S&P 500: Further pain in store

I usually take a look at stocks in the Chart of the Day, but on the big turns I do switch back to the indices and currencies. In the case of today’s market, the spotlight is on the S&P. The current view is that if it does not go down and stay down now, it never will.

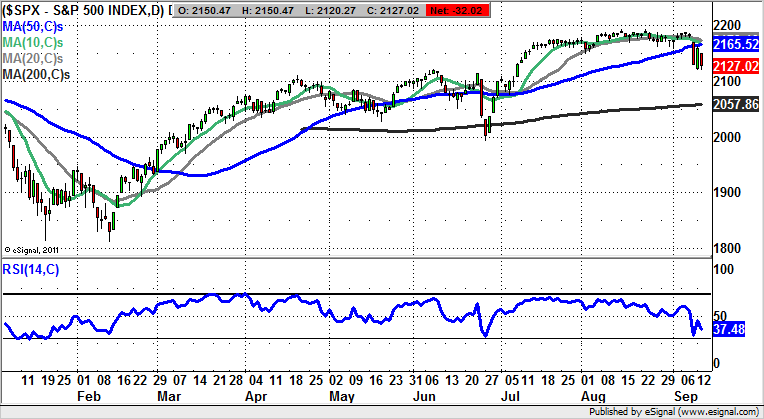

S&P 500 (SPX): Gap down through 50 day moving average targets 2,050 zone

One of the best ways of losing money in the recent past has been to either short leading indices on new highs in the US, or of course try to kick them when they are down. In fact, it could be argued that the latter has been even more painful than the former, especially with the snapbacks from the temporary dips in the market such as June and in January / February earlier this year. The reason, of course, is the ultra low interest rate environment and the search for yield. On that basis, one should have been buying dips such as the latest one at the end of last week, assuming that the bounce will be quite strong. In fact, for Tuesday on the S&P it was, with a rebound from the main 2,120 former resistance now new support. However, the risk here is that as little as an end of day close back below 2,120 could be enough to drag the US index back down to the next credible level of support for this market at the 200 day moving average running towards what was the former May / June floor at 2,057. This could be seen over the next 2-4 weeks, especially while the 50 day moving average at 2,165 caps the price action.

Comments (0)