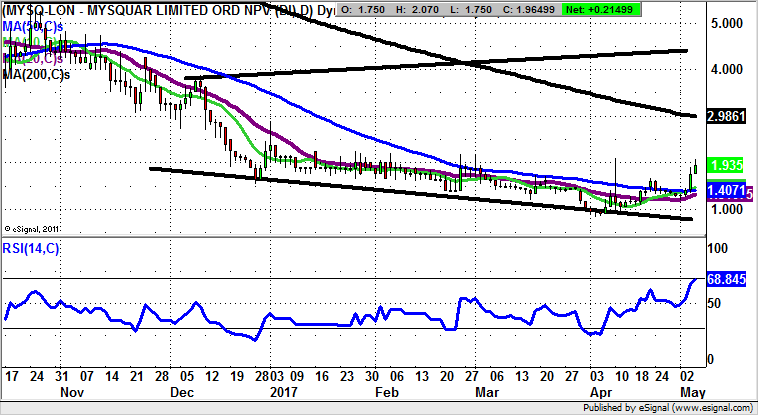

MySquar: Triangle formation points back towards 4p

MySquar (LON:MYSQ) certainly ticks most of the new economy buzzwords of the moment. The question now is whether the company can deliver on the business model.

In theory the idea of a company which has a dominant position in terms of social media, gaming and payments in a large emerging economy should be one which floats well on the stock market. However, while the share price of MySquar has had its moments, the overall position here since it came to market has been of a slow slide. This has left the stock back down near 2p, as opposed to 10p at the best times, soon after the IPO and then early last year.

But while the stock market’s impatience is legendary, it could finally be that MySquar is now in bargain basement territory. Such an idea is backed by the way that it is possible to draw a broadening triangle formation on the daily chart from as long ago as December. The resistance line projection target of the triangle is an implied 4p over the next 1-2 months. Even for those who believe such a target is a little on the overoptimistic side, we have a situation where an intermediate rebound could stretch towards the 200 day moving average, now at 2.98p – a decent return on where we are currently.

Comments (0)