Valuation vigilante: The Edinburgh Investment Trust

The fund manager sticking to his disciplined approach

Neil Woodford is probably the best known fund manager of his generation – so when he left Invesco Perpetual in January 2014 to set up his own firm it created a massive dilemma for the company. They responded by appointing Mark Barnett as his replacement, and he has delivered steady returns in the face of difficult market conditions.

The most cost-effective way to benefit from Barnett’s expertise and foresight is to invest in the Edinburgh Investment Trust (LON:EDIN), which has just released its half-year accounts to the end of September. This £1.6bn UK Equity Income fund has ongoing charges of just 0.61% and no performance fee, unlike his other closed-ended fund, the Perpetual Income and Growth Investment Trust. It is also much cheaper than his two open-ended equivalents that cost 1.67%.

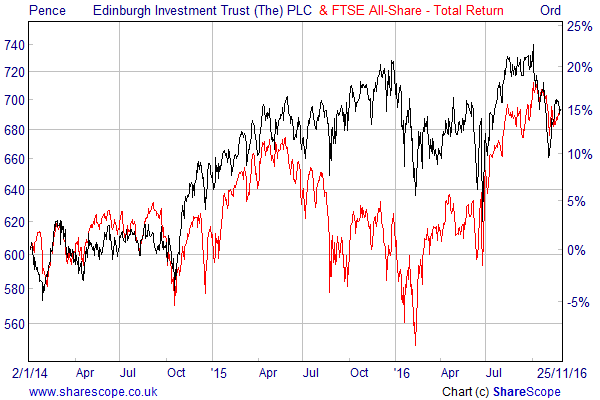

EDIN aims to achieve an increase in the Net Asset Value (NAV) per share in excess of the growth in the FTSE All-Share Index and to grow its dividend by more than the rate of UK inflation. Over the six months to 30 September it fell short of its objective with a 6.6% increase in NAV compared to a 12.9% gain from the All-Share, although the share price total return was much closer at 11.1%. This included a 3.8% increase in the first interim dividend that was well ahead of the 2% rate of inflation.

A concentrated portfolio

The main reason for the strong performance of the UK stock market over the six months was the recovery in commodity prices and the ongoing low interest rates, as well as the fall in the value of the pound following the referendum. Most of the fund’s portfolio is concentrated in the Financials, Consumer Goods, Health Care, Industrials and Consumer Services sectors, which meant that it missed out on the rally in miners but avoided the decline in the UK domestic banks.

Barnett favours companies that offer visibility of revenues, profits and cash-flows and which are managed for the primary purpose of delivering shareholder value in the form of a sustainable and growing dividend. As a result of this and of the exposure to domestically focused sectors that were badly affected in the aftermath of the Brexit vote, the portfolio lagged behind this year’s rise in the broader market index.

At the end of September the 10 largest holdings accounted for 43% of the fund and included tobacco companies such as Reynolds American, Altria and British American Tobacco; pharmaceuticals like AstraZeneca and Roche; and other blue chips such as BP, BT and BAE Systems.

The scale of the decline in the Brexit-sensitive sectors was more severe than the manager had expected and although he has not fundamentally changed his sector allocation, he has taken advantage of some of the areas worst affected by the sell-off. This included new investments in the fashion chain Next and the Secure Trust Bank, as well as the specialist secured lending fund Hadrian’s Wall Secured Investments.

Challenging outlook

Barnett believes that the short-term outlook for the UK stock market will continue to be dictated by the movement of global bond prices and the GBP/USD exchange rate. The low bond yields and the fall in the value of the pound have pushed UK share prices higher to the extent that they are now trading on a PE ratio of 17.5 times forecast 2016 earnings.

He thinks this ‘valuation looks full’, especially given the lack of underlying profit growth this year, and considers it unlikely that ‘the re-rating of UK equities will continue unchecked against a backdrop of higher valuations and ongoing pressure on corporate profitability.’

Writing in the accounts, Barnett said that without the boost to the value of overseas earnings from the fall in the pound, profits growth would have been flat in 2016, and the outlook next year looks similarly muted.

Barnett says that the most important discipline is to remain ‘vigilant about valuation’.

He expects a more difficult near-term UK economic picture to emerge with rising inflation putting pressure on consumer spending and hindering the rate of economic growth. The uncertainty over Brexit could also adversely affect UK employment and the level of investment.

Another factor to consider is the possibility of higher interest rates in the US, or the realisation by investors that the extremely low bond yields no longer reflect the medium-term outlook for inflation and interest rates. We have already seen a meaningful move higher in 10-year bond yields that could be a precursor of things to come.

Disciplined approach

In the face of these threats Barnett says that the most important discipline is to remain ‘vigilant about valuation’. He also points out that bottom-up opportunities for long-term investors have started to emerge as a result of the massive sector rotations that have occurred since the Brexit vote.

Against this backdrop his focus continues to be on companies that can demonstrate sustainable top-line growth and translate it into profit, free cash flow and dividends without excessive financial leverage.

The challenging environment favours active portfolio management and a selective approach to portfolio construction that is focussed on prudence and capital preservation, which is exactly how Barnett has positioned the fund.

Edinburgh Investment Trust shares currently trade on a 1.4% discount to NAV, which is tighter than that of the 5.7% average for the listed UK Equity Income sector. They offer a competitive historical yield of 3.5% with the dividends paid every quarter.

Comments (0)