Themed Watchlist 5 (continued): Insurance (US)

Following on from my last blog post, I’m looking at the US insurance market. The US has been hit by lots of insured losses this winter, thanks to El Niño – like Brian, he’s a very naughty boy!

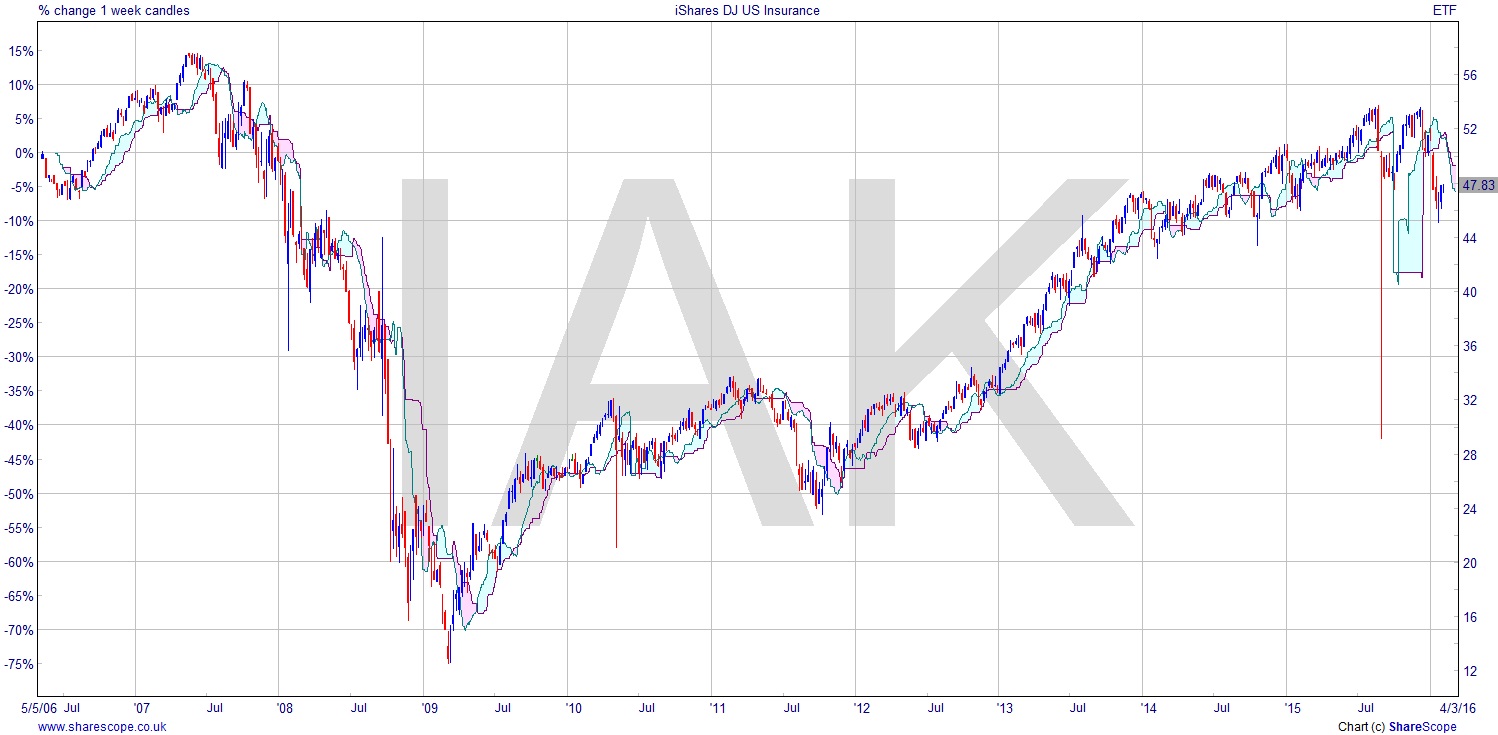

Again we’re seeing the same sector failure we’re seeing here in UK insurance. In this case a clear double top formation followed by a confident move to below the Ichimoku cloud. I’d be looking at the same thing here: a bounce downwards from the cloud base, making a lower high and a right shoulder for the H+S, which would then be complete. I’d even be happy to see it rise up above the cloud if it makes a clear lower high.

Interestingly, this sector has not, in spite of the seven-year bull market, managed to reach the pre-crash level. Of course we are looking at an ETF here, but it will have rules, and they’ll have been applied consistently over the last ten years since the ETF was launched. So we have a valid data set. This particular ETF is iShares DJ US Insurance (NYSE MKT: IAK). There are some pockets of support (perhaps around $42-$44) but basically it’s a free ride down to around $30 with a likely overshoot of $28.

So which insurance companies are worth a butchers?

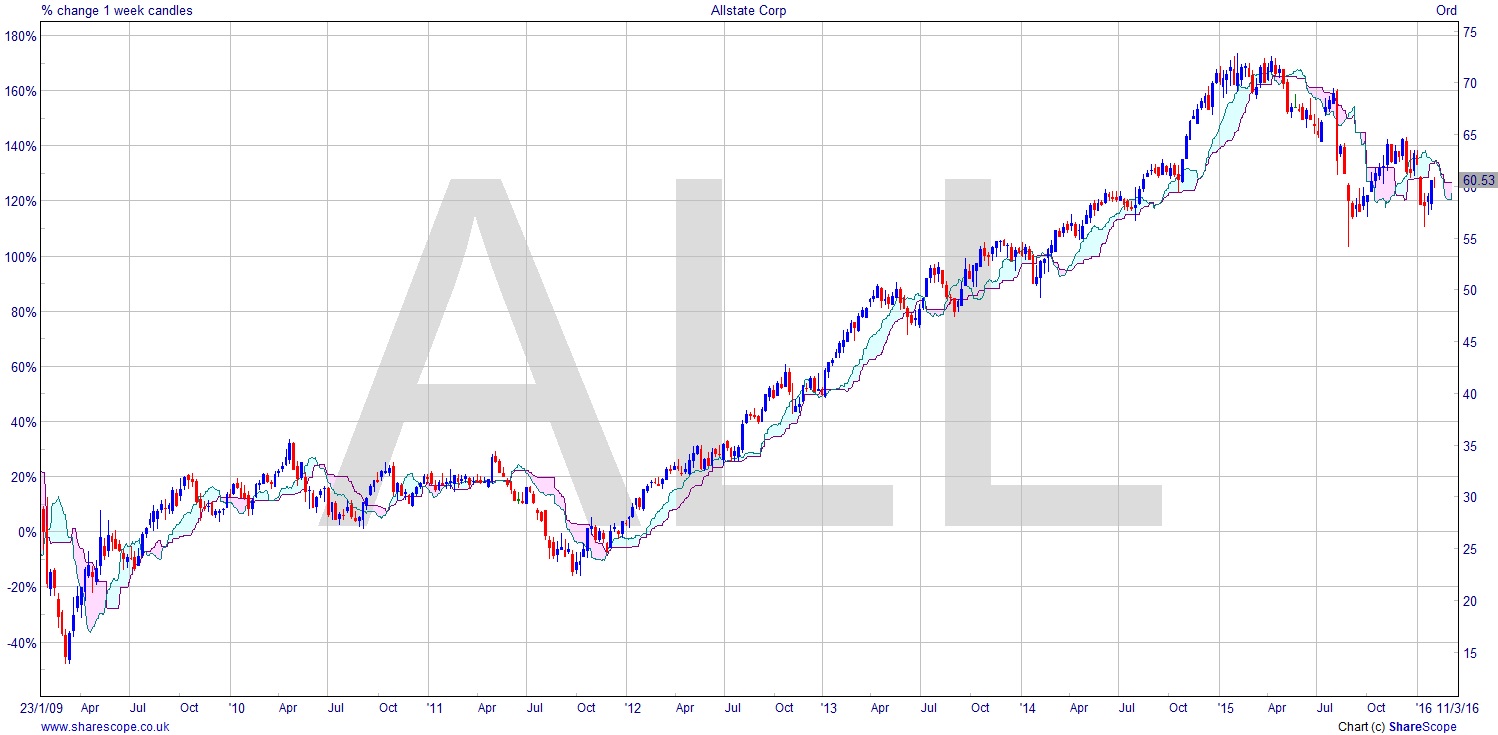

One of the leading insurers in the US is Allstate Corp (NYSE: ALL). They’ve had a brilliant few years, probably not least because of a massive advertising campaign on American network TV. And they were good ads too – very engaging, featuring actor Dean Winters (Rescue Me, Law & Order: SVU) and a voice over by Dennis Haysbert (The Unit, 24). In any event, that led to a rise in share price from around the $30 area in 2011 to over $70 last year. It’s now made a lower high and, although there isn’t really a H+S here, the trend has certainly changed. With such a steady rise – and that really is a great trending rally there – we might see a bit of a roller-coaster fall. Let’s see…

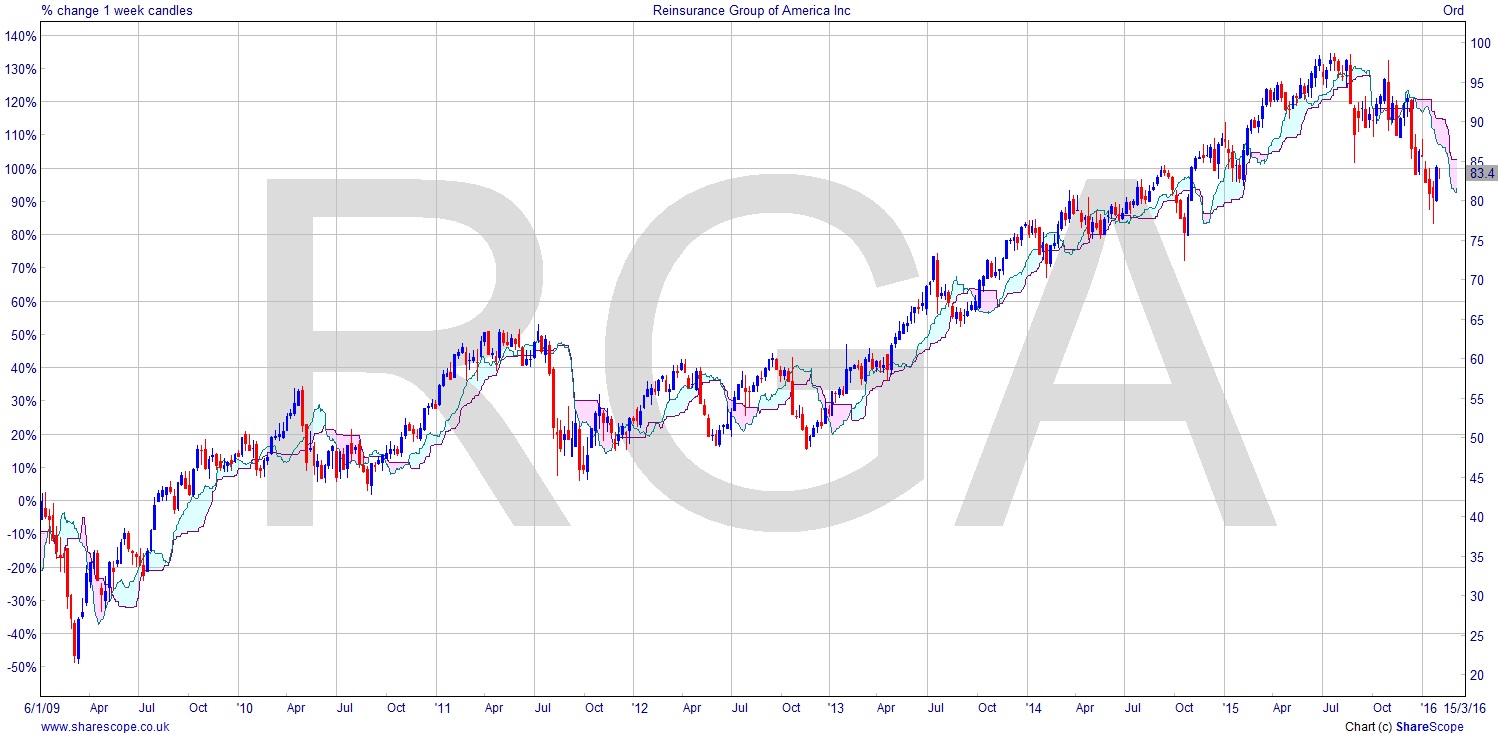

Reinsurance is going to be hit once claims start to come – and they are. Reinsurance Group of America Inc (NYSE: RGA) must then be in the firing line. Again, we have the pattern of ATH in ’15, and now a series, in this case, of lower highs. There’s major support at $50 and it sits around $80. The important 50% level in Gann analysis will be important here. Stocks often seem drawn towards it as they fall. It’s a very good point at which to look for the end of a bear rally if we see one. There is some support around the $75 -$80 level so it may not drop quickly and could encounter a congestion area on the way. But El Niño is not just for Xmas – it’s for two years. Two years of atrocious weather and insurance claims. Get in!

The key with all of these stocks, ETFs etc. is entry. You have to have a good reason for the timing of your entry. Instinct is for closing positions, not opening them.

Comments (0)