Royal BS

The best description I’ve heard of a bank is “someone who will lend you an umbrella, but if it starts to rain they’ll want it back”. Pretty accurate. I’ve not touched banking stocks in April 2007. After the credit crisis I remarked, as regular readers may know, that there would be no point investing in stocks from the banking sector, as every time they would have so much as the sniff of a profit, either government or regulatory fines would nullify them. It’s what I call a damaged sector.

It’s getting on for a decade now that banks have not been worthy of inclusion in a portfolio, unless you have a highly speculative risk profile, or perhaps a little punt at the ‘arse end’ of your portfolio. It’s not over yet. Today I read that RBS has reluctantly made a provision of £1.6bn for their defined benefits pension scheme shortfall. This is required by the regulator (so once again government and/or regulation destroying Blue ‘Chippiness’). There were other provision making a total of another £2bn hitting this year’s results.

I must admit, I hadn’t really factored the defined benefits pension scheme shortfall into my original thinking about banks all those years ago, but it is certainly a big factor now. Ironically, it’s the low interest rates that allow them to profiteer elsewhere and are forcing them to pass those profits on to the pension schemes so all the Baby Boomers can have more comfortable retirements than we will.

It’s not exactly a sad story for RBS, one could say. After all, they are meant to be the arbiters of risk, and they’ve missed the mark on this one. Actually that’s part of a broader pattern with this particular bank. I think a lot of companies probably thought the government would give them a way out of the defined benefits obligations, but instead they’ve forced them to make good. I suspect that once interest rate rises start to kick in then we’ll see some of these companies go to the wall (not just in the banking sector), and along with them their ability to make good these pension payments. Any company being sold at a few cents on the dollar, but with massive pension obligations, is not going to be an attractive proposition. Perhaps, then, the government will step in and guarantee or even bail out. That’s what they normally seem to do with broken businesses, which is how RBS, or as it is more accurately referred to, Royal Bank of England, still exists.

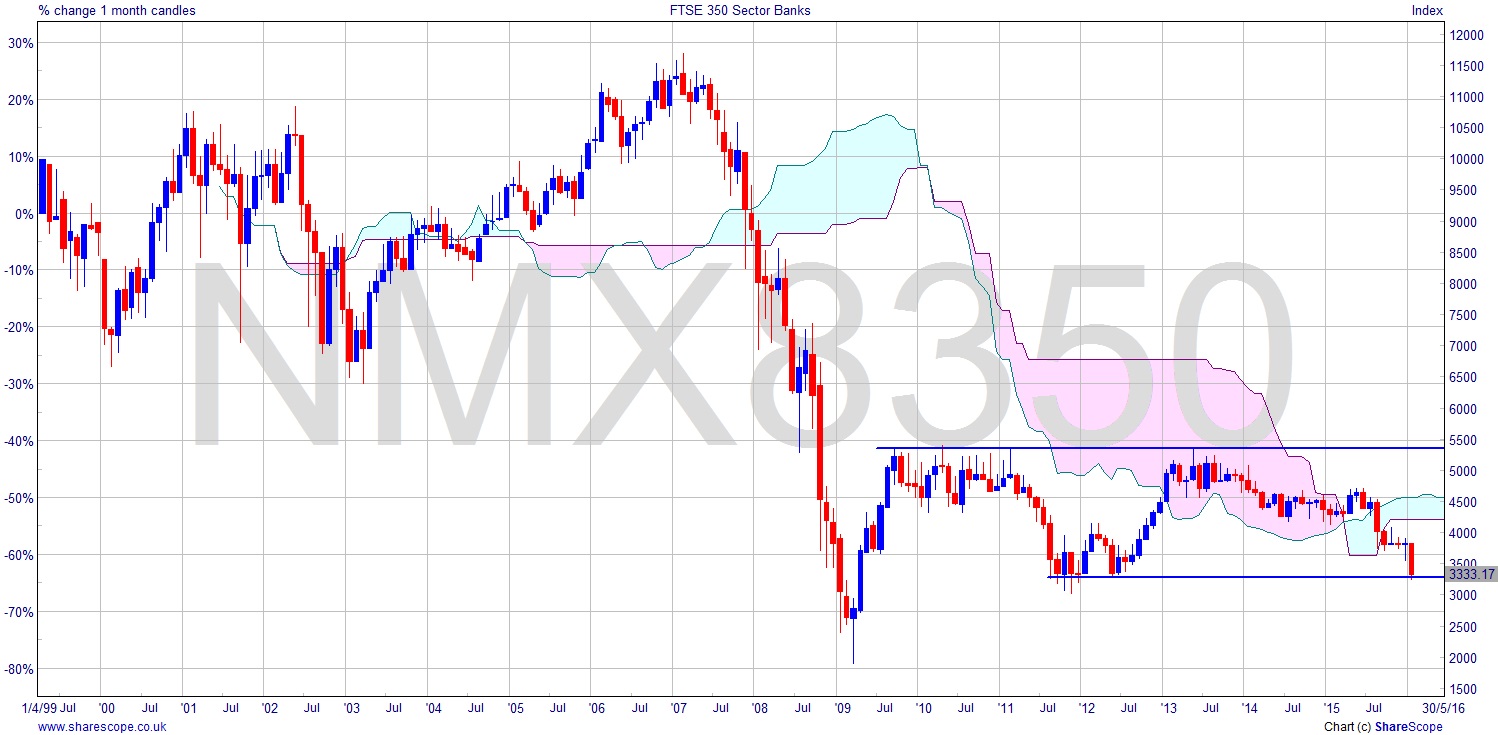

A quick glance at the FTSE 350 Banking Sector (NMX8350) chart is all you need to not bother glancing any more. It’s range bound since ’09, and for the future there is a great resistance level at just under 5,500 which will see a revival of the whole sector. One day. Maybe. But right now it’s languishing at the bottom of the range, threatening to fall out of bed and to the same depths as the very bottom of the market in ‘09, a level of 2,000. It’s below the cloud, and given that the monthly candle will finish this week it’s almost certainly going to look as bad as… well… it looks.

I only mention the banking sector at all because I know a lot of investors, who certainly don’t have a high risk profile, dabble in it. They think banking can’t stay down forever, and it gives them some feeling of nostalgia. In reality more like neuralgia. Of course it can’t stay down forever, but perhaps until each of us dies, and I don’t like those odds.

So, just for a gas, I’m going to look at the RBS (RBS) chart. Maybe I should call it Royal Blackhole of Stupidity. Royal BS for sure. Zoom in as much as you like on this chart (I’ve shown the monthly chart here). It doesn’t look any better whatever you do. I’ve also put some little pointers that should have been clear to any low to medium risk investors. It’s a very clear chart.

Comments (0)