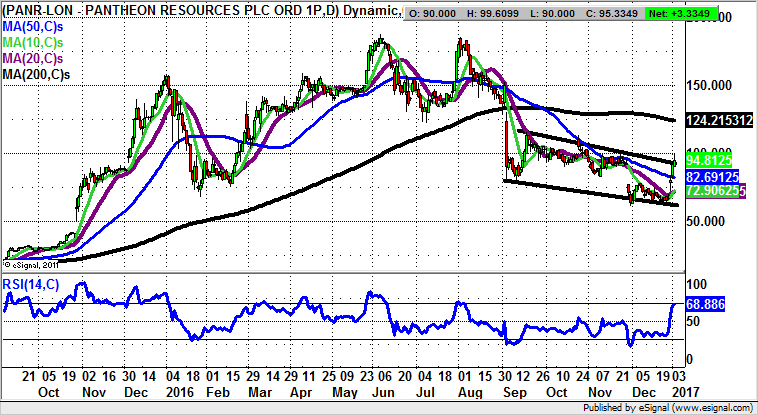

Pantheon Resources: Sustained price action above 100p required

A previous technical call on Pantheon Resources (LON:PANR) suggesting that below 100p the stock could fall to 50p was not exactly popular. However, the late 2016 dive towards 60p meant that this view was not too wide of the mark.

Pantheon Resources was one of the most outstanding small cap stocks of the first part of last year. This was all the more satisfying given that much of the outperformance was achieved when the price of Crude Oil was still relatively low.

Unfortunately, it would appear that at least in some aspects the good news story here was a little too good to be true and we have suffered a negative re-rating. The problem for a technical analyst such as myself is that when making a call on a very popular company a “shoot the messenger” scenario can arise if one is the bearer of bad news.

The view in the autumn here was that below 100p risked a dive to 50p, which was something battered bears clearly did not want to hear. This point was underlined by the relative lack of retweeting or likes for the article after it was posted. However, it proved to be one of the only correct bearish calls on the stock around.

The position now is that we are trading in the wake of a so called island reversal by the shares where they gapped down in November and then gapped up last month. However, even after all of this the 100p level proves elusive.

The view is therefore that it may be worth waiting on an end of day close above the 100p level before targeting a move to the 200 day moving average at 124p over the following month. Back below the 50 day moving average, currently at 82p, is probably the best indicator of a potential fresh negative reversal at this stage.

Comments (0)