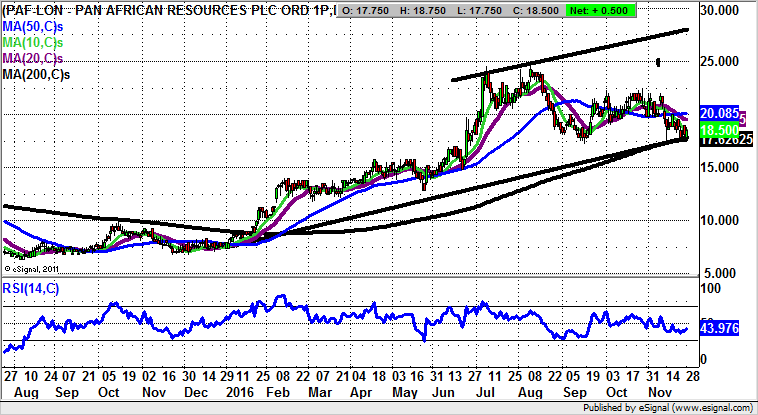

Pan African Resources: Above the 200 day line targets 28p

Although there is still over a month to go to get over the finishing line, looking at some of the best performing stocks of the year to date reveals a surprising name or two.

Although the concept of momentum trading is one which is easy to understand, it can be somewhat problematic to carry to its conclusion, even in the most robust of situations. The first is that one can be afflicted with a fear of heights, in terms of buying a stock or market at the top of the range. The second is that once you are in, being able to hold on for a large profit can be equally problematic.

However, we can see in the example of one of the biggest risers of the year to date, Pan African Resources (LON:PAF), how there has been a pullback/consolidation from the best levels, which provides an opportunity for technical traders. For instance, the stock is back at the floor of a rising 2016 price channel / 200 day moving average at 17.62p.

The message now is that at least while there is no end-of-week close back below this zone we could see a decent resumption of the gains so far this year. The favoured destination on a 1-2 months time frame is regarded as being back to the top of this year’s price channel at 28p.

I own this share in my sip.