Pantheon Resources: It’s make or break time for shareholders

Pantheon Resources bulls have certainly had the rug pulled from underneath them over the past couple of weeks. There are some interesting technical ramifications of what has been happening here.

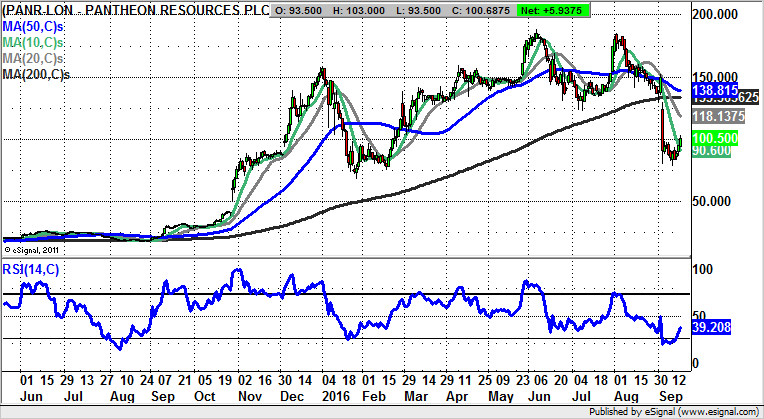

Pantheon Resources (PANR): Key trading zone near 100p

One of the bigger developments in the past couple of years for the smaller end of the stock market has been the way that social media has really kicked in to be an influence on the growth shares arena. This has in many ways been even more of a driver than the Bulletin Boards were at the time of the Dotcom Bubble, largely on the basis that I would suggest there has been rather smarter analysis of some of the better plays around. This was certainly the case with explorer Pantheon Resources over the past year, with the shares propelled to dizzy heights above 180p. Alas, at the beginning of the month they fell to a 78p floor before the tentative recovery we have seen in recent days. My view is that there are only two explanations here of the magnitude of the decline. The first is that there has been a fundamental change in the prospects for the company. The second is that market markers, knowing that the herd has been in the stock up to its eyeballs, allowed the price to fall rather further than it perhaps should have. Instead of sub-80p, perhaps towards 120p might have ordinarily been enough on the negative drilling news. I am favouring the second scenario, especially if we see an end of day close back above the post collapse high of 98p this week, and effectively the stock heads straight back up again after the flush out. Sub-80p again though, might warn that Pantheon was something of a bubble.

Comments (0)