Volatile markets can make you money

With volatility at its lowest in two years during August, it may be the right time for investors to make a play on a volatility spike, either by entering the options market or by playing with the VIX index. After a scary 24 June, asset prices entered a long period of tranquility, during which equity prices marched higher, central bankers took a vacation, and volatility declined. Investors were able to enjoy a quiet summer without having to fret over their investments. But September has ushered in a period of unrest. The upside potential of the equity market has been challenged once again while investors digest economic data, update interest rate expectations, and come to terms with the end of summer. The mood is changing.

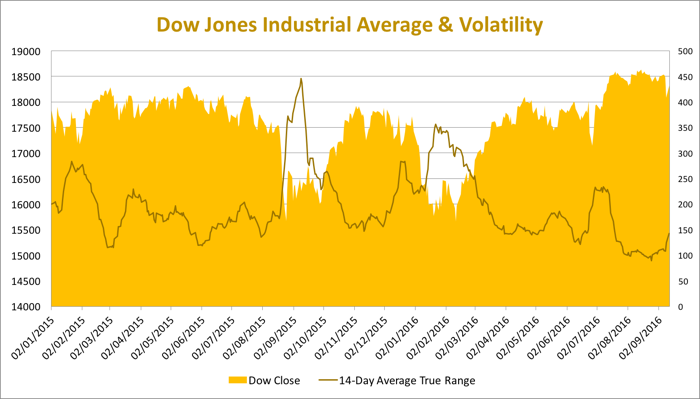

At times, this year has been really rough in terms of volatility. Take its beginning, for example. The commodity sell-off that marked the end of 2015, just after the first rate hike in the US, was extended into the beginning of 2016, pushing volatility to its highest during January and February. By then, asset prices were under intense fire and the VIX index hit a level of 32.09. But with the FED under-delivering in terms of expected rate hikes, the market entered a quiet period and the VIX declined to levels near 12-13. The relative tranquility was only punctured by the Brexit vote, which brought a new set of problems into the market. The VIX was pushed higher again, to a level of 26, but quickly entered a new peaceful period that lasted until just a few days ago. Apart from the interest rate move and Brexit vote, the market has been relatively quiet. This reality may change as we approach the end of the year, when the FED is again pressed to hike its key rate and investors start recalculating how far this market has gone without supporting fundamental data. Not that the main equity indexes have been going gangbusters during the year, but both the US and the UK market have been rising in spite rather than because of real economic data.

But today, I don’t really want to discuss the prospects for equity markets for the rest of the year. On the contrary, I want to adopt a neutral stance and instead suggest a play on the potential rise in volatility that may come with the return to reality after the end of summer. The key factors are a potential mismatch between equity prices and fundamentals, and the return of central bank games that are expected to be played for the rest of the year.

There are several ways of placing bets on volatility. Options are usually the first thing that comes to my mind when volatility is on the table. The price of calls and puts is positively correlated with volatility, and thus options are expected to benefit from any rise in volatility. Investors with a large long portfolio may wish to purchase some puts on the S&P 500 now, to insure their portfolio against any sudden backdrops that may come on top of interest rate hikes. It’s like buying insurance for your house, car, or any other esteemed asset. Investors without the underlying assets can simply buy both a call and a put on the S&P 500 with a strike price close to the current level of the index (at-the-money). Such a strategy is known as a straddle and earns you money if the market moves significantly in either direction. The worst that could happen would be for the market to remain at the same level, in which case the investor would lose the premium paid for both options.

This two-legged strategy is a great way of keeping market neutrality and exploiting a rise in volatility, but sometimes comes at prohibitive prices. An example helps understand this. Let’s say you want to purchase both a call and a put on the S&P 500 with a strike price of 2,125 (which is close to the current market price of 2,127), expiring in December. This strategy would cost around $136 ($68 for the call and $68 for the put). That means that if you keep the options until their maturity date, you need the market to move above 2,263 or below 1,991 to breakeven, which represents a rise/decline of +/-6.4%. A similar strategy expiring in October would cost around $70 ($37.5 for the call and $32.5 for the put). In this case the breakeven occurs with the S&P 500 moving +/- 3.2%. Of course, you can make money if volatility rises for a few days, by selling the options before maturity; but in general, options offer downside protection on upside potential that comes at an expensive price. If the market moves significantly either way, the strategy will make a decent profit, but if the movement is less pronounced the option holder ends up losing the option premium.

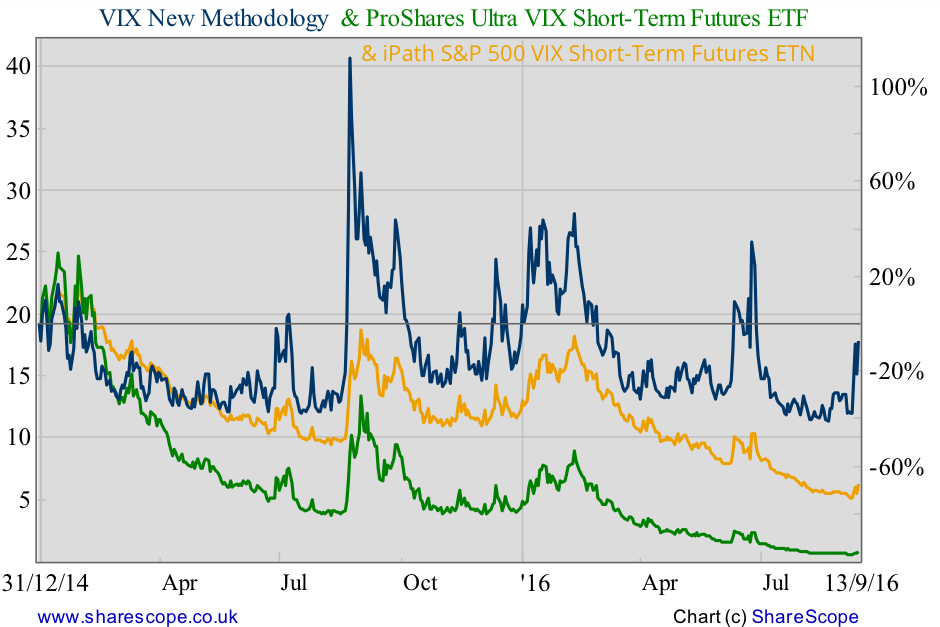

An alternative to options is to directly buy the VIX index – or, more precisely, an ETN or ETF that tracks its value, as is the case with the iPath S&P 500 VIX Short-Term Futures ETN (VXX). The problem is that this popular ETN does a really bad job in tracking the VIX, as it often performs very differently from the index it is supposed to track. Besides that simple fact, investors must be aware that the VXX loses value over time and therefore isn’t suitable as a long-term holding. The reason behind this is the fact the futures market for VIX contracts is usually in contango, which makes it costly to roll over positions and leads to the erosion of a few percentage points in performance from the ETN every month.

A better way to track the VIX is through a leveraged ETF like the Proshares Ultra VIX Short-Term Futures ETF (UVXY), which does a much better job in capturing VIX movements. Nevertheless, don’t expect any ETF or ETN to track the VIX 100%, or even 80%, because the VIX results from applying mathematical formulae, which makes it difficult to track and leads to huge tracking errors for ETFs. But, as you can’t buy the VIX directly, these are often the best options available to play the VIX.

One way or another, you should be careful with these strategies. In the case of a straddle, you must acknowledge that there is a mountain to climb in the form of the option premiums. In the case of VIX, you must also be aware that the daily movements can be huge. You also be careful not to hold any VIX-tracking ETF for too long because of the market contango. But after acknowledging all these points, both strategies may come in useful at this point.

Comments (0)