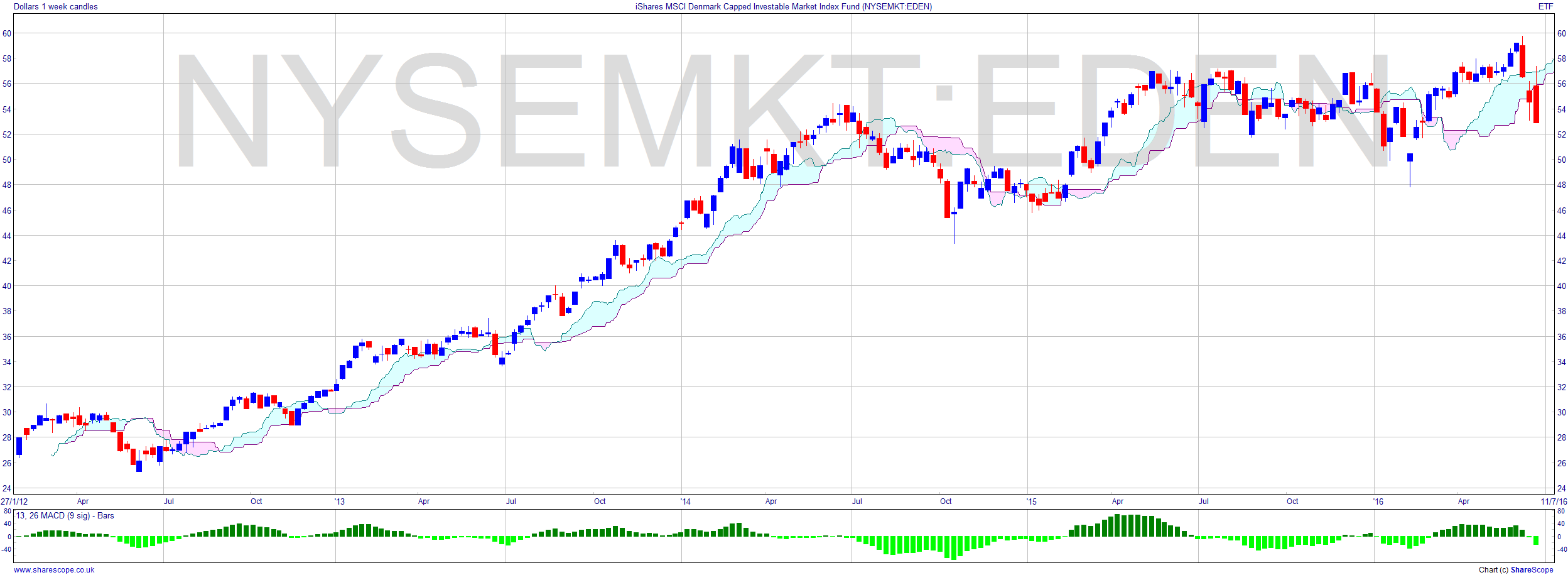

One of the main results would be access to the oil up there. Denmark has to be a good bet then as they would essentially become another Norway: a hugely rich oil nation with a small population. A pre-emptive investment through an ETF could be a SIPP/ISA play. There only seems to be one ETF available and it’s dollar-denominated (there are a few Nordic alternatives but they won’t allow you to isolate the risk to Denmark). It’s called iShares MSCI Denmark Capped Investable Market Index Fund [NYSE MKT:EDEN]. It’s been doing rather well and we could be seeing a measured move setting up here over the last two years. So there is a case to argue that’s an entry point. Of course it could more or less go sideways for another two years, but it’s certainly been much more resilient than the FTSE 100 over the last couple of years.

For the measured move I’m saying that the $48 to $58 range is a congestion area and so we might expect it to break upwards and match the move into the range – i.e. $48-$26. Let’s call it $20, a 30%+ potential upside. It would certainly change the global balance of power in oil if Norway and Denmark suddenly have huge reserves much closer to the developed world.

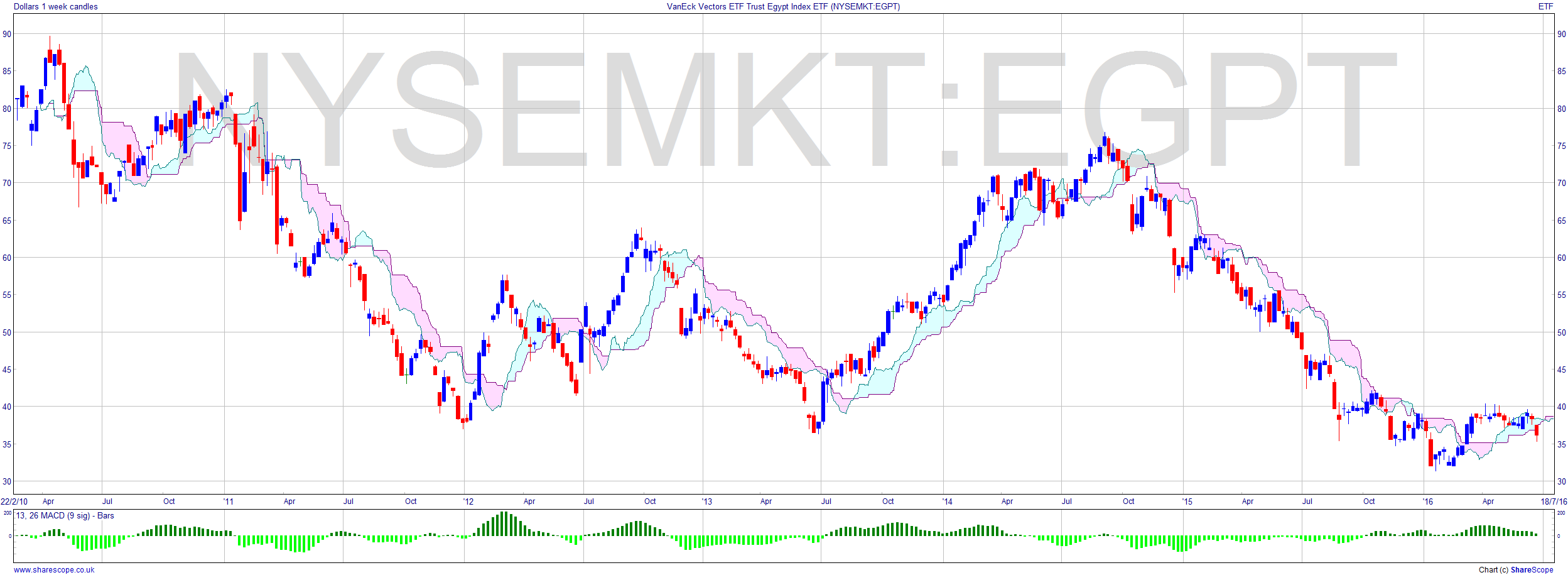

Contrastingly, a short on Egypt could be a good move too. I wrote about Egypt when I was examining the effect of the Bataclan attacks in Paris and the beach attacks in Egypt. Since then a plane has disappeared. The shooting in January was not the first such attack on tourists there. The Foreign & Commonwealth Office (FCO) advises against travelling to what looks like every tourist attraction in Egypt from Sharm el Sheikh to the Valley of the Kings. The only Egypt ETF, again a dollar-denominated New York listing, is VanEck Vectors ETF Trust Egypt Index ETF [NYSE MKT:EGPT]. The chart is looking weak again with a drop right across the cloud and a failure to rally above $40. The military conflicts in the region won’t be helping either. I guess everyone’s gone to Iceland instead. Egypt relies heavily on tourism and that’s been effectively scuppered.

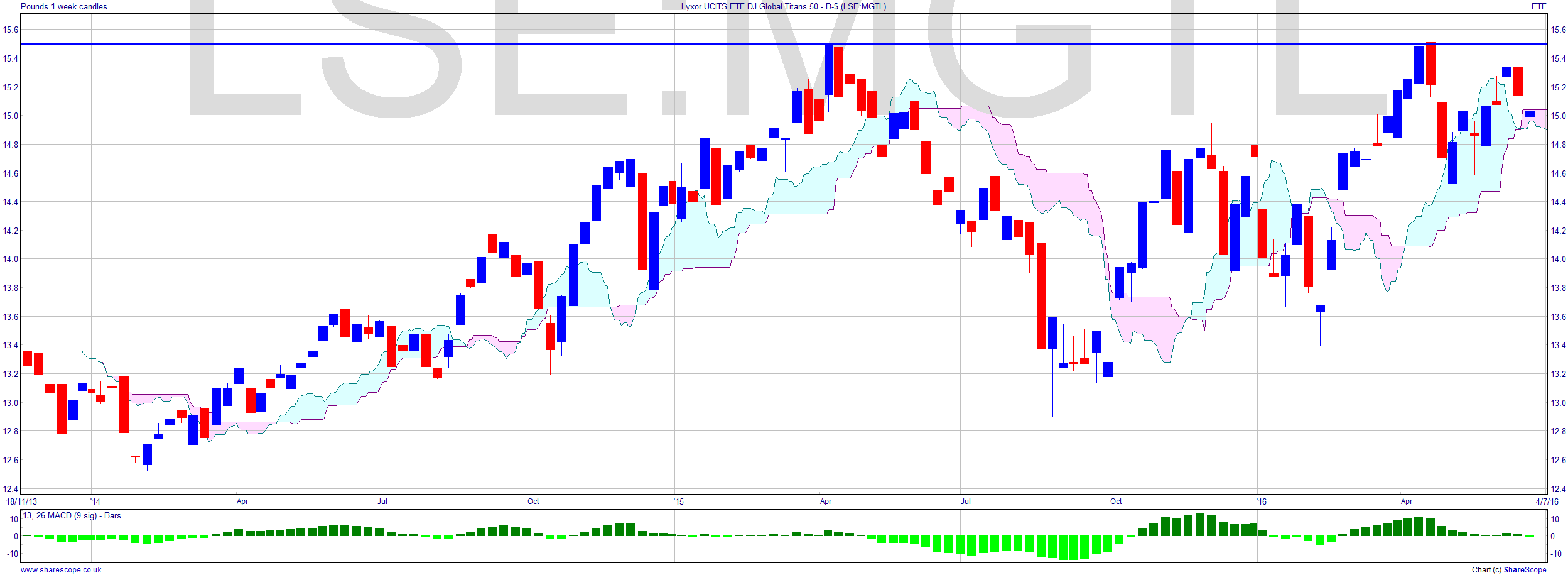

Lots of sectors will benefit. Marine insurance, shipping and all raw and manufactured goods that are shipped this way since lead times will perhaps even be halved. Then as ports – and the towns around them – start to be built, this could revive the global economy as infrastructure is put in place to handle the new trade routes. In fact I’d go as far as to say this is the best thing that could happen to the world economically speaking. Economic growth is never better than the early stages of building infrastructure. So we could be looking at a generation of growth. Perhaps the long play is a global index ETF. This one’s listed in London: Lyxor UCITS ETF DJ Global Titans 50 D-£ [LSE:MGTL]. There’s not a lot to say about this chart and the strategy is a very long-term one. But in terms of entry a higher low could be an early entry to anticipate a break out above the resistance at around £15.50. It really is a very long-term play though and probably one for the SIPP.

Aside from the global index ETF there are all manner of global ETFs for everything from Water to Clean Energy and every sector you can imagine, so target whatever sector you wish. Controlling risk into very specific areas is a reality nowadays.

As a long-term framework for investment strategy this is a very broad-based set of long-term opportunities with a scaffold for shorter-term moves. So either the polar ice cap melts in summer soon or we have another world war. Global warming may yet do us some good.

Comments (0)