Negative Equities: Rolls Royce, FirstGroup

I often have a look at the FT to see what’s good for a story. I can’t help noticing today that the number of negative stories far outweighs the positive ones. Top of the list today is Rolls Royce plc (RR.). Now I’ve written a few times about the profit warnings they’ve issued over recent months. Well, there’s another one today. You have to wonder what’s going on there. Profit warning after profit warning. It’s almost as if the directors want a takeover bid.

Oh. I don’t see most news as news. Most of it is within the influence of the companies themselves and therefore must be taken with a pinch of spin. However, that there is so much negativity, especially against the backdrop of the US streaking ahead robustly, must be cause for celebration for shorting opportunities, and the chance to close out some long running positions in UK stocks. Following the hedge fund model we should all have halved our equity portfolio a few months ago to control risk.

Commodities, including Gold taking another holiday from going up, are looking decidedly weak. Good news for the Yanks. Actually low oil prices are the alleged cause for the low profit from FirstGroup (FGP). Apparently it’s cheaper to drive now, so people are doing more of it. This sounds, quite frankly, like a load of bollocks. Maybe it’s just too expensive to go by train is what it is. They operate diesel trains too, so presumably it’s gotten cheaper to drive them as well. Maybe it was the wrong kind of leaves on the line? Or the wrong kind of wheels on the train… ones that don’t go round and round? Or maybe it was the wrong kind of management and pricing structure?

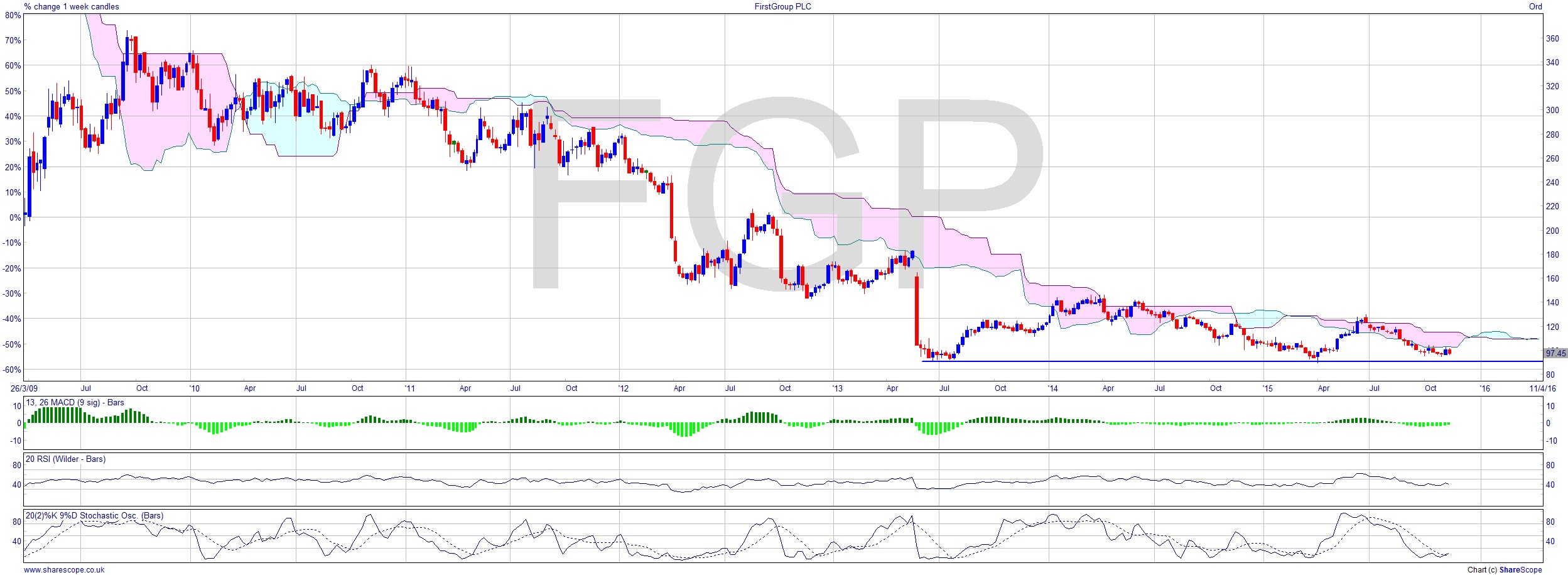

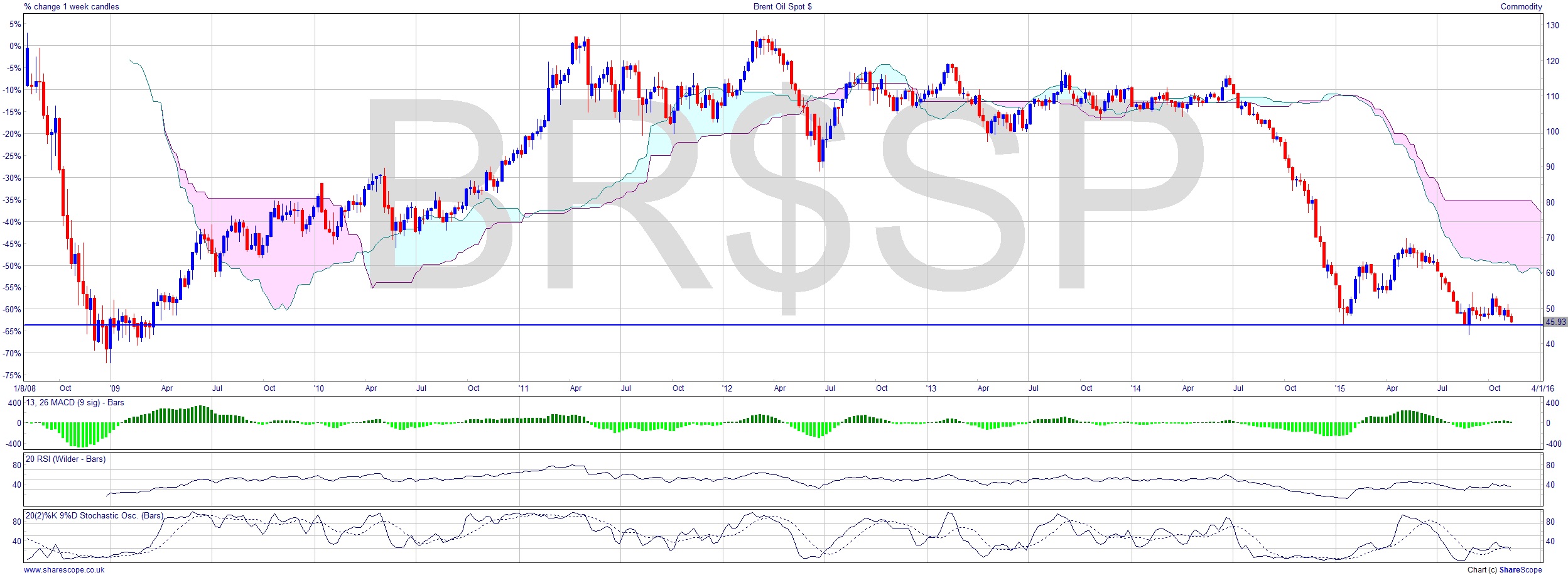

Looking at the chart, this is a stock with no compelling reason to buy since 2009, when they were 3 times more than they are now. Still looking weak. So if it’s true oil is to blame then they’d better hold those bonus cheques because oil doesn’t look that clever either. I normally use WTI (West Texas Intermediate) as the yardstick for oil but given this is a UK story I’ll use Brent. I’ve taken a long-term chart here because it’s important to see the lows back in 2009. I’ve shown the support level at $45. It’s looking very brittle at the moment and a fall from here really is free fall. A while back, as oil was rising, I casually mentioned to a friend that I expected oil would go as low as $35 (WTI that is, which is generally a bit lower than Brent – presently $42.36). This Brent chart is looking very weak indeed.

A question I’d like to ask is doesn’t FirstGroup hedge its input costs? A lot of companies had actually hedged against $70 oil last year, and above that level they were fine, but below it they were increasingly worse off. But if it’s low oil prices causing the problems at FirstGroup then what happened in 2010, 2011, 2012, 2013 and 2014? Perhaps they went long bad ideas. Oil was broadly range bound through those years. To be fair they did lose the lucrative East Coast line, but that’s probably because they made a crap job of running it when they had it.

Comments (0)